ChainLink

Chainlink price prediction – Mapping LINK’s road to $30 on the charts

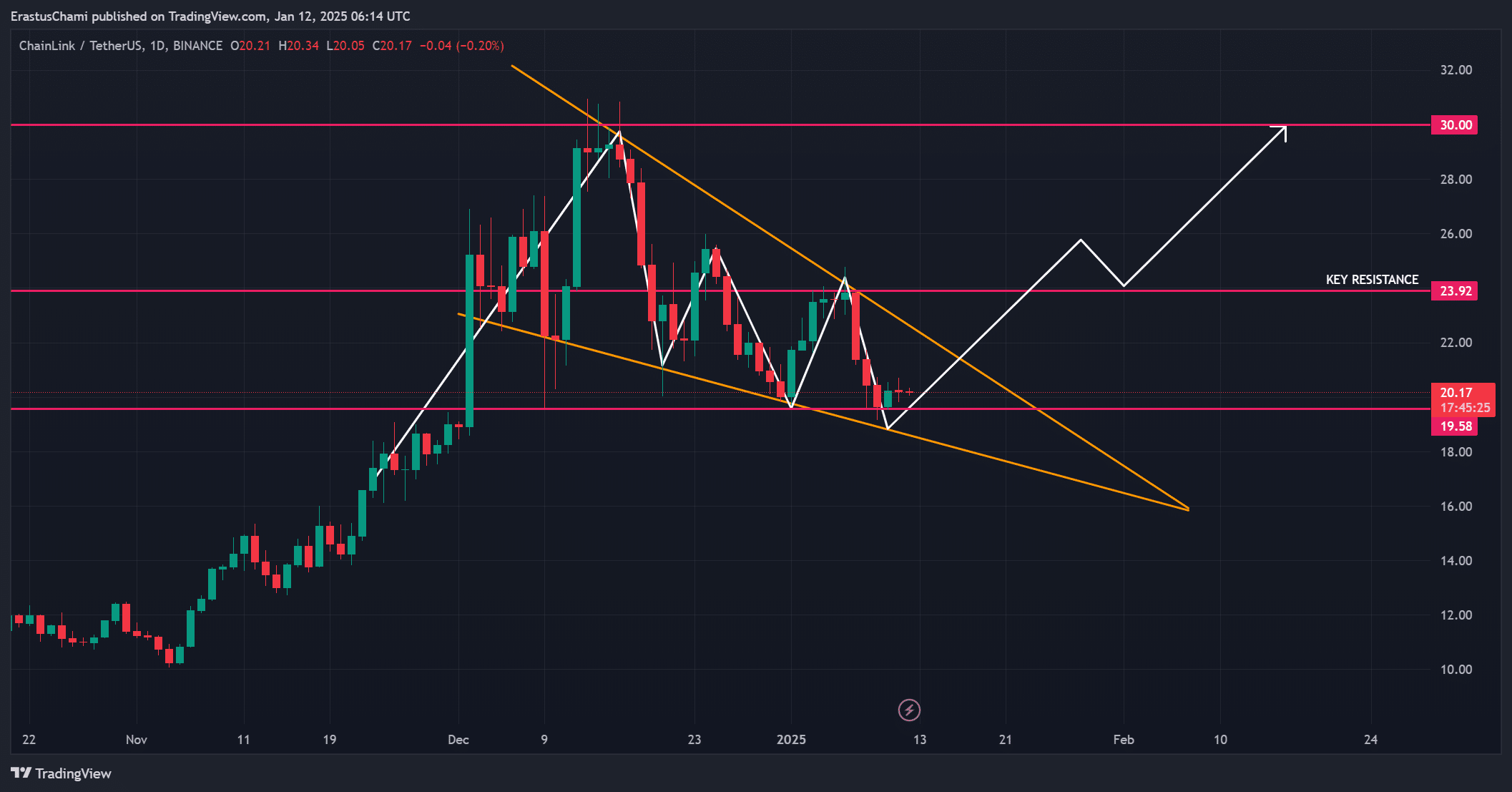

LINK has been consolidating within a bullish pattern, poised for a potential breakout.

- LINK’s descending wedge pointed to a bullish breakout, with $23.92 resistance as the critical level

- Market sentiment strengthened as Open Interest rose and exchange reserves continued to decline

Chainlink [LINK] has been grabbing the attention of the market with its steady consolidation and potential for a major breakout. Trading at $20.17 following a 0.62% hike at press time, the cryptocurrency seemed to be showing signs of strength within a descending wedge pattern.

With resistance at $23.92 acting as a critical level, LINK could be on the verge of a significant rally towards $30. Will the market momentum support this bullish trajectory?

What does the price action reveal?

LINK’s price action has remained confined within a descending wedge, characterized by lower highs and lower lows. However, this structure is commonly associated with bullish breakouts, especially as prices approach the apex of the wedge.

Consequently, a breakout above the $23.92 resistance could trigger a surge towards $30 – A level that may attract significant interest.

On the downside, a failure to break above resistance could lead to further consolidation, delaying the bullish scenario. Therefore, the coming days will be crucial in determining LINK’s next direction.

On-chain activity strengthens optimism

Chainlink’s on-chain metrics also supported a favorable outlook. Active addresses have grown by 0.86% in the last 24 hours, signaling greater user engagement on the network. Additionally, transaction counts have risen by 0.88% – A sign of greater activity and demand.

These metrics, together, underscored the growing interest in Chainlink, which is essential for sustaining a potential rally.

Moreover, the exchange reserves for LINK declined by 0.11% too, indicating reduced selling pressure as fewer tokens seemed to be held on exchanges.

Consequently, this could create a favorable supply-demand dynamic, supporting price hikes on the charts. Worth noting, however, that consistent growth in these metrics will be key for a sustained bullish run.

Market sentiment and liquidations favor a bullish outlook

Finally, the market sentiment for LINK appeared increasingly optimistic at press time.

Open interest surged by 5.42%, reaching $724.59 million – A sign of greater participation and confidence among traders. Furthermore, liquidation data revealed higher volumes for shorts compared to longs, suggesting that traders have been leaning towards a bullish bias.

Is your portfolio green? Check out the LINK Profit Calculator

Chainlink seems to be positioned for a breakout with its bullish wedge pattern, growing on-chain activity, and strong market sentiment.

The key lies in breaking the $23.92 resistance, which could unlock a rally to $30 or beyond. Therefore, all signs point to LINK being ready for a significant upward move in the near future.