Chainlink surges 18% in 3 days – How whales helped LINK’s recent surge

- LINK prices have surged by 18% in just three days after retesting a critical support level near $19.

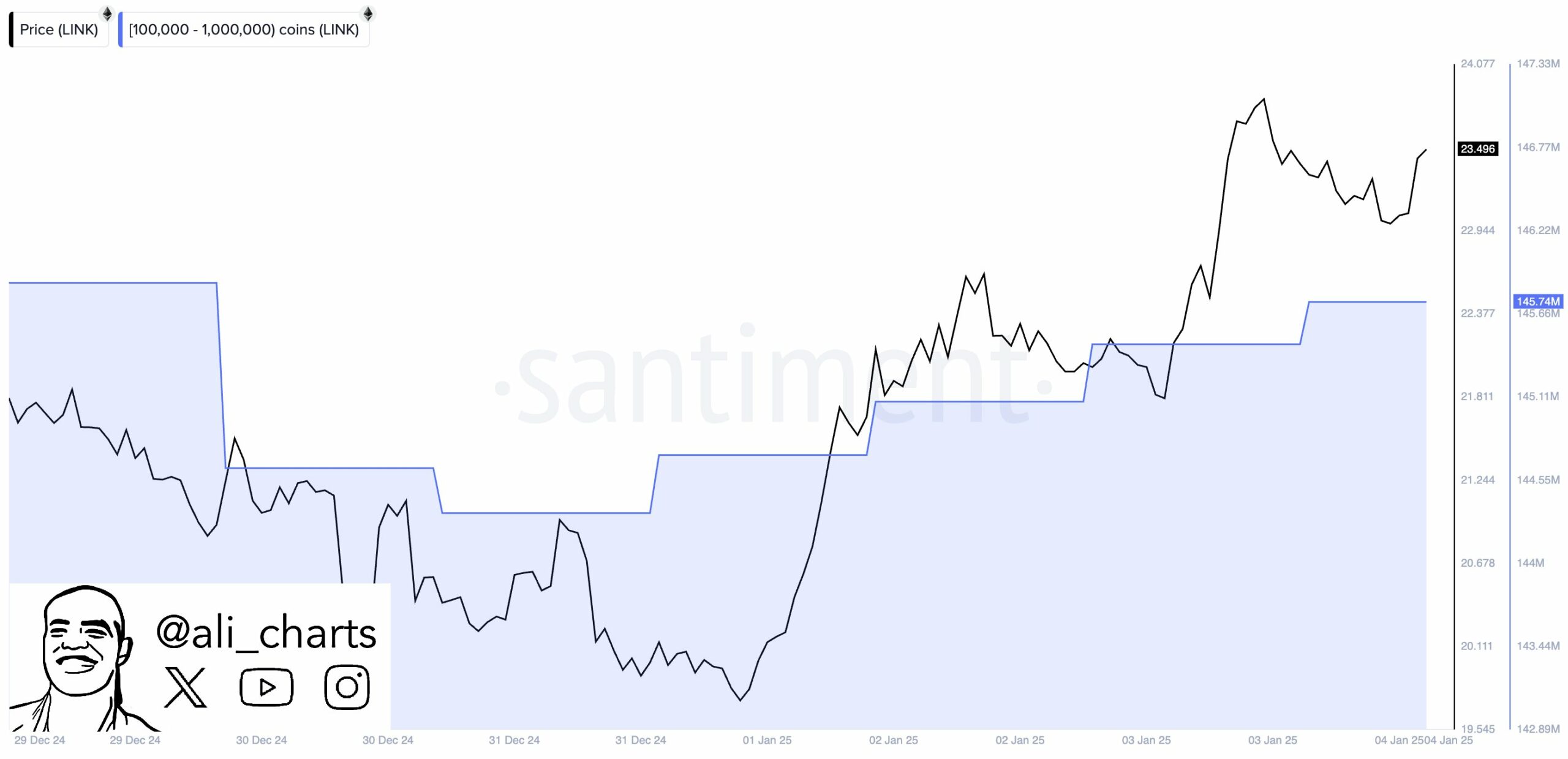

- The token whale activity intensified as over 1.40 million LINK were accumulated, signaling potential for further rally.

Chainlink [LINK] has been at the center of crypto investors’ attention after a recent significant surge. In the last three days alone, LINK surged by about 18% after its bounce off from the key support zone at around $19.

The rebound indicates the asset strength despite the volatile market.

Adding fuel to the rally is a notable increase in whale activity. According to a renowned analyst on X (formerly Twitter), large holders have purchased over 1.40 million LINK in the last 96 hours.

Such substantial accumulation often hints at a growing confidence among Chainlink major investors, possibly signaling long-term bullish sentiment.

Exchange outflows decline, but LINK whales show confidence

AMBCrypto’s closer look at LINK’s on-chain metrics revealed positive trends for the token.

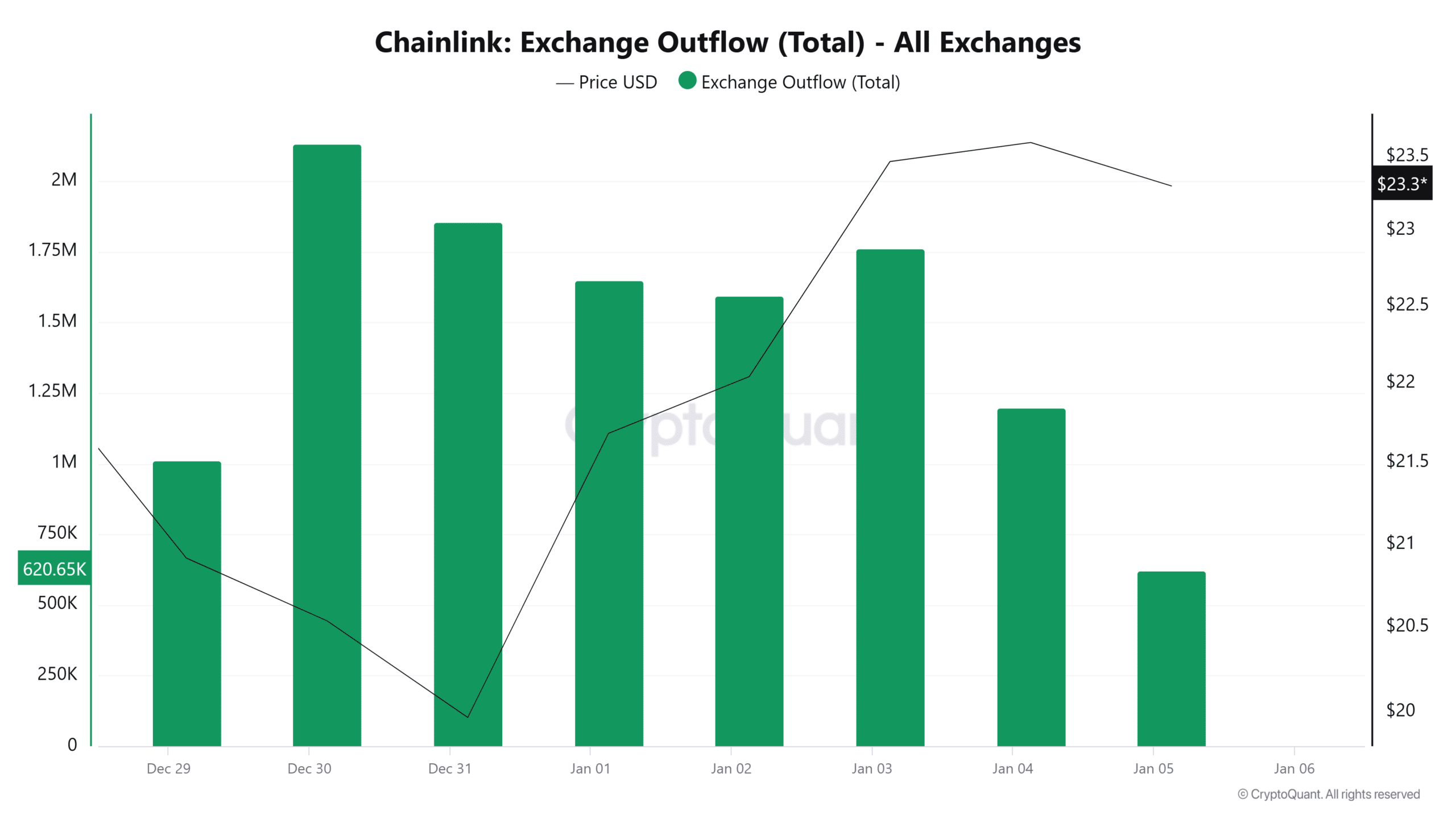

The exchange outflows — which typically indicate the movement of tokens away from trading platforms-have steadily decreased over the last three days.

This suggests fewer LINK holders are moving assets to exchanges for potential sell-offs, pointing to market optimism.

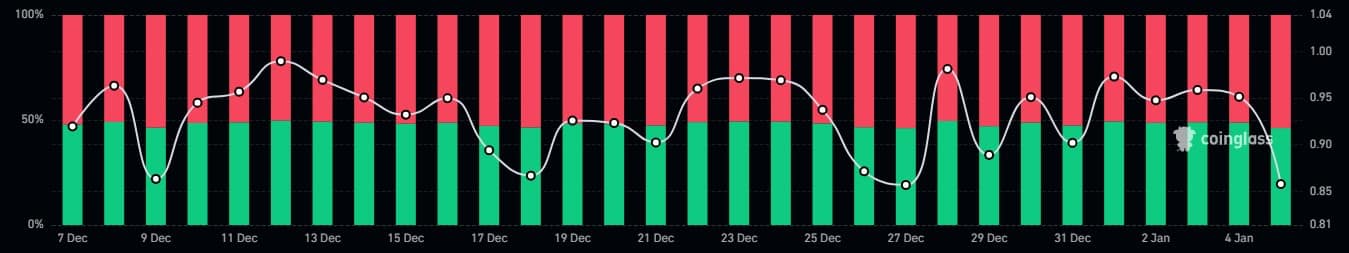

Interestingly, while the Long/Short Ratio was bearish, short positions were slowly declining as indicated by the Coinglass data. This trend might be attributed to profit-taking after the recent rally.

However, the steady accumulation by whales suggests a focus on long-term gains rather than short-term speculation.

Could whale activity propel prices higher?

The sustained accumulation by whales could be a signal for further price rally. Historically, increased whale activity has often preceded bullish rallies in the crypto market.

If this trend continues, LINK could experience a stronger upward momentum in the coming days.

Read Chainlink’s [LINK] Price Prediction 2025–2026

Additionally, the sluggish declining presence of long/short ratio supports the possibility of reduced selling pressure.

Combined with whale confidence, this scenario could pave the way for LINK to test higher resistance levels.