Chainlink: What next for LINK after reaching $20T in transactions?

- LINK has now surpassed $20 trillion in total transaction value executed on its network.

- Over the past 24 hours, traders have accumulated millions of dollars worth of LINK, with active addresses reaching a new high.

Chainlink [LINK] has been on a bullish path since last week, posting a modest 1% gain as traders continue to buy the token.

AMBCrypto’s analysis indicates a growing demand during this period. While the growth appears gradual, it could set the stage for a major price rally in the coming days. The analysis below outlines how this could unfold.

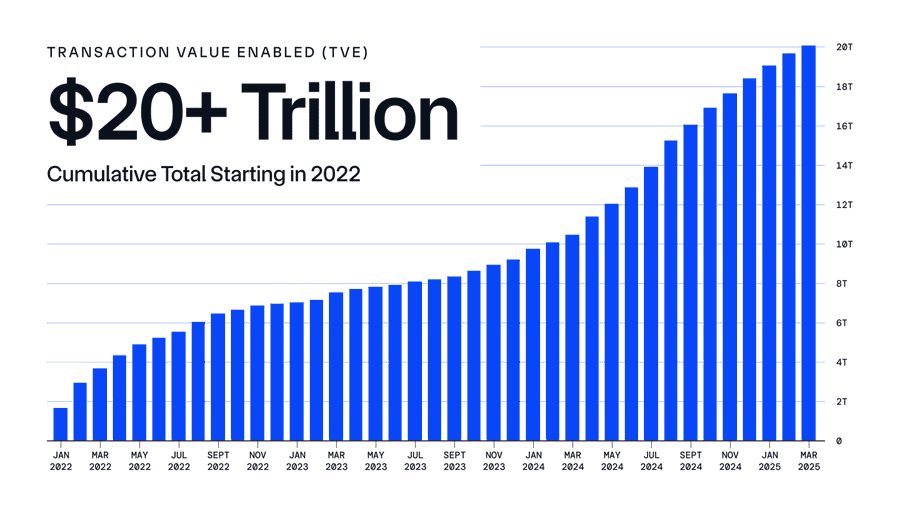

LINK’s TVE surpasses $20 trillion

There has been a significant increase in the Total Value Extracted (TVE) on Chainlink, which has now reached a new milestone of $20 trillion.

TVE is a metric that measures the total value of transactions facilitated by Chainlink’s oracle services.

A high TVE suggests strong adoption among blockchains and protocols that rely on Chainlink’s price data as a primary source.

The market has responded positively to this development, as key indicators show not only increased usage of Chainlink but also renewed buying activity from traders.

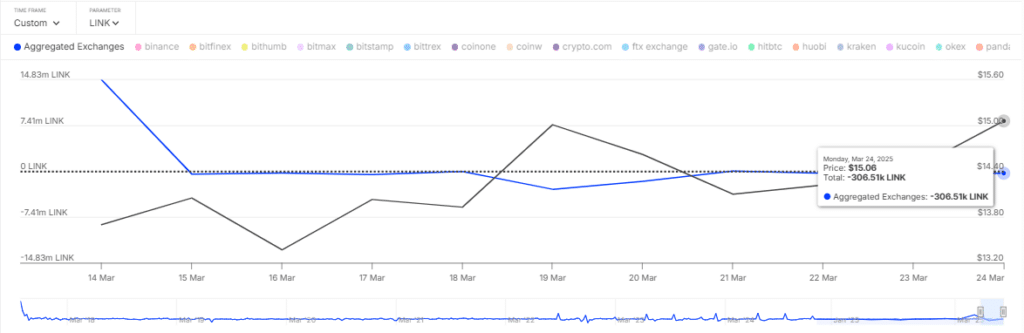

Traders accumulate LINK as activity surges

In the last 24 hours, LINK acquisitions have seen a significant increase. Data from IntoTheBlock reveals that 306,510 LINK, valued at approximately $4.5 million, were purchased during this period, resulting in negative exchange netflow.

Negative exchange netflow reflects growing market confidence, as users transfer assets from exchanges to private wallets for long-term storage rather than immediate sale.

The increase in LINK purchases coincided with a rise in daily active addresses, which reached their highest level since December 2022.

The continued growth in active addresses could benefit LINK, as it signals increased trader participation and potential for further buying activity, aligning with recent exchange netflow trends.

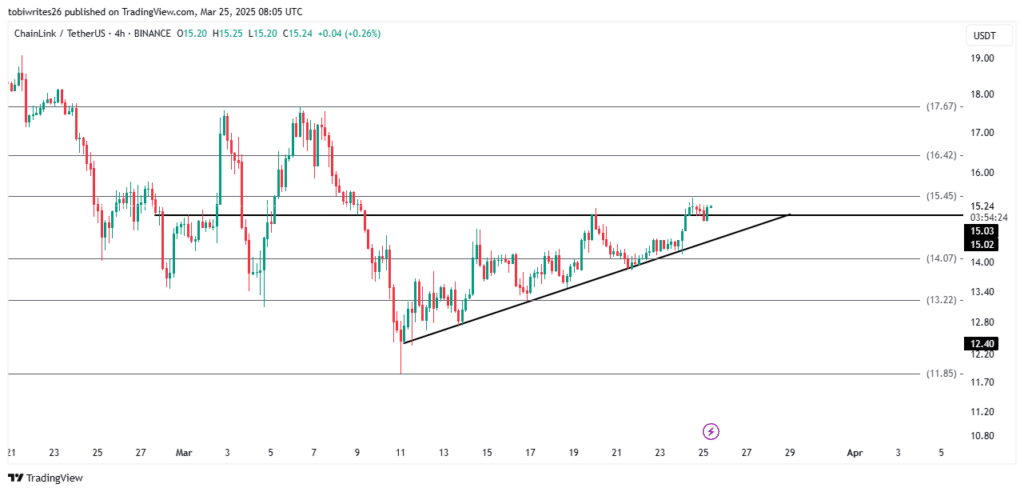

LINK remains in a bullish phase

LINK remains in a bullish phase, as evident from its chart pattern. The asset has slightly broken out of an ascending triangle, defined by a horizontal resistance level and a rising diagonal support line.

This pattern often signals accumulation, with a breakout potentially marking the beginning of a significant rally. LINK is already progressing in this direction, steadily advancing toward a projected target of $17.67.

AMBCrypto used Fibonacci retracement levels to pinpoint two critical resistance zones that may hinder LINK’s upward trajectory.

The first resistance is at $15.45, where price reactions have already been observed. The second is at $16.42. If LINK overcomes both barriers, it could potentially reach its ultimate target of $17.67.

Overall, market sentiment remains optimistic. As traders continue accumulating LINK, sustained buying pressure could drive the asset toward its projected goal.