Chainlink [LINK] eyes a 20% rally before 6 December, here’s why

- LINK was bullish, with a possible 20% rally toward a bearish order block at $8.965

- Short and long-term LINK holders saw gains.

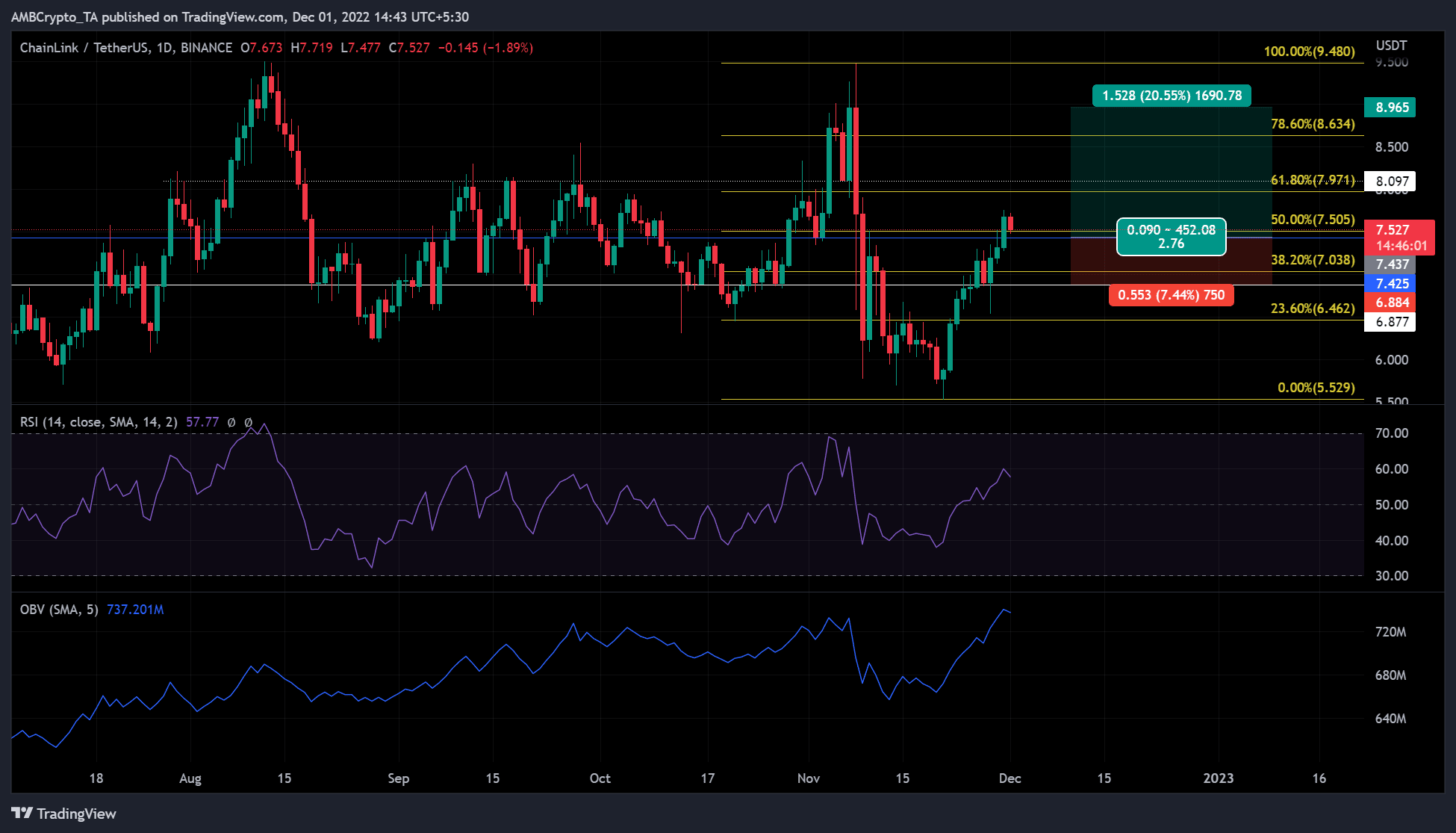

Chainlink (LINK) has rallied 30% since 21 November. At press time, it was trading at $7.527 and on the verge of a potential 20% rally toward a bearish order block target.

In other news, Chainlink Labs has launched a transparent “Proof of Reserves” system that allows users to confirm and determine whether the exchanges’ “Proof of Reserves” are true or false. In addition, LINK will launch a staking service on 6 December 2022.

The aforementioned increase in the utility of LINK could help drive the price rally.

Do the bulls have what it takes to regain the value of LINK before the market crash?

LINK could regain its pre-crash value. But, it has been facing key resistance at $8.097 since September.

However, it broke through this resistance on 4 November before a price correction began. After the correction, it was set for another rally, but the FTX saga caused the uptrend to turn into a downtrend.

LINK is now targeting the pre-FTX saga level of $9.5. The target could be between the bearish order block at $8.965 and $9.5 in the next few days or weeks. But can the bulls push through this uptrend?

Both the Relative Strength Index (RSI) and On Balance Volume (OBV) technical indicators suggest that the bulls can make it. At press time, the RSI was at 57, having risen from the lower areas bordering the oversold entry area. This showed that the bulls have steadily gained influence on the market.

The OBV also saw a steep rise in the last few days, indicating a huge trading volume that can increase buying pressure. Therefore, LINK could break through the 61.8% and 78.6% Fib resistance levels.

However, an intraday close below the $7.245 support would invalidate the above bias. In such a case, LINK could find new support towards the 38.2% Fib level ($7.038). A stop around this Fib pocket offers a good risk-reward ratio for long trades.

LINK recorded profits

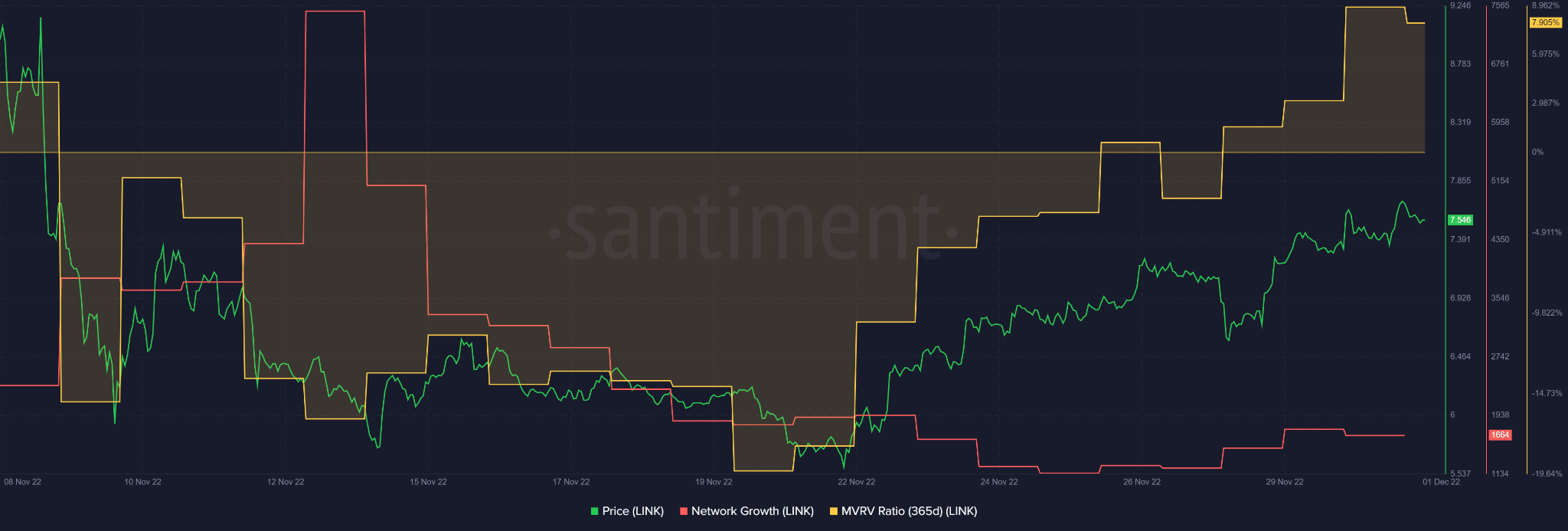

According to Santiment, the 365-day MVRV was in positive territory, showing that long-term LINK holders posted gains. Interestingly, short-term LINK holders also recorded gains.

Moreover, LINK’s network growth has increased since 26 November. During the same period, the price of LINK also increased. However, network growth fell slightly at the time of going to press.

But if BTC holds the $17K mark and continues to rise, LINK could break through resistance to the north. However, any bearish sentiment towards BTC would undermine LINK’s price recovery.