Chainlink: Exploring the possibility of sustained whale interest amidst bull rally

- Chainlink was on the list of the top 10 purchased tokens among the 100 biggest Ethereum whales.

- A few metrics were bearish, but the market indicators suggested otherwise.

Chainlink [LINK] continued to increase its adoption with new partnerships, the latest being with Elure Labs. As per the official announcement on 13 January, Elure Labs has integrated Chainlink Price Feeds to help ensure that collateralization ratios were calculated based on tamper-proof market data.

Lending protocol @eulerfinance integrated #Chainlink Price Feeds to help ensure that collateralization ratios are calculated based on tamper-proof market data.

Watch the video to understand how the integration helped increase user confidence in the #DeFi platform ?? https://t.co/BJ62vb5c8g

— Chainlink (@chainlink) January 26, 2023

How much are 1,10,100 LINKs worth today?

Apart from the new integration, LINK also remained one of the top choices for the whales. WhaleStats, a popular Twitter account that posts updates related to whale activity, revealed that LINK was on the list of the top 10 purchased tokens among the 100 biggest Ethereum whales on 26 January.

JUST IN: $LINK @chainlink now on top 10 purchased tokens among 100 biggest #ETH whales in the last 24hrs ?

We've also got $SHIB, $MATIC, $SNX & $BIT on the list ?

Whale leaderboard: https://t.co/N5qqsCAH8j#LINK #whalestats #babywhale #BBW pic.twitter.com/XyT1UXQdQW

— WhaleStats (tracking crypto whales) (@WhaleStats) January 26, 2023

LINK’s chart responded in favor of investors as its weekly chart was painted green. Its price increased by over 11% in the last seven days, and at the time of writing, the token was trading at $7.16 with a market capitalization of over $3.6 billion.

What the metrics suggest

A few metrics remained in favor of LINK over the last week, while the rest supported a bearish outlook. CryptoQuant’s data revealed that LINK’s exchange reserve was increasing, which indicated higher selling pressure. Similarly, the active addresses and transfer volume also registered a decline.

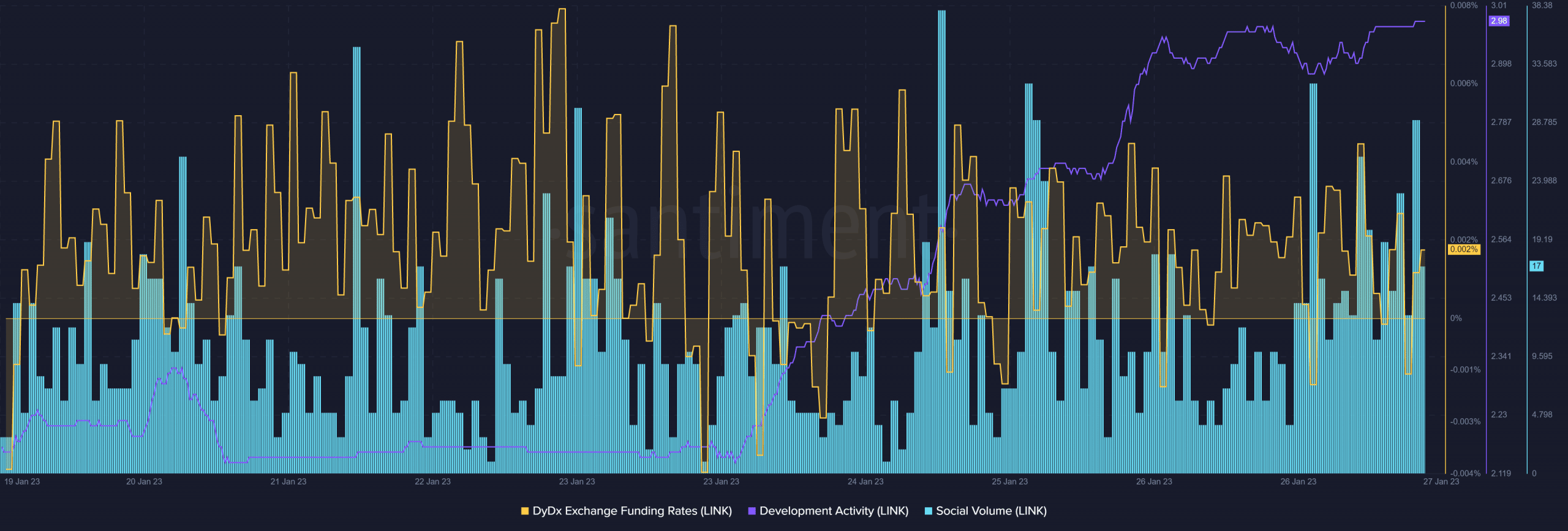

As per Santiment’s chart, LINK’s DyDx funding rate declined slightly over the past week, suggesting less demand in the futures market. However, the token’s development activity went up substantially.

Moreover, LINK’s popularity increased as its social volume remained high consistently.

Realistic or not, here’s LINK’s market cap in BTC’s terms

LINK investors can relax

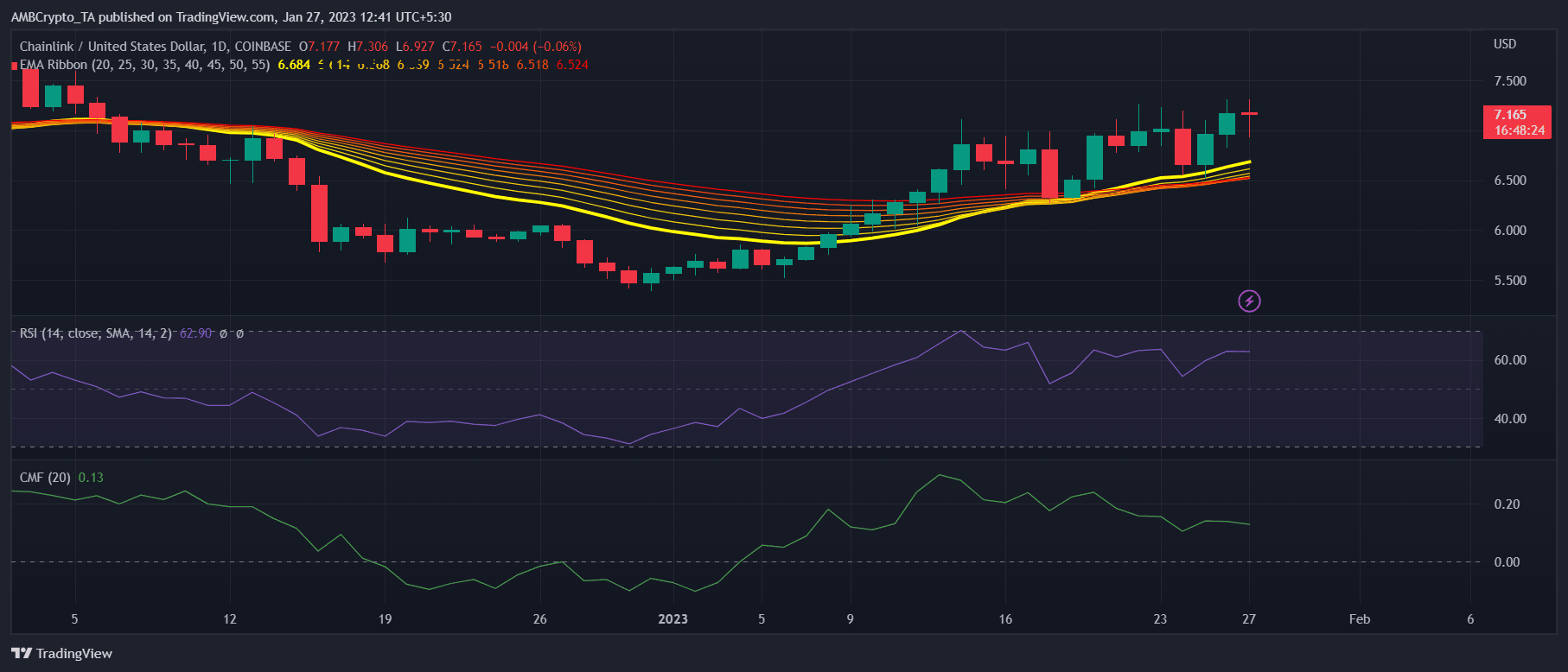

Carrying forward the bullish stance noted above, LINK’s Exponential Moving Average (EMA) Ribbon revealed a buyer’s advantage in the market because the 20-day EMA was higher than the 55-day EMA.

The Relative Strength Index (RSI) was restive above the neutral mark, which was bullish. Moreover, despite the Chaikin Money Flow (CMF) registering a slight decline, it was still considerably above the neutral mark, further increasing the chances of a continued price surge.