Chainlink reaffirms its interest in the NFT market, thanks to…

Chainlink [LINK] rapidly expanded its scope in the last few years of its existence as the need for its services becomes more apparent. The blockchain network revealed that it aims to maintain the pace moving forward during this year’s SmartCon convention.

Chainlink reaffirmed its interest in the NFT market which is among the rapidly developing Web3 segments. The blockchain network announced as part of its product keynote that it would provide NFT floor pricing feeds to NFT users.

Coinbase and Cryptex Finance will be among the first partners to leverage Chainlink’s oracle data for NFT price feeds.

.@CoinbaseCloud has partnered with Chainlink Labs to launch NFT Floor Pricing Feeds, a collection of #Chainlink Data Feeds tracking the floor prices of the top 10 NFT collections.https://t.co/LsHITv9QtAhttps://t.co/6VsVL0vqKn pic.twitter.com/TzuQ7IKYOm

— Chainlink (@chainlink) September 29, 2022

In the same line of pricing feeds, Chainlink confirmed a collaboration with CF Benchmarks. The partnership will facilitate the rollout of a Bitcoin interest rates benchmark called CF Bitcoin Interest Rate Curve (CF BIRC) for a variety of securities.

The upcoming developments stand to be added to the growing list of Chainlink services. These are to collectively build up more use cases and utility for ChainLink’s LINK token.

The latter traded at $7.52 at press time and was trading 3.2% lower than its price of 30 September. Furthermore, its 30 September price of $7.69 was after the altcoin witnessed a 9.65% retracement from its weekly top.

The pullback happened after LINK retested its 0.236 Fibonacci level towards mid-week. An unsurprising outcome after the 30% upside it achieved from its previous week’s lows.

The price failed to cross above the same Fibonacci level in the previous two attempts earlier in September. This confirmed that LINK’s lower range gained relative strength during the month.

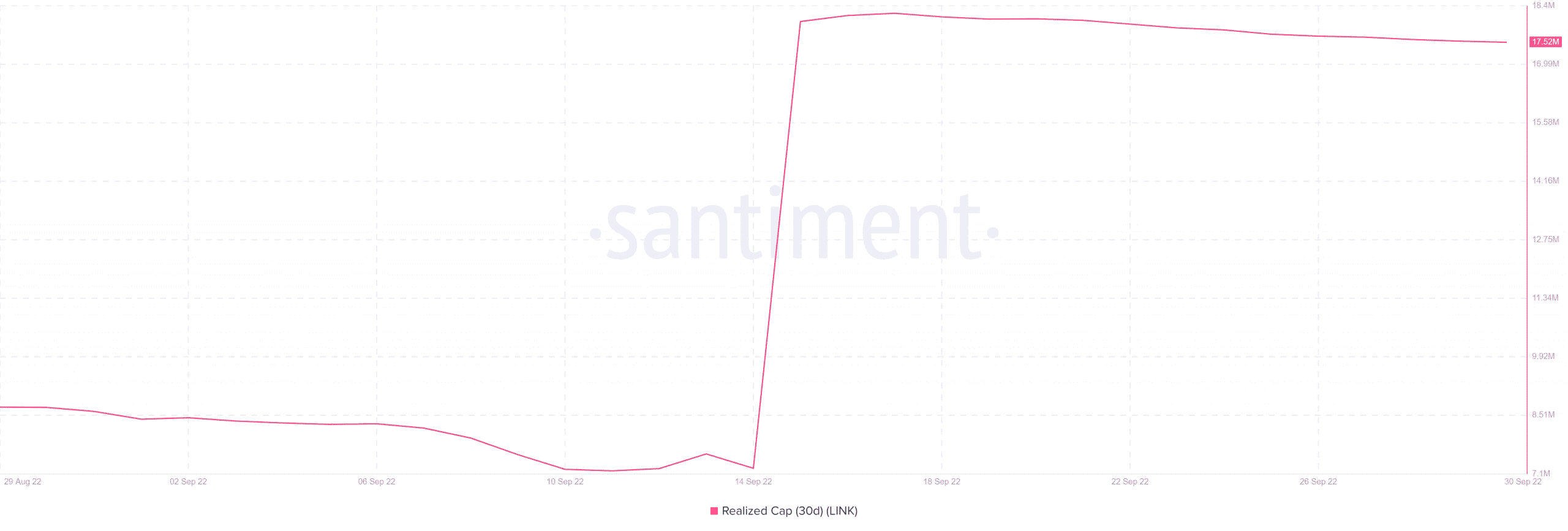

Its realized cap also more than doubled in the last four weeks from as low as 7.23 million to as high as 18.22 million.

It retraced slightly to 17.52 million on 30 September which was roughly 0.56% of LINK’s circulating supply.

The realized cap indicated a higher realized value for LINK since the last time that they were moved.

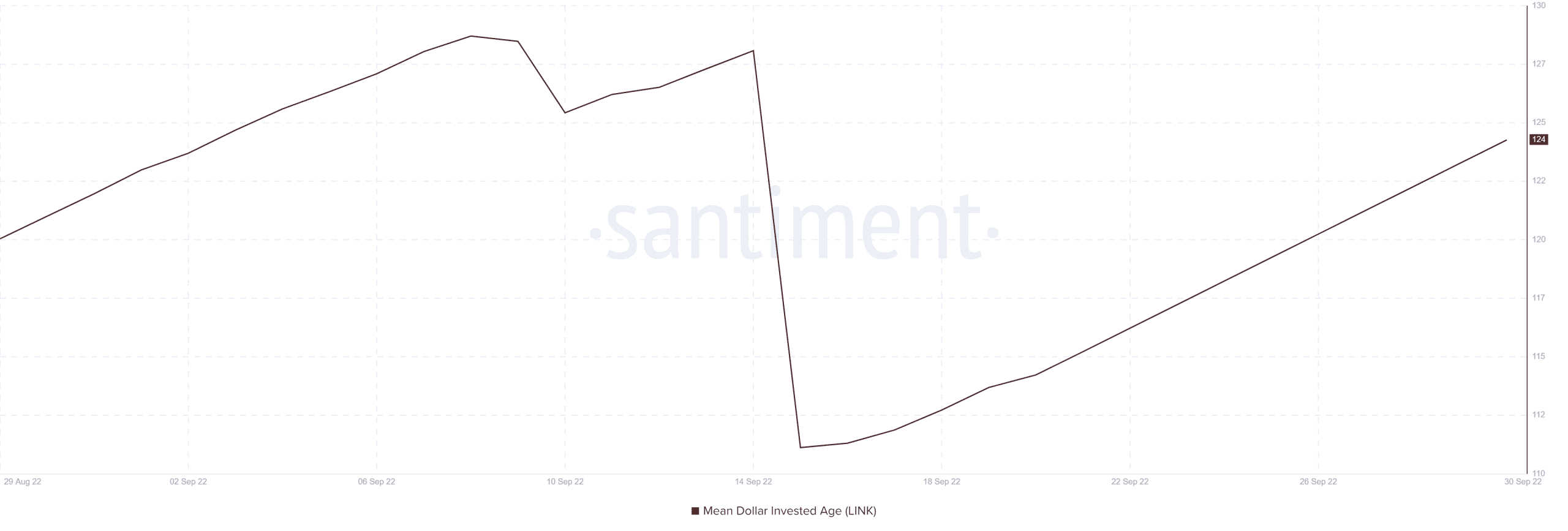

The mean dollar invested age (MDIA) metric also registered an uptick after a sharp crash in mid-September. This observation confirmed that investors have been accumulating for the last two weeks.

A footprint of short-term profit-taking

Well, LINK’s price action indicates a shift towards short-term profits after every short period of accumulation.

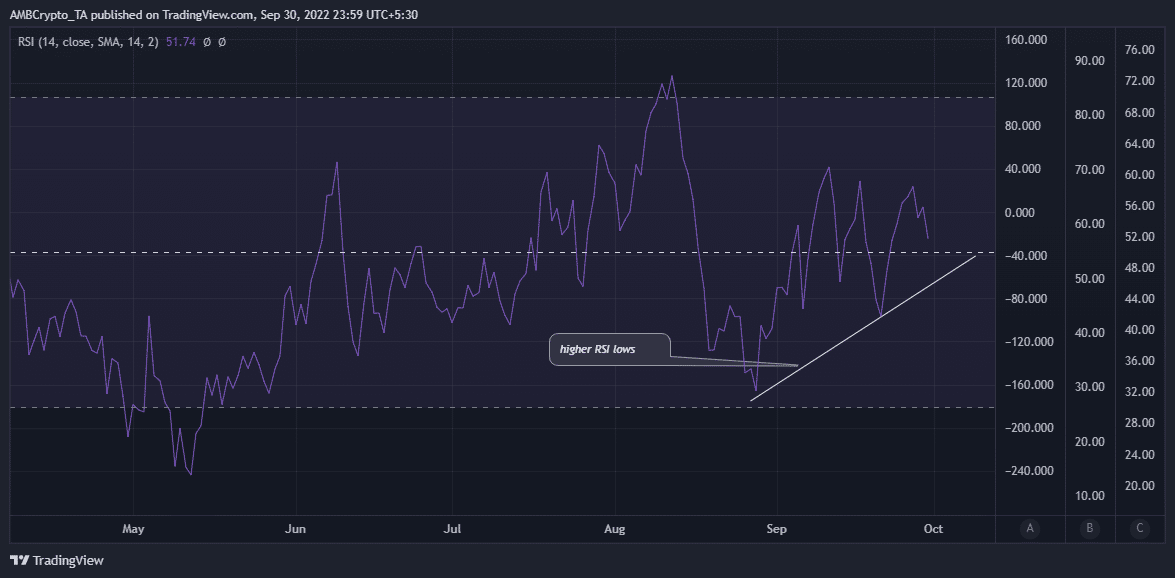

However, as of 30 September, LINK’s Relative Strength Index (RSI) grew substantially in the last four weeks and this was observed as higher RSI lows.

LINK was still trading below its August highs even as relative strength received a boost. This might be a sign of more short-term upside to come, in which case we should expect LINK to overcome the current resistance level.

In conclusion, LINK is still relatively close to its current 2022 lows. Nevertheless, there might be some risks ahead that may trigger some price slippage.

The other side of the coin looks favorable for the bulls especially if market conditions will allow it.

![Sonic [S] sees $1.4 billion liquidity surge as network upgrade sparks investor interest](https://ambcrypto.com/wp-content/uploads/2025/03/F0D8CF78-0B88-471B-BD85-84A9F049FDBA-400x240.webp)