Chainlink hits 2024 lows: Should you buy discounted LINK?

- LINK has seen massive drawdowns, which could trigger trend reversal.

- Price chart analysis supports a trend reversal scenario, but whale interest was mixed.

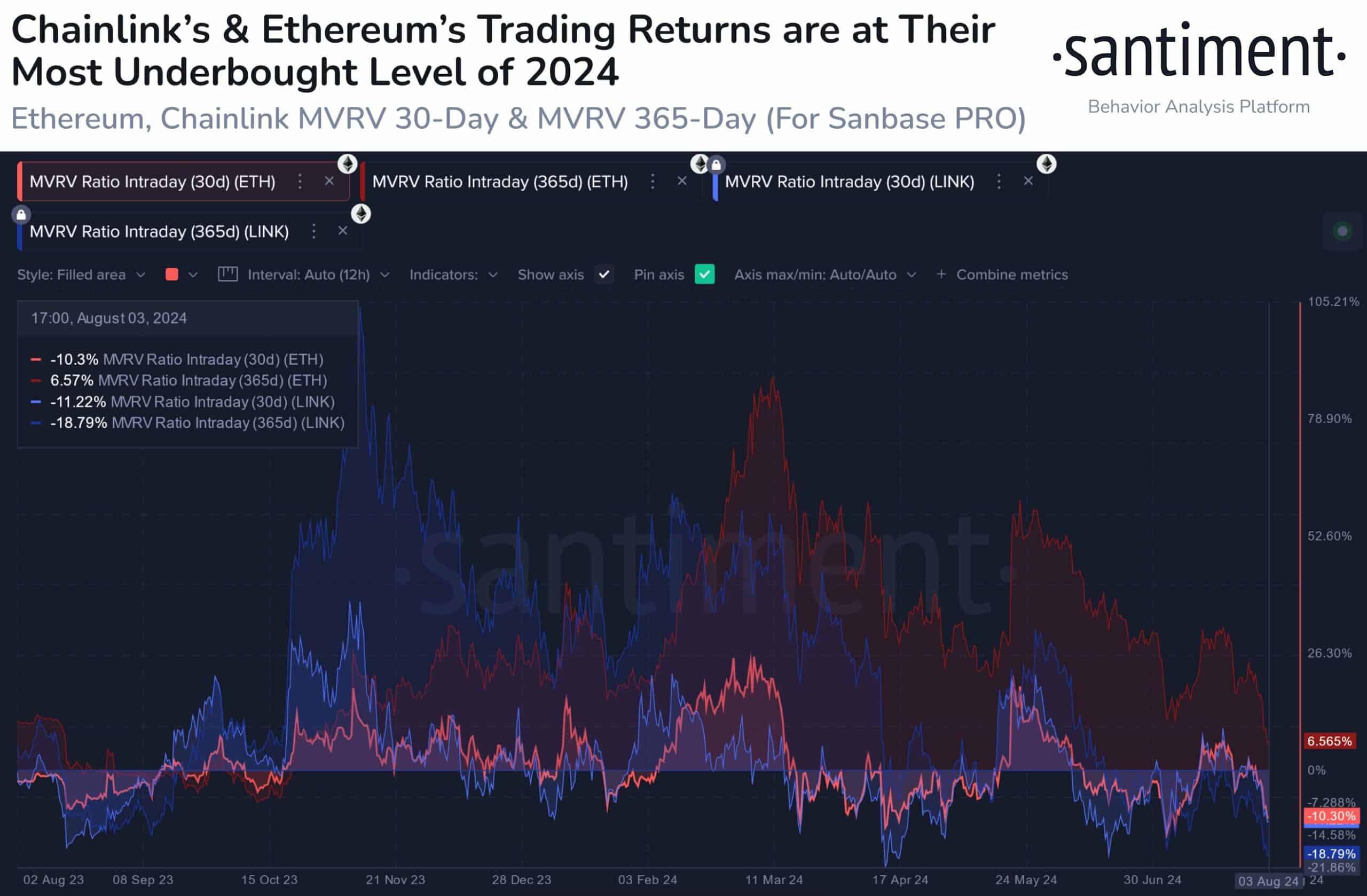

Negative market sentiment has dragged Chainlink [LINK] to short and long term trend lows, marking massive discounts for the altcoin. According to Santiment data, the drawdowns justify grabbing the discount.

‘Historically, the more ‘blood in the street’ there is from other traders, the more justification there is to buy into others’ pain.’

Santiment analysis was based on the MVRV (Market Value to Realized Value) metric, which gauges the token’s valuation. A negative value suggests a token is undervalued and a great buy.

However, a positive value denotes a token is overpriced and could tip holders to sell for profit.

For LINK, the MVRV ratio was down 11% and 18.7% on the monthly and yearly adjusted basis. That means LINK was in a great buy position for short and long-term investors.

So, does the price chart position also support a buy idea for LINK?

LINK price analysis

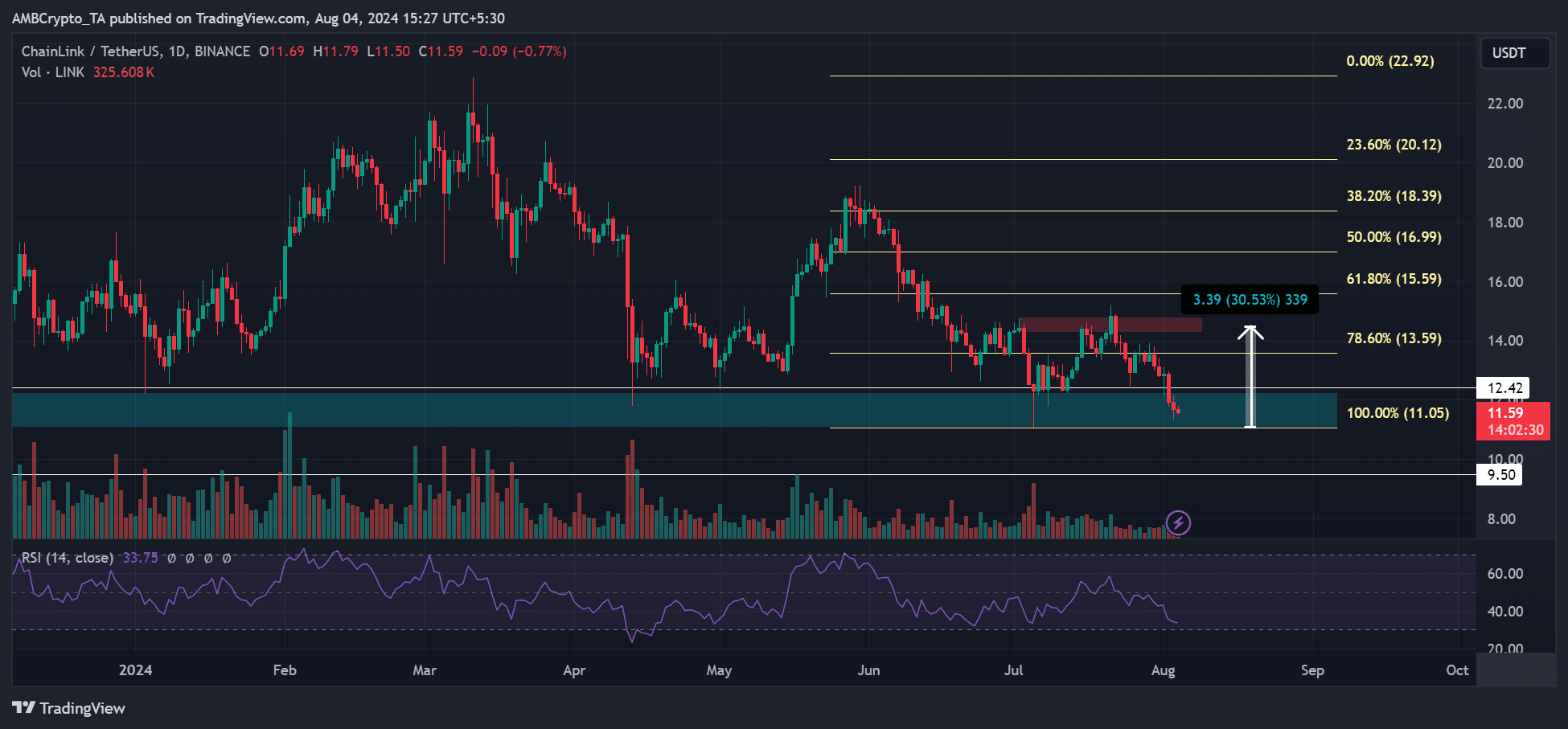

LINK rallied 87% in early 2024, jumping from $12 to $22, about 1.8X returns who held it for the first three months of the year.

However, it erased everything in Q2, and an attempted recovery also resulted in losses. At press time, LINK traded at $11.59 and was on track to hit the June low of $11.05.

The $11 level has been a key demand zone throughout the year. In short, LINK was a crucial demand zone that supported the Santiment thesis. It could be great for swing traders aiming to go long.

If market sentiment improves, the immediate bullish target above $14 would offer a 30% return.

However, an extended weak sentiment could drag LINK below $10 and compound the market bloodbath.

Whale interest in LINK

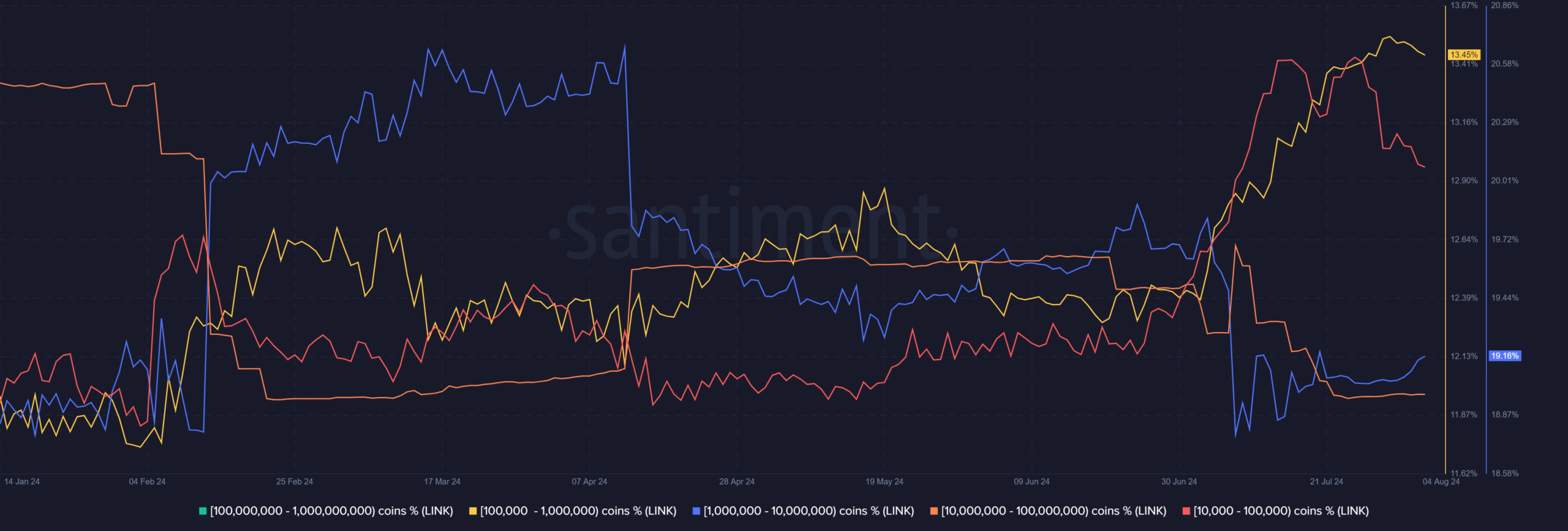

Interestingly, a whale cohort was going long at the current lows and demand level.

Addresses holding between 1M -10M LINK (blue) have accumulated since late July and ramped up a buying spree in August. They now control 19% of the LINK supply.

However, current sell pressure seems to come from addresses holding 10K -100K coins and 100K – 1M coins. Collectively, these two groups control about 20% of LINK supply, almost similar to the cohort that is accumulating.

Tracking Bitcoin’s [BTC] next direction could determine whether LINK will bounce from the above $11 demand zone.