ChainLink

Chainlink: Can this new update push LINK to 2024 highs?

Chainlink positions LINK as a universal gas token, fueling price growth with increasing adoption.

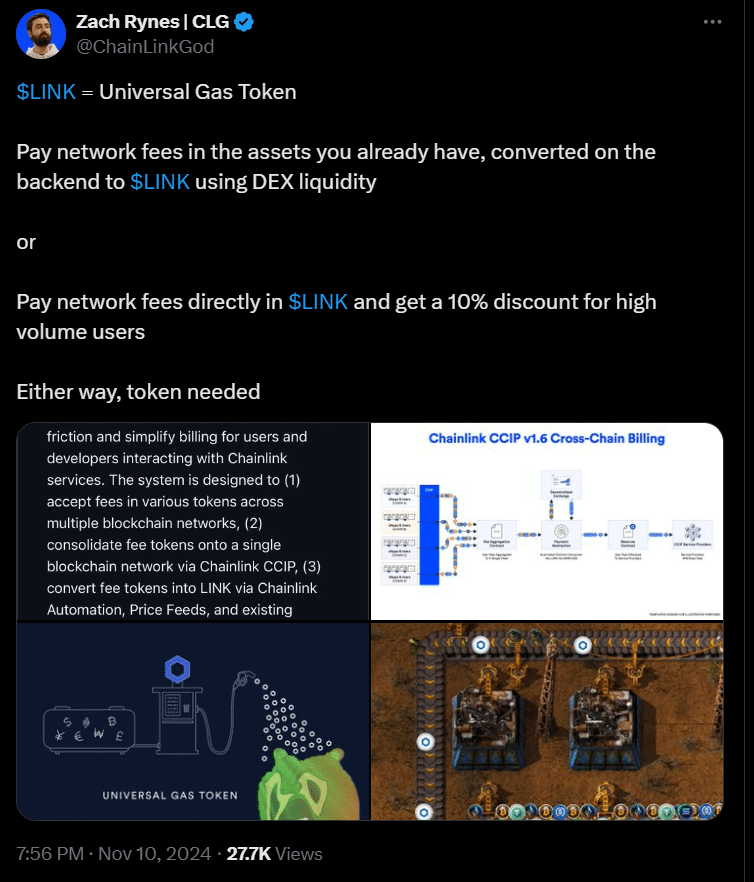

- Chainlink introduces LINK as a universal gas token for network fees.

- Chainlink CCIP enables Cross-Chain Billing with LINK as a core token.

With LINK emerging as a universal gas token, Chainlink ecosystem continues to expand, driving adoption and price growth. As the token gains traction, the 2024 high of $22.87 could be broken soon.

Chainlink drives LINK’s demand

Chainlink is making significant strides in the blockchain space by positioning LINK as a universal gas token.

The token provides flexible options for users to pay network fees across blockchain services, either directly in LINK or by converting other assets through decentralized exchanges (DEXes).

Chainlink’s new approach allows users to pay fees in LINK and receive a 10% discount, incentivizing high-volume users. The Chainlink CCIP v1.6 Cross-Chain Billing solution also consolidates various tokens into LINK for payments, simplifying the fee process for developers.

As the universal gas token, LINK is becoming central to Chainlink’s future growth, increasing its demand across the blockchain space.

LINK’s steady upward momentum

Chainlink’s price has recently fluctuated, with the token trading slightly down around $14 on Monday, 11th November, after a 6% rally on Sunday.

Despite the small pullback, the token continues to show strong upward momentum, driven by the growing adoption of LINK as a universal gas token.

Chainlink faces immediate resistance at $15 with the potential for further price gains if it breaks above this level. A surge past $15 could see the token test its projected yearly high of $22.87, with further room for growth in 2024.

On the downside, LINK has support at $12.04, a level that may act as a safety net in case of a pullback. A drop below this support level could indicate more bearish pressure, leading to a retest of lower levels.

However, as long as the token stays above $12.04, the bullish trend remains intact, and the path toward $22.87 is clear.

LINK Open Interest shows wide adoption

As of 11th November, the 7-day average open interest stood at $434.08 million, showing strong engagement in the futures market.

The spike in open interest, particularly on 8th November, when it reached $478.4 million, indicates heightened trading activity and confidence in Chainlink’s future potential.

Is your portfolio green? Check out the LINK Profit Calculator

This surge in open interest aligns with the broader trend of increasing demand for LINK, fueled by the token’s growing use in blockchain services.

As Chainlink’s ecosystem expands, more traders are getting involved, showing optimism about the future of the token.