Analysis

Chainlink hits 2023 price ceiling: Can bulls still benefit?

LINK recorded an impressive recovery as traction from CCIP spiked. But 2023’s supply area could derail further upside.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- LINK was up +35% in September but hit the 2023 price ceiling.

- Demand in the derivatives market surged in the second half of September.

The crypto market posted mixed results in Q3. For Chainlink [LINK], the bearish pressure in August was firmly outweighed by increasing traction from its CCIP (Cross Chain Interoperability Protocol) in September.

Is your portfolio green? Check out the

LINK Profit CalculatorBNB Chain is the latest entrant to adopt Chainlink’s CCIP to empower its ecosystem developers. LINK was up +35% in September but hit a key 2023 price ceiling.

Should Chainlink buyers consider these levels?

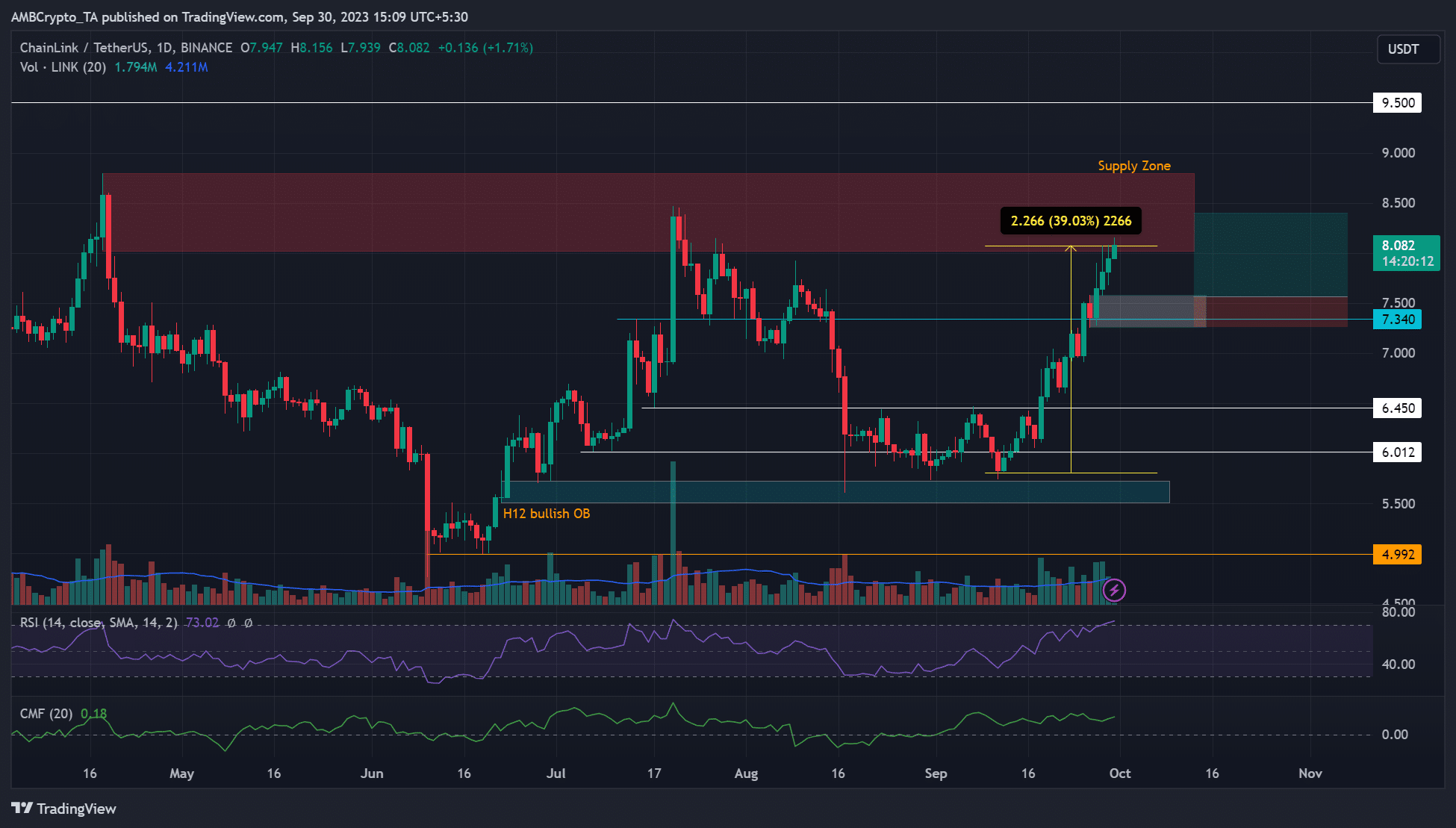

At press time, LINK was up 39%, measured using the Price Range tool, from the H12 bullish order block (OB) at $5.5 to the 2023 supply area of $8.80 – $8.03.

Notably, the RSI has steadily reclaimed the upper ranges and hit the overbought zone, underscoring the demand increase in the Spot market in September.

Similarly, the CMF hovered above the zero mark, suggesting LINK recorded significant capital inflows.

But the overbought condition and supply area could make a reversal likely. If so, the retracement could ease at the confluence of the bullish OB of $7.25 -$7.58 (white) and $7.34 before targeting the supply area again.

Alternatively, the rally could extend to $9.5 if LINK convincingly flips the supply area into support.

The two scenarios could present two buying opportunities at $7.25 – 7.58 and $8. The take-profit targets can be placed in the supply area and $9.5.

Chainlink recorded massive demand in September

According to Coinglass, the derivatives market demand for LINK doubled in the second half of September as Open Interest rates surged from $100 million to over $200 million at press time.

How much are 1,10,100 LINKs worth today?

On the liquidation front, more short positions have wrecked across all timeframes. About 24 hours before press time, more than $1.3 million worth of short positions were liquidated. The trend underscores the strong bullish bias.

So, buyers can seek re-entry above the supply area or at the bullish OB near $7.