Chainlink functions in motion, but LINK keeps struggling with circulation

- Chainlink introduced a new developer platform with access via the Ethereum and Polygon Testnets.

- The token circulation has hovered around the same region for some time.

Chainlink [LINK], the decentralized oracle network announced the launch of a new platform called the “Chainlink Functions.” According to the project, this new side of its chain would enable developers to connect smart contracts with existing APIs via its network.

Read Chainlink’s [LINK] Price Predcition 2023-2024

For a while, Chainlink has repeatedly mentioned that it aimed to onboard more developers into the crypto ecosystem. And, this could be a step in that direction. Notably, the project highlighted that the platform is not available on any mainnet yet.

Instead, developers might be able to access the Chainlink Fucntion on the recently passed Ethereum [ETH] Sepolia Testnet and Polygon [MATIC] Mumbai. The blog post also pointed out,

“A developer can build a decentralized off-chain voting system for a DAO by using Chainlink Functions to fetch off-chain votes and relay the vote result on-chain to trigger a smart contract-based action.”

Slow in circulation and on-chain volume

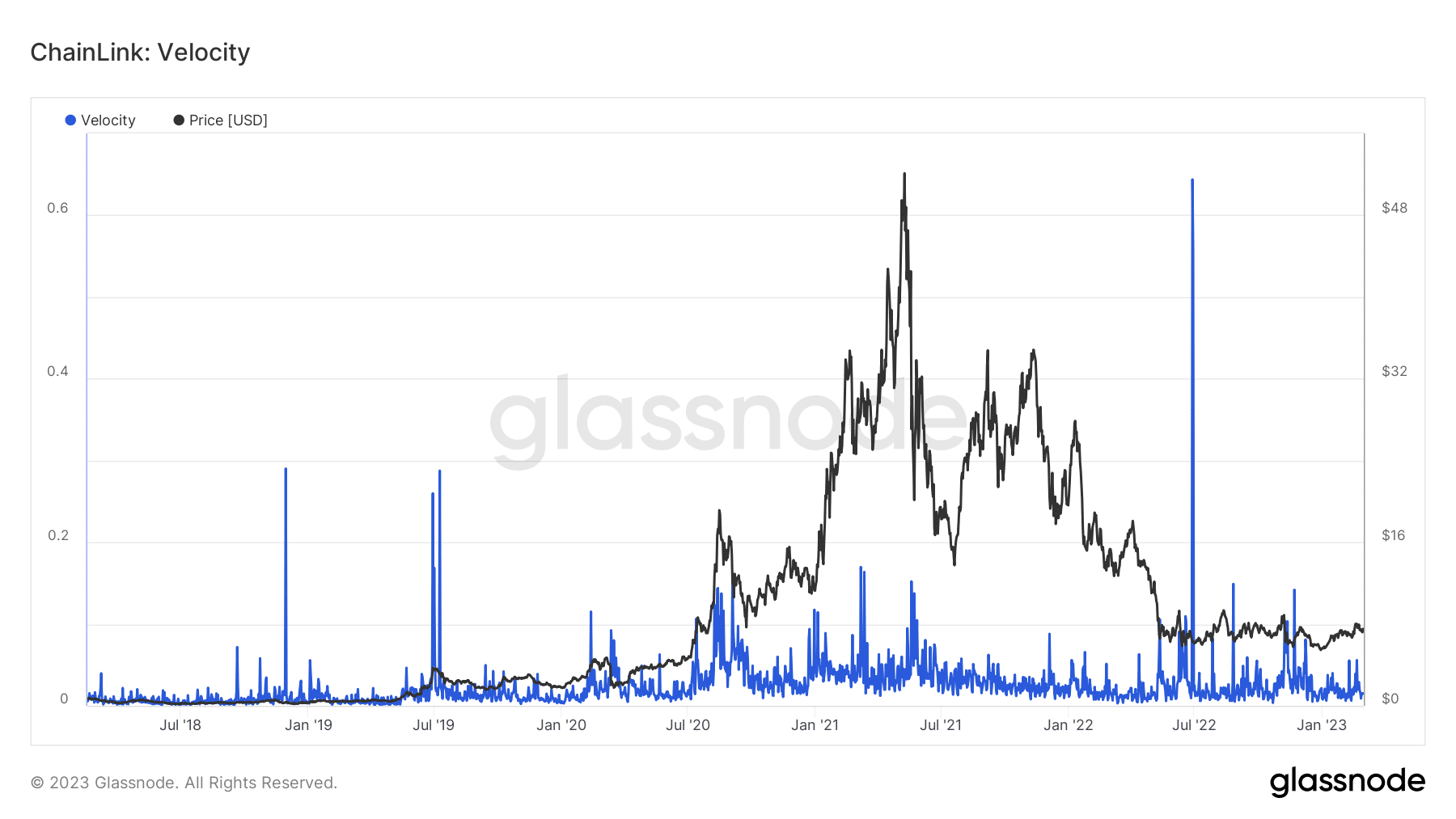

Despite the development, Glassnode data showed that the LINK velocity was at a very low spot. The velocity measures the rate at which tokens circulate in relation to the on-chain transaction volume and market cap.

With the condition at press time, it inferred that LINK tokens had not been in high circulation lately.

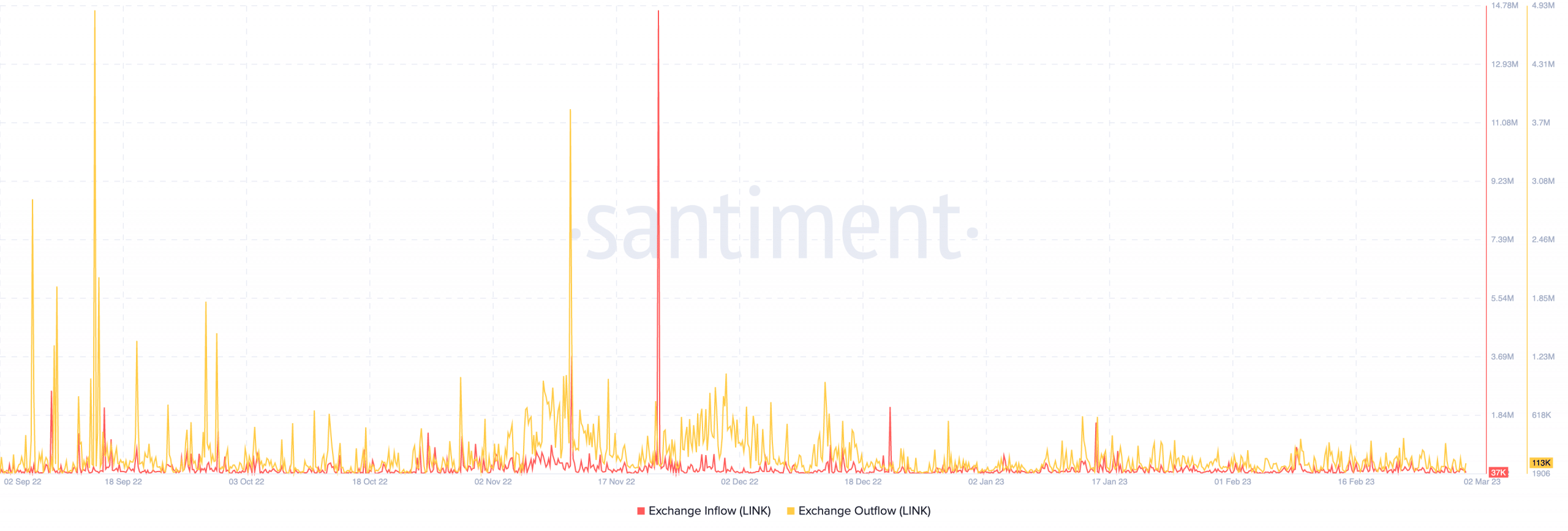

As per other market happening, Santiment showed that LINK has not experienced any notable inflow wave over the past few months.

The metric gauges how many tokens are being deposited into exchanges, mostly signaling an intention to sell. So, the decline to 37000 implied that investors may not have made enough gains to sell.

On the flip side, the exchange outflow was higher at 113,000. However, it was still extremely low compared to the records at some point. Taking both metrics into consideration, it seemed that more LINK holders preferred to keep their assets rather than dump them.

How many are 1,10,100 LINKs worth today?

LINK addresses keep holding back

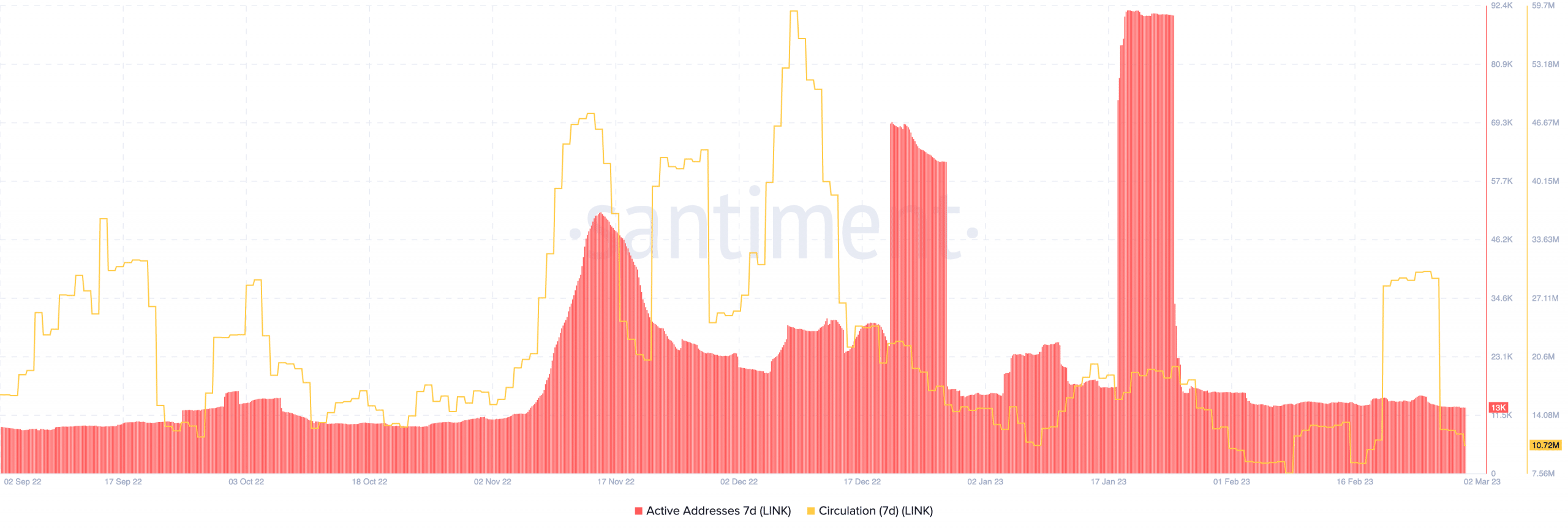

Furthermore, on-chain data revealed that active addresses on the Chainlink network had been somewhat stagnant. The metric shows the level of investor interaction with a project.

At the time of writing, the seven-day active addresses were 13000. Hence, the standstill means that the sentiment towards LINK was not particularly exciting.

In addition, circulation within the said period has not been on the upside. Since the dump on 26 February, LINK has found it difficult to improve in the number of unique tokens used. This drop aligned with the velocity status mentioned earlier.

Nonetheless, Chainlink mentioned in its release that the crypto community should expect more developer-concerned announcements as it tries to bridge the gap between the web3 ecosystem and the traditional sector.