Chainlink: This is why a correction is likely before LINK’s next bull run

- LINK’s price could drop below $8 before the rally continues.

- Investor sentiment remains bullish as the market continues to recover.

After gaining 8.98% in the last seven days, Chainlink [LINK] is finding it hard to improve its performance and has stalled around $8. Interestingly, the stalemate could be traced back to historical data, and pseudonymous crypto analyst Ali_Charts identified this.

Is your portfolio green? Check the Chainlink Profit Calculator

Chaos before tranquility

According to Ali, LINK’s stagnancy could be linked to its 30-day Market Value to Realized Value (MVRV) ratio. The metric, using market capitalization and realized capitalization, can be very instrumental in identifying tops and bottoms.

So, Ali used Santiment’s on-chain to track Chainlink’s MVRV, noting that the token experienced a steep correction when the metric was 19% between July and August. As of the time, the analyst posted on X (formerly Twitter), LINK’s MVRV ratio was 20%.

Data from @santimentfeed shows that the last two times #Chainlink MVRV 30D surpassed 19%, $LINK underwent a steep correction!

Notice that #LINK MVRV 30D recently hit 20%, suggesting a brief correction before higher highs. pic.twitter.com/4zsKoYdupQ

— Ali (@ali_charts) October 2, 2023

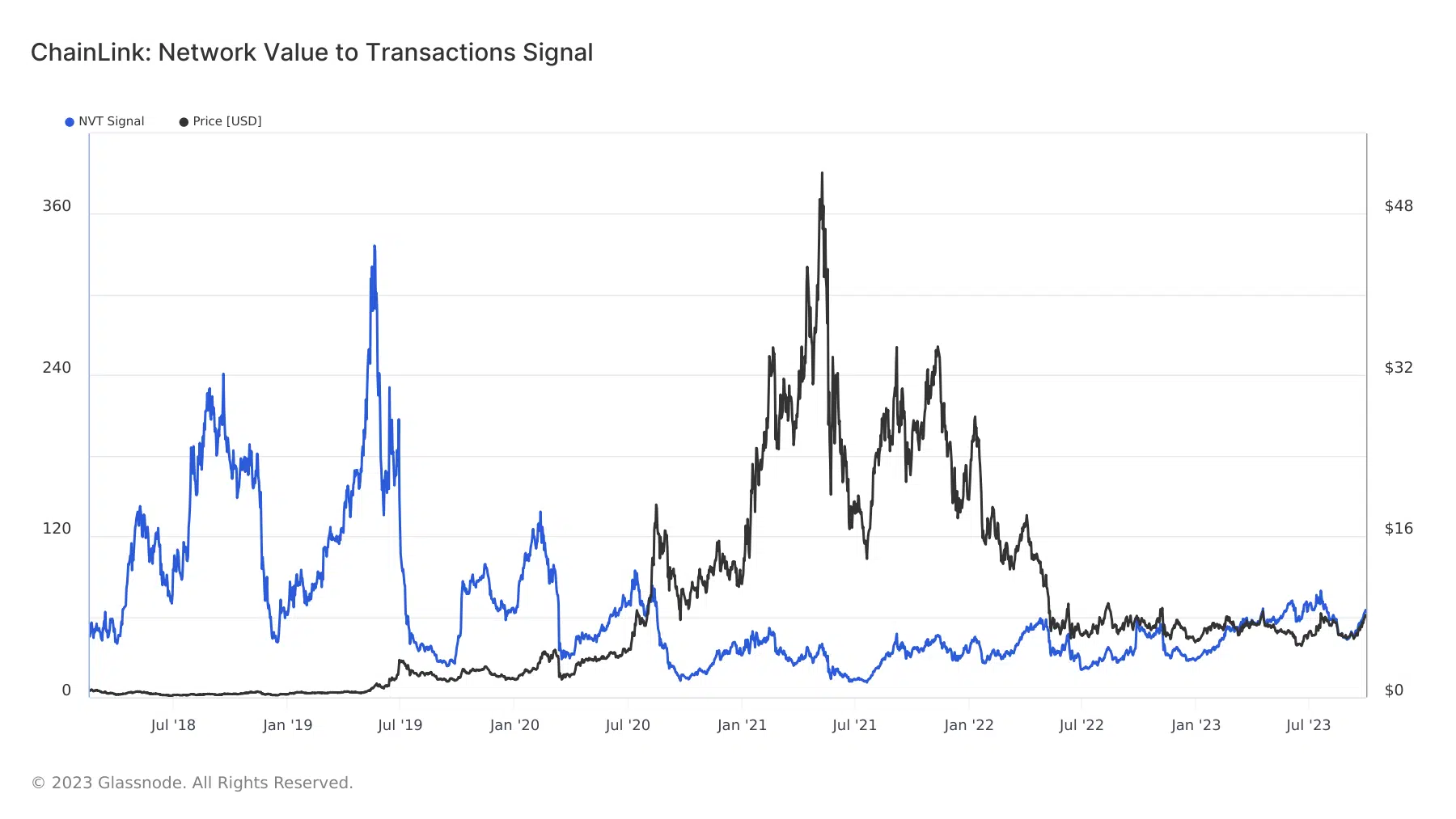

Ali, however, noted that the correction would only last a while, and LINK could be headed for a higher high. As of this writing, the Network Value to Transaction (NVT) signal increased to 63.57.

As a modified version of the NVT ratio, the NVT signal uses the 90-day Moving Average (MA) of the daily transaction volume. For this reason, the metric can tell when investor sentiment is bullish or not.

A high NVT signal means that the project has a relatively high network value but low network activity. In this case, the sentiment turned out to be bearish. However, when the NVT signal is low, it means that there is high network activity but low network value.

Compared to previous cycles, the NVT signal can be said to be relatively low. Therefore, the sentiment around LINK remained bullish.

The wait for the recovery

Meanwhile, Chainlink’s weighted sentiment over the last seven dropped to 0.132. Weighted sentiment shows the unique positive or negative commentary market participants have about a cryptocurrency.

When the metric is positive, it implies that the average market participant is bullish on the asset. But for LINK, the decrease in the metric suggested that market players could also be expecting a drawdown for the time being as Ali mentioned.

However, traders seem not to care about the possible correction. This was indicated by LINK’s funding rate. Funding rates are periodic payments paid between longs and shorts. A positive funding rate implies that longs are paying short to keep their contracts open.

Read Chainlink’s [LINK] Price Prediction 2023-2024

Conversely, a negative funding rate suggests that shorts are making the payments. At press time, LINK’s funding rate was positive, indicating that traders could be waiting on the rally after the correction to cash in on the long positions.