Chainlink investors should consider this before closing a trade

Chainlink’s LINK cryptocurrency garnered a lot of hype and attention last week triggering a strong bull run. Unfortunately, the return of FUD in the market curtailed its potential upside, instead triggering another sell-off.

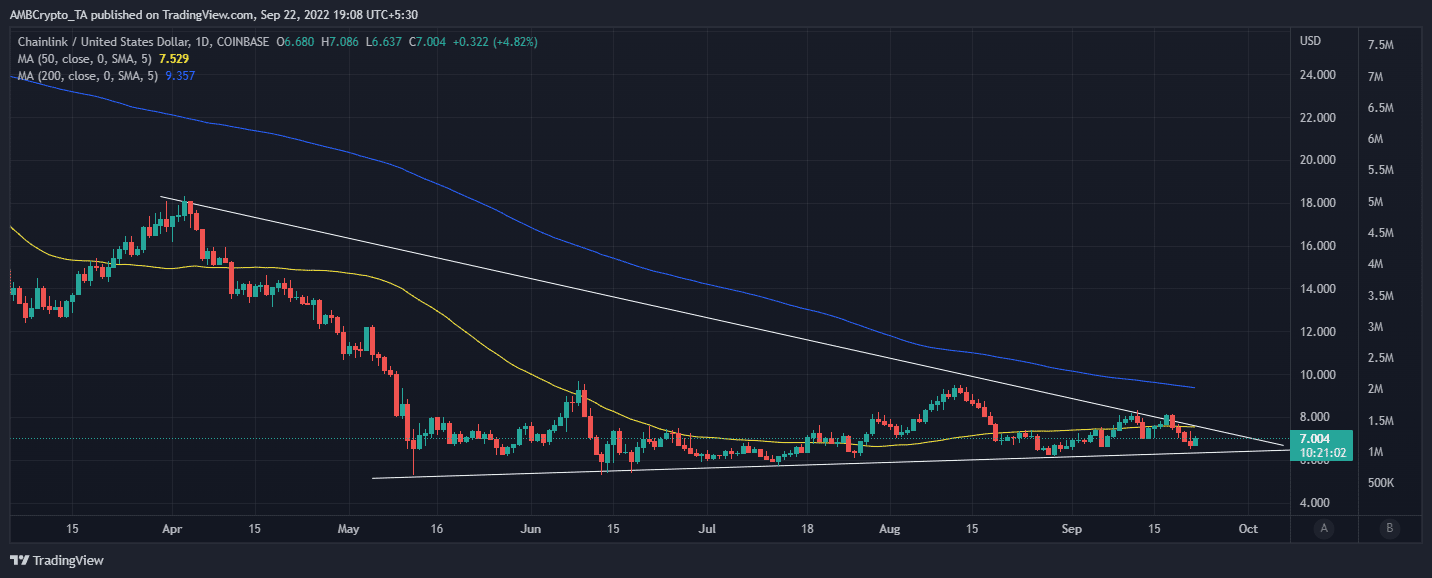

LINK’s subsequent sell pressure led to an 18% retracement from last week’s high of $8.14 to this week’s low of $6.51. It managed a 5.21% rally to its press time price of $7.03 but there might be more to its current level than meets the eye. LINK’s price action is currently squeezing into a tight resistance and support range.

Breaking the wedge

LINK’s wedge pattern might provide some insights into what to expect in the short term. It briefly broke through the resistance line prior to the retracement, indicating strong momentum. The lower range also leads to a similar observation after the bears failed to push all the way to the support line.

The bullish price action in the last 24 hours reflects a slight pivot in the RSI. While this observation creates a bullish bias, it does not necessarily guarantee such an outcome. LINK bears might still regain dominance and push for a structured break below support.

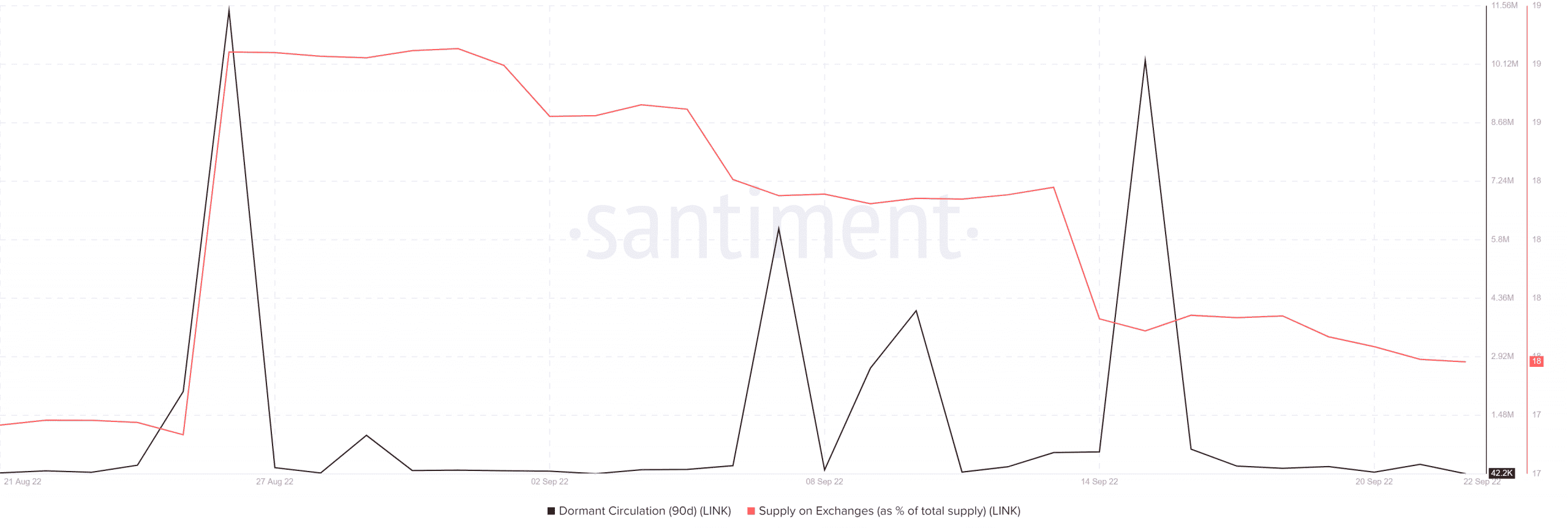

Perhaps LINK’s on-chain data will help provide more clarity to investors. Here are some of the considerations that investors should look into. LINK’s 90-day dormant circulation metric had its last major spike at around mid-September.

The same metric indicates that there has been relatively low activity since then. This means most of the LINK tokens privately have not been moved. A sign that long-term buyers are still holding on to their LINK tokens.

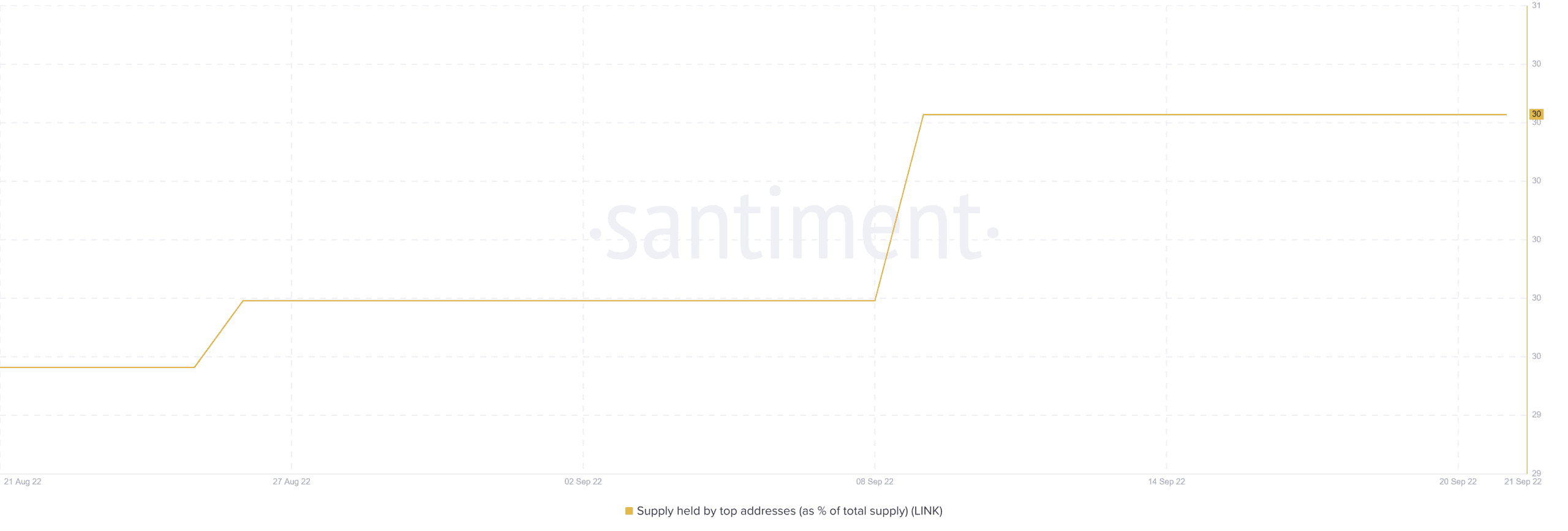

The dormancy metric observation is favorable for the bulls from a supply perspective. It confirms that the amount of LINK available on exchanges is lower, hence a demand increase may trigger a strong uptick. Speaking of supply, top addresses have been accumulating in the last 30 days.

The above metrics collectively confirm that the top address or whales have been accumulating LINK. Despite this, its price action only achieved a small marginal gain from its current 2022 low.

This might be a sign that most top LINK holders believe that it is currently in the bottom range of the current bear market.

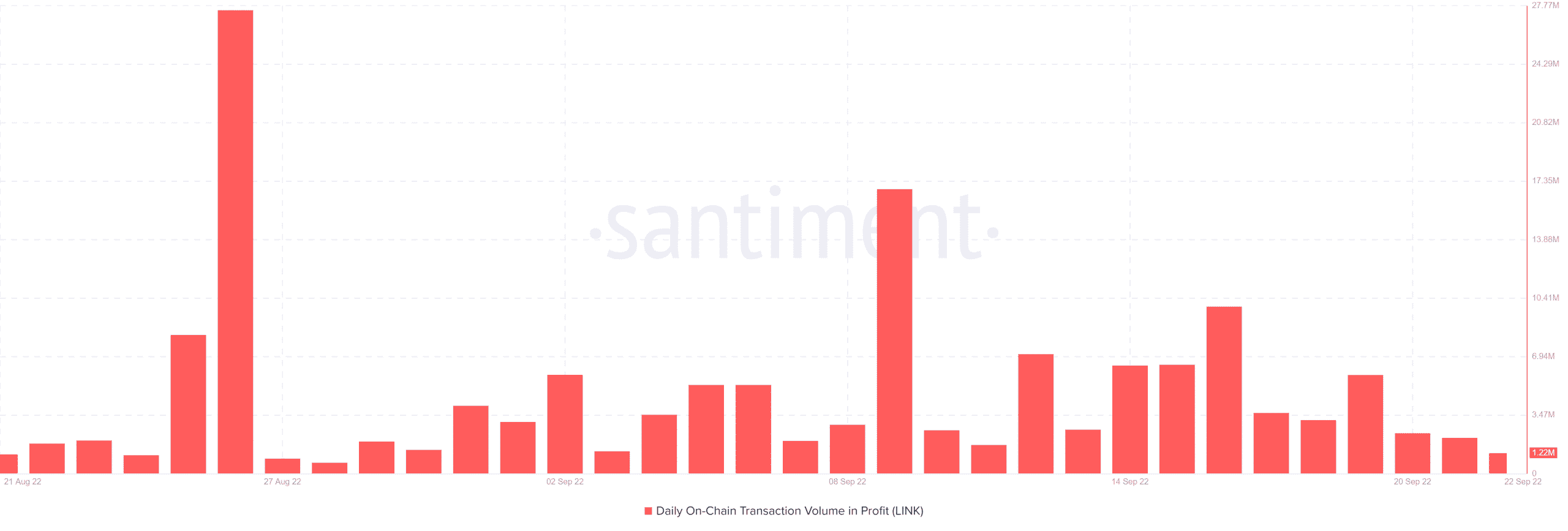

LINK’s daily on-chain transaction metric is perhaps one of the few metrics currently painting a not-so-favorable picture.

Lower profitability from daily on-chain transactions may appear bearish. One might interpret it as a result of the bearish price action or a reflection of the FOMO that has prevailed in the last few days.

However, investors are likely to double down on accumulation when most investors are in the red. Nevertheless, there is always room for the more potential downside.