Chainlink [LINK] whale sells after $30 rejection – What’s next?

- Chainlink saw dormant circulation spikes from long-term holders after the rejection at $30.

- Lack of conviction from the large holders meant the rally was unlikely to continue.

Chainlink [LINK] experienced a “Trump Pump” earlier this month, resulting in a 21% hike in a single day when Trump-affiliated World Liberty Financial (WLF) bought $1 million worth of LINK tokens.

Over the past two weeks, some on-chain metrics indicated increased sell pressure from whales. The price move to $30 was used to secure profits.

Can we expect a Chainlink accumulation above $20 and a renewal of the upward momentum?

Whale transaction spike sparks fear

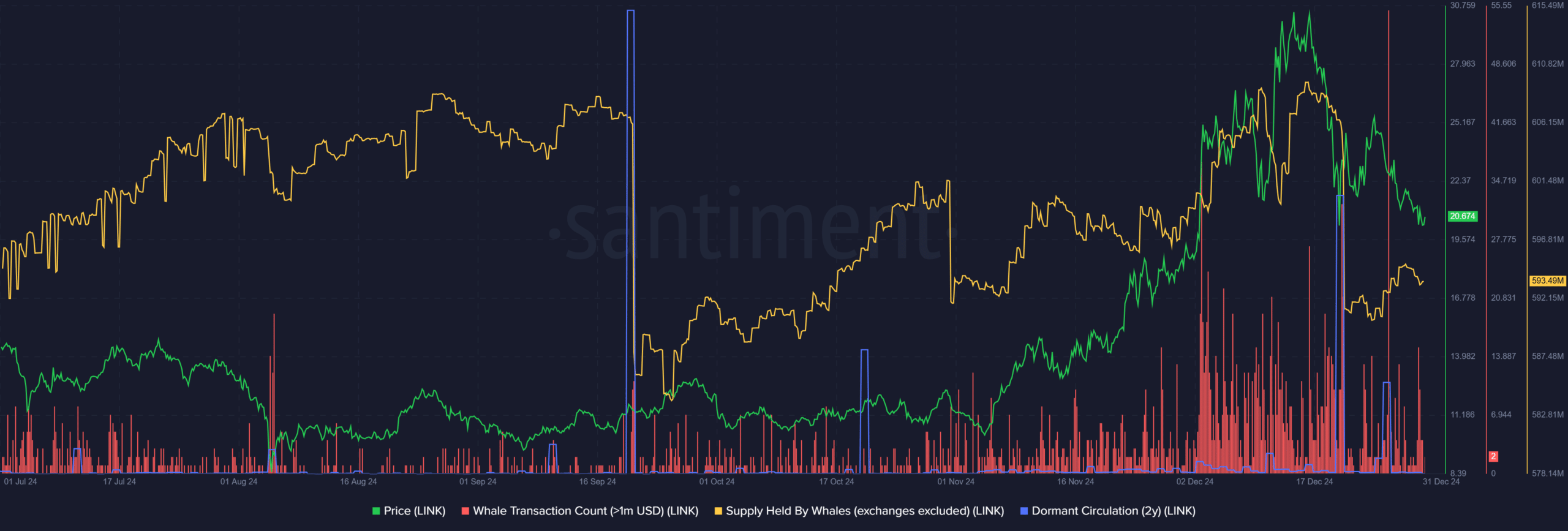

Source: Santiment

Toward the end of November, as LINK prices rallied past the $20 mark, the whale transaction count of more than $1 million began to rise.

This increased whale transaction activity persisted throughout the time Chainlink was trading above $22.

Over the past two weeks, it has begun to recede, but there were two major transaction days that were the second and third highest of any day in the past three months.

They occurred on the 20th and the 26th of December.

The latter came when LINK saw its price bounce rejected at $25. This indicated increased panic among large holders and an uptick in selling pressure over the past ten days.

The heightened daily transaction activity from whales was on the same scale as that from the second half of 2021, supporting the idea of profit-taking from whales when the rally didn’t continue.

Chainlink continues to hunt liquidity pockets to the south

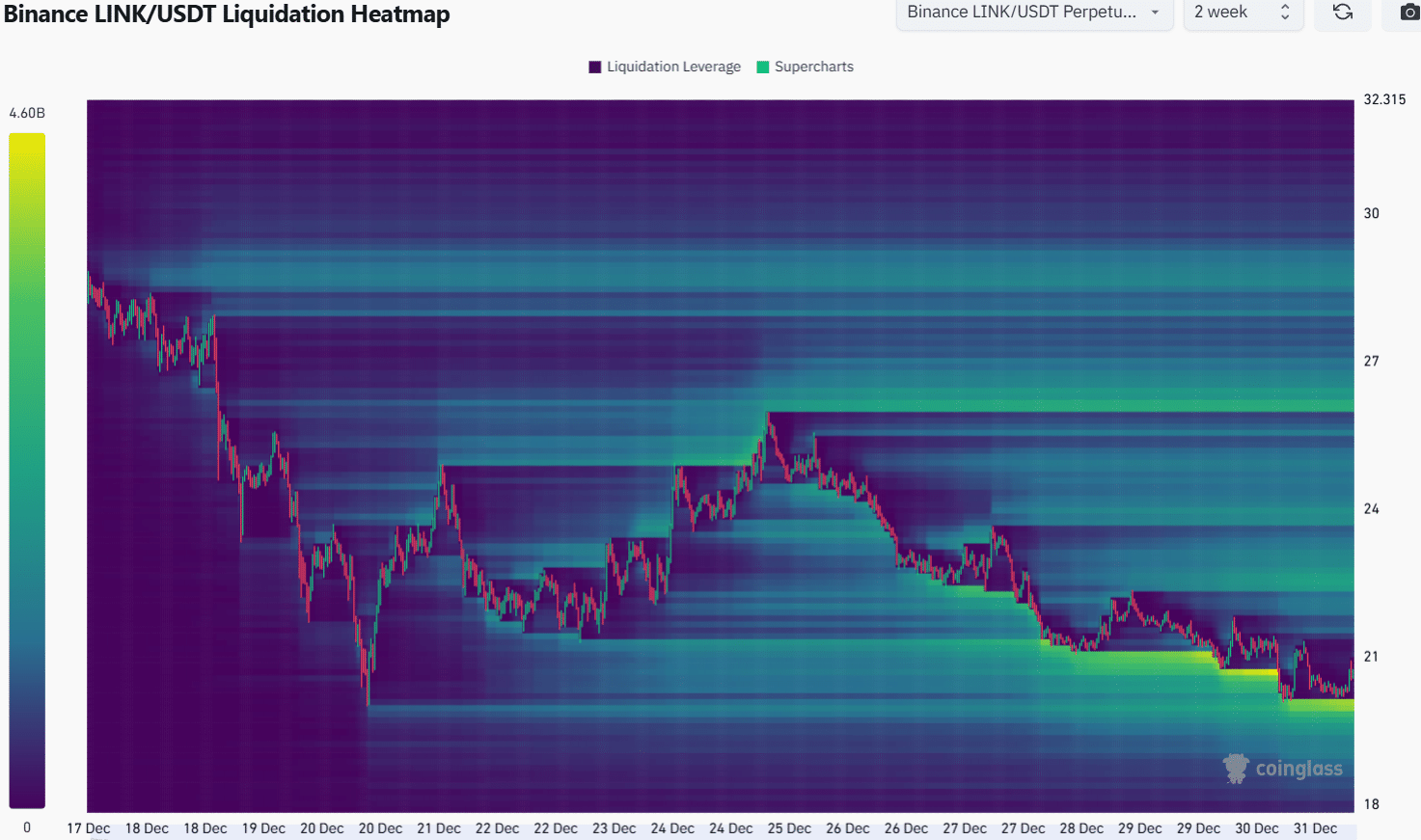

Source: Coinalyze

The liquidation heatmap of the past two weeks highlighted the steady fall in LINK prices. Especially in the past week, the trend has been steadily bearish.

Realistic or not, here’s LINK’s market cap in BTC’s terms

Liquidity pockets formed underneath short-term support zones, but they could not keep the bears away for long.

If this pattern continues, the $20 level, which saw a bounce on the 30th of December, might attract prices downward in search of liquidity, fueling another drop.