Chainlink crashes through support: More pain ahead for LINK investors?

- Chainlink plunged 38% this week, breaking past major support zones.

- Potential further declines could target the $5 support level, with a recovery possible if resisted.

As the cryptocurrency market faces a challenging phase, Chainlink [LINK] has not been spared, experiencing significant downturns that align with broader market trends.

This past week, LINK’s value dropped by 38%, with a sharp 25% decline observed just in the last day.

Besides the recent price action of Chainlink coming against the backdrop of LINK’s recent surge above $21 in March, the decline is influenced by technical patterns observed on its price chart.

Technical outlook on Chainlink

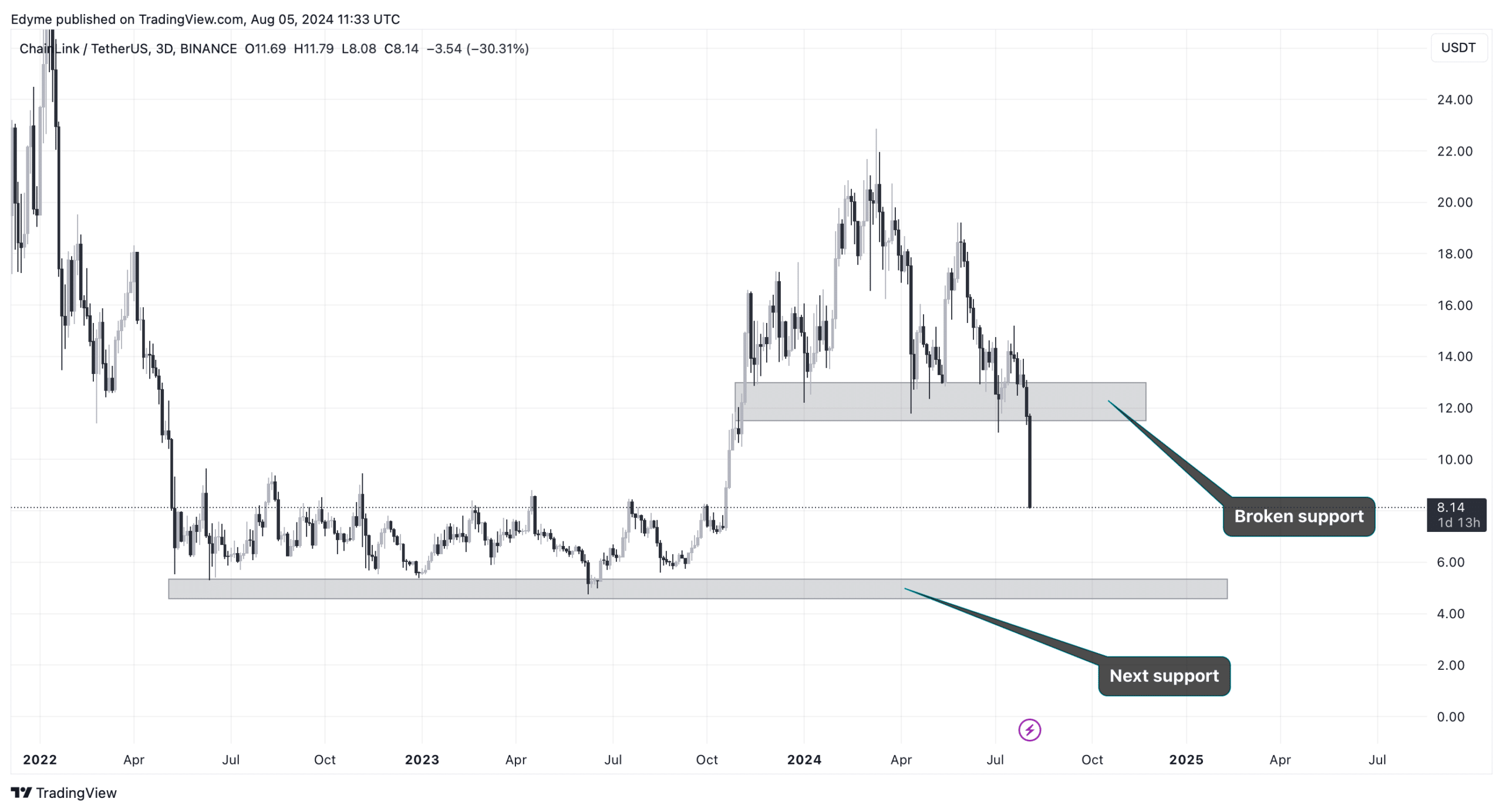

Analysis of the 3-day chart reveals that LINK has broken through a critical support level, indicating potential for further downside.

In trading, a “support level” refers to a price point at which an asset typically does not fall below, as buying interest is strong enough to counteract selling pressure.

So far, since LINK broke through the support in between the $13 to $11.40 range, the asset has faced further decline suggesting a weakening in buyer enthusiasm.

Looking at the chart there is a likelihood of LINK falling further till it reaches another major support which is currently found at the $5 region.

Should LINK reach this support and break through again we could see more significant selling pressure. Conversely, if the price stabilizes or bounces back at this point, it could indicate a potential recovery and restoration of investor confidence in LINK.

Who is seeing this as an opportunity?

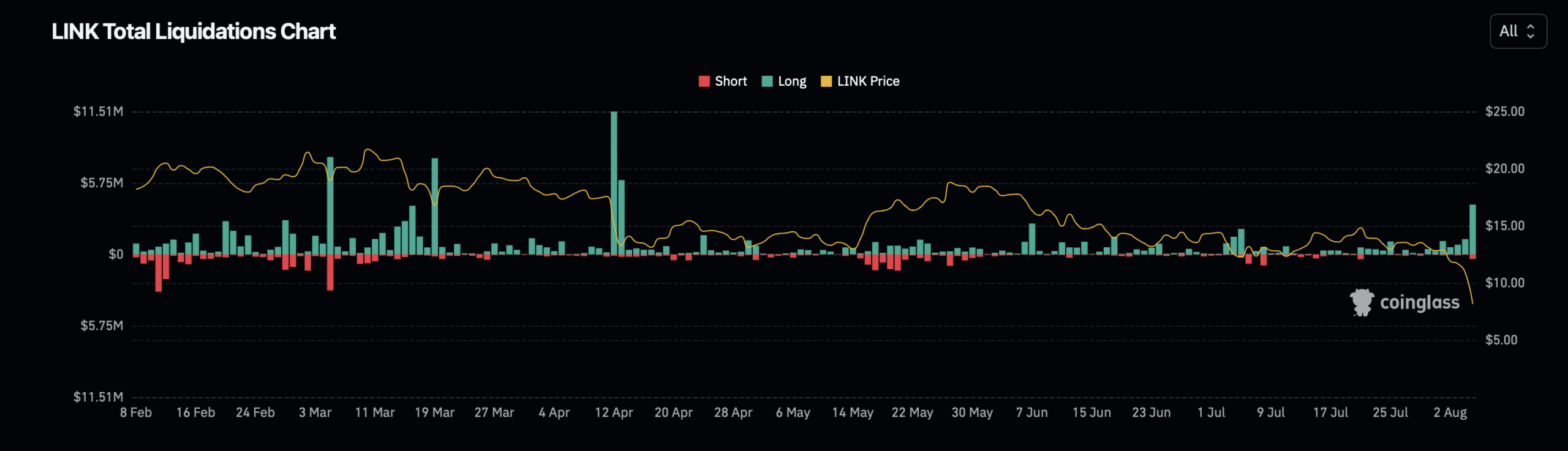

The market’s reaction to these movements has been mixed. Data from Coinglass highlights that in the last 24 hours, the broader crypto market saw over 290,799 traders liquidated, with total liquidations amounting to $1.11 billion.

Source: Coinglass

Within these figures, LINK-specific liquidations contributed over $6 million, dominated by long position liquidations of $5.11 million, compared to $384.43k from short positions.

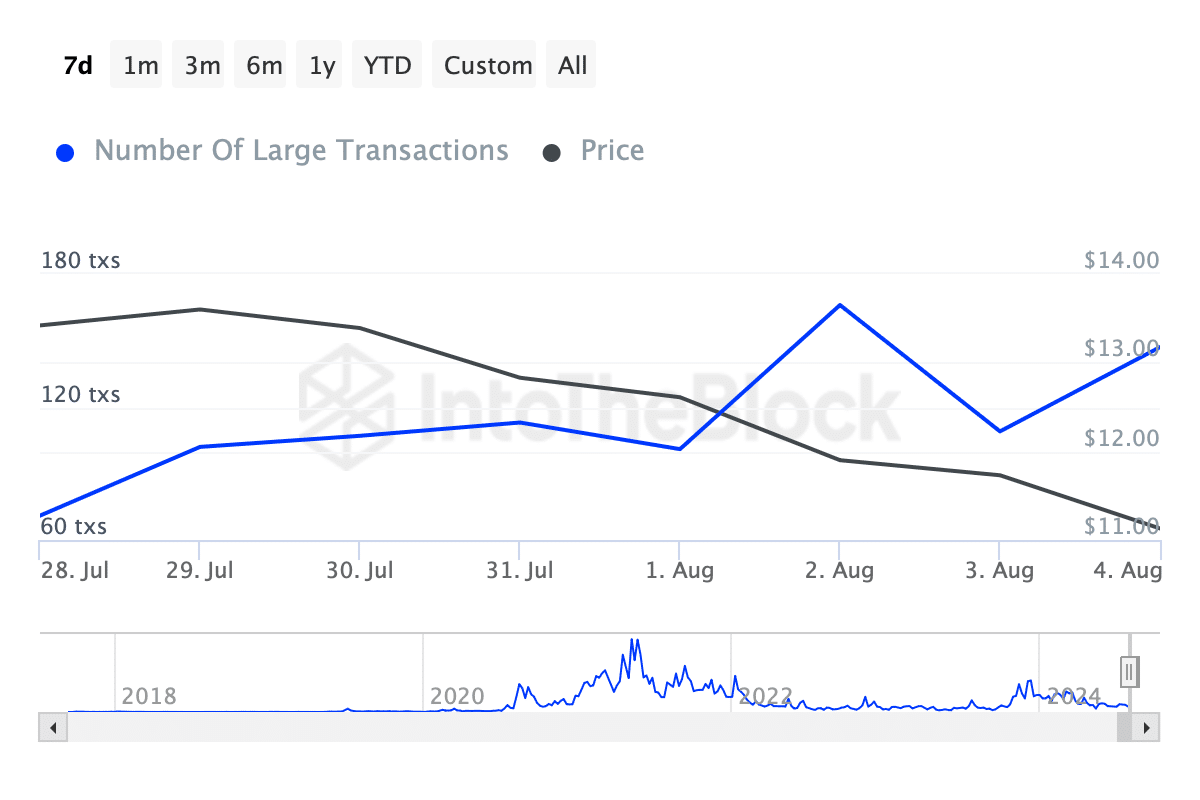

Interestingly, despite the downturn, some large-scale investors, or ‘whales,’ appear to be viewing the lower prices as buying opportunities.

Read Chainlink’s [LINK] Price Prediction 2024-25

Data from IntoTheBlock indicate a significant increase in large transactions (over $100,000), rising from 71 transactions last week to 147 today.

This uptick suggests that while the short-term outlook might seem bearish, certain investors are positioning for what they believe could be a favorable long-term trajectory.