Chainlink [LINK] dropped to a key support level – Will it hold?

![Chainlink [LINK] dropped to a key support level – Will it hold?](https://ambcrypto.com/wp-content/uploads/2023/02/1674498400465-2035673a-30b4-4d09-9d04-ad2daf91367b-3072-e1675418540175.png)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

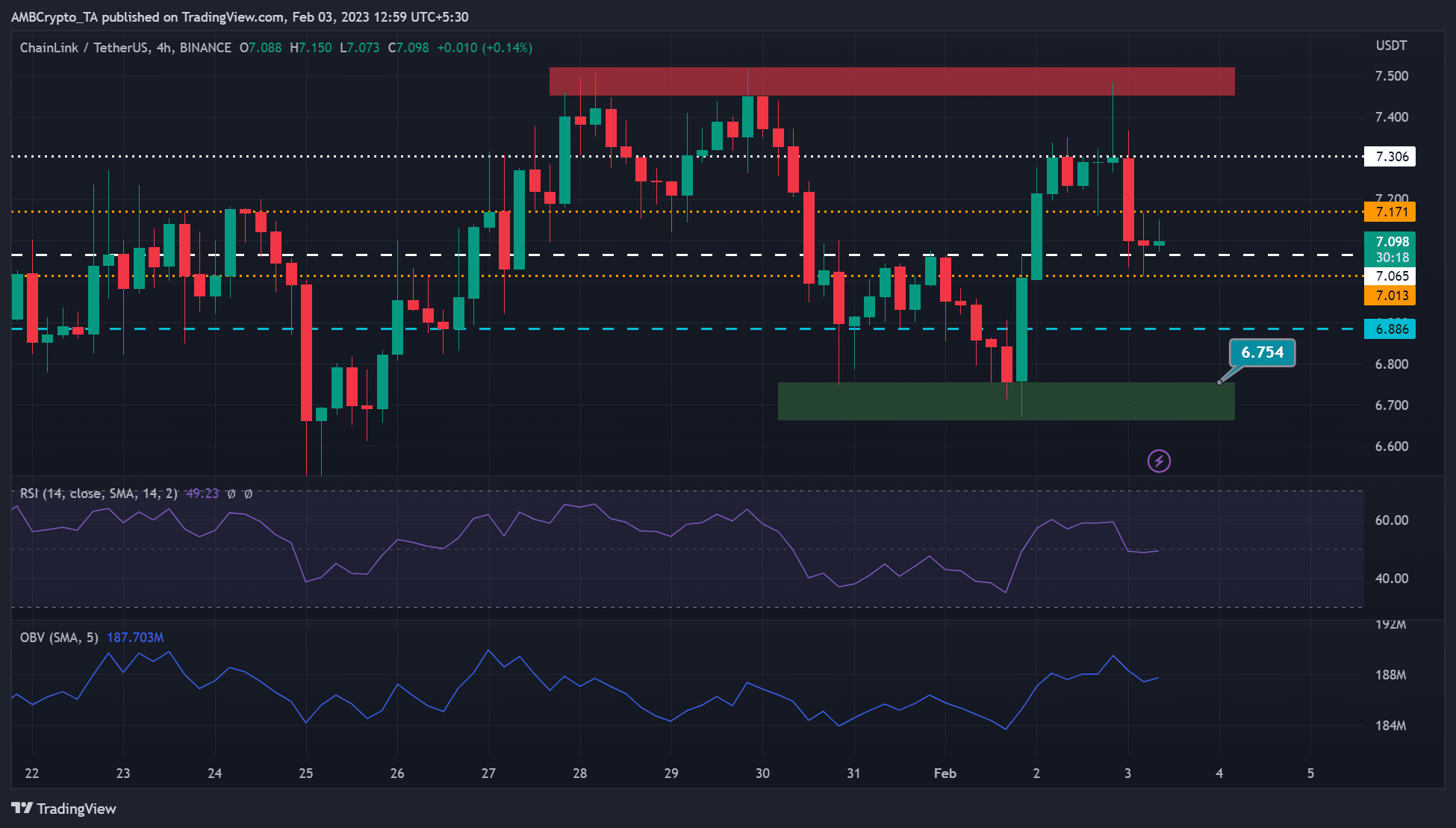

- LINK faced a price rejection at the selling pressure zone at $7.500.

- Holders still enjoyed profits.

Chainlink’s [LINK] uptrend momentum was facing a crucial short-term blockade. LINK dropped sharply by 6% after hitting the above crucial selling pressure zone. Its value declined from $7.484, but the plunge stopped at $7.065.

Is your portfolio green? Check out the LINK Profit Calculator

At press time, LINK’s value was $7.098 and could break a crucial support level in the next few hours if Bitcoin [BTC] fails to reclaim the $23.5K level.

The support at $7.075: Can it hold?

At press time, LINK’s Relative Strength Index (RSI) was 49, indicating an almost neutral structure leaning toward a bearish bias. Therefore, bears could take control of the market, especially if BTC drops below the $23.5K level.

Read Chainlink [LINK] Price Prediction 2023-24

Such a move could see LINK break below the $7.065 support level and settle at $7.013 or $6.886 in the next few hours. This would offer short-selling opportunities.

However, a break above the $7.171 hurdle would invalidate the above bias. Such an upswing would tip LINK bulls to break above the bearish order block at $7.306 and retest the selling pressure area of $7.500.

Investors and swing traders should track BTC price action, especially along the $23.5K price level. Any drop below the level would tip LINK bears to devalue the asset in the short term, while a surge above it would push LINK’s value toward $7.306.

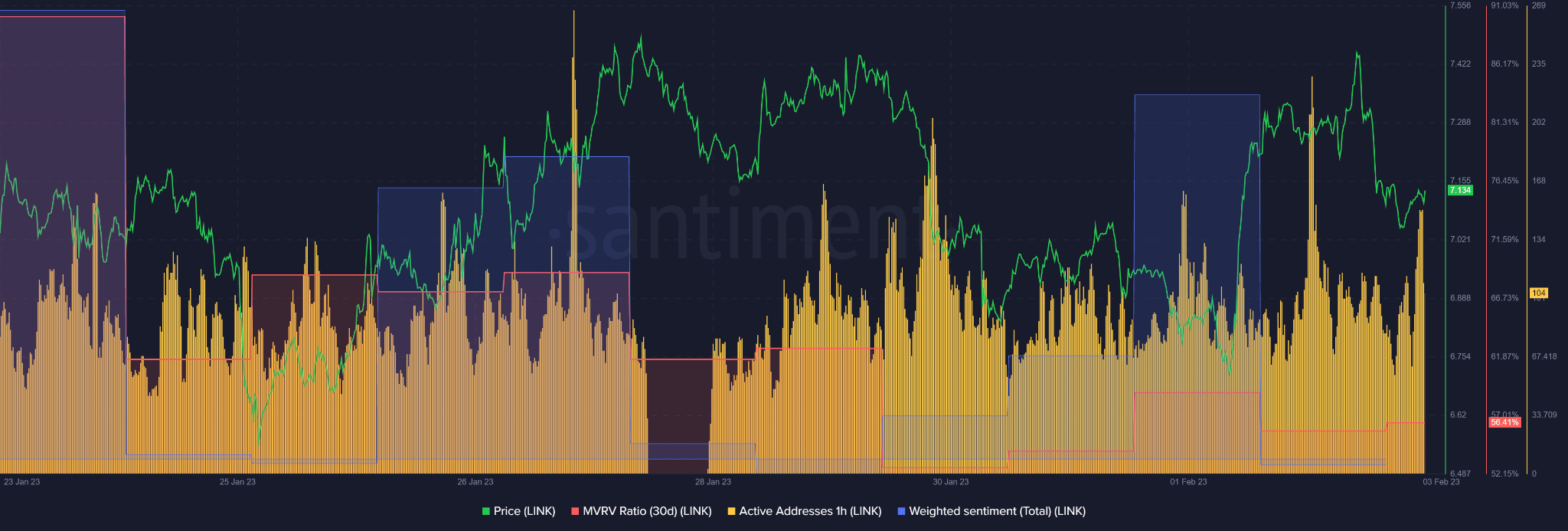

LINK’s hourly active addresses spiked, but sentiment turned negative

As per Santiment data, LINK’s active addresses spiked in the past hour, indicating that more accounts were trading the asset, which could boost its trading volume and buying pressure. If the spikes continue, the $7.065 support could hold.

However, any decline in the active addresses would tip bears to devalue the asset. In addition, LINK’s sentiment had dropped sharply and turned negative, indicating that analysts were bearish on the asset. This could undermine bullish momentum in the short term.

Nevertheless, short-term holders still pocketed gains, as evidenced by the positive elevation of 30-day MVRV. But a drop in LINK’s prices could eat away holders’ profits, thus worth tracking BTC price action to gauge the status of investors’ holdings.