Chainlink: Why THIS support could define LINK’s next move

- LINK found significant support at $22.54, previously a resistance level.

- Historically, rising Open Interest during a consolidation phase, as seen in LINK’s chart, often precedes a significant price move.

Chainlink [LINK] is well known for its crucial role in connecting smart contracts with real-world data. Recently it has shown promising price movement on its chart.

This resilience at new support levels suggests the possibility of an upward breakout, potentially setting it on a path to new all-time highs.

However, past trends and external metrics reveal mixed signals, prompting traders to remain vigilant.

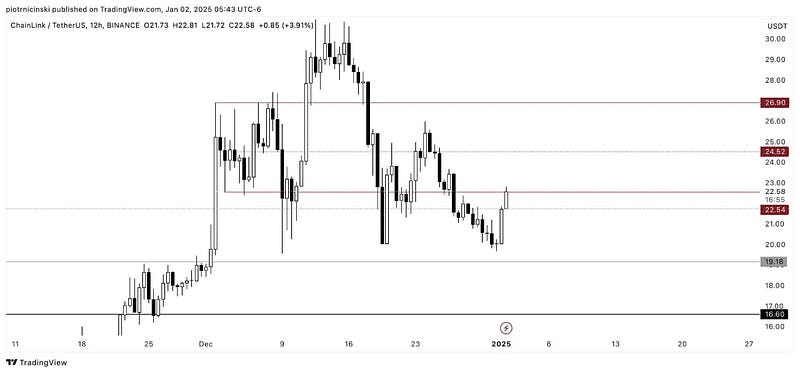

Resistance turns to support

In the 12-hour chart, LINK found significant support at $22.54, previously a resistance level. This classic “support flip” has traders speculating whether the coin will resume its upward momentum.

The Relative Strength Index (RSI), a key technical indicator, hovered near 50, at press time, reflecting neutral market sentiment.

The current consolidation indicates market indecision, aligning with LINK’s struggle to close decisively above $22.58. This pattern often precedes a breakout or breakdown.

If LINK surges above the next resistance level at $24.52, it may target $26.90 or higher. However, failing to hold $22.54 as support could lead to a re-test of the $19.16 region.

Given the doubled revenue figures for Chainlink software services from 2022 to 2023, institutional interest could provide a bullish push.

However, historical price patterns indicate LINK might remain subdued within this range, especially with its volatile lower time frames. Traders should monitor the RSI and price action closely for clearer signals.

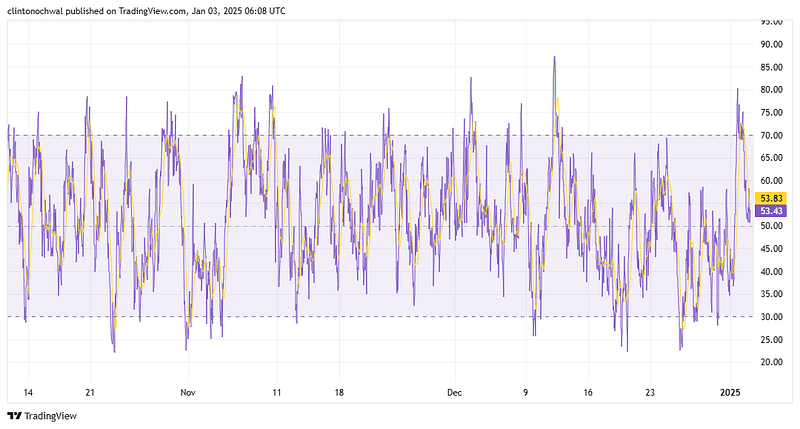

Open Interest analysis

Open Interest (OI) for LINK has seen a steady increase in recent days, signaling heightened trader activity and interest in the market. Currently, LINK’s OI has climbed by approximately 8%, reflecting renewed commitment from both bulls and bears.

Historically, rising OI during a consolidation phase, as seen in LINK’s chart, often precedes a significant price move. If the price breaks above the $24.52 resistance, we could see an influx of new positions, further driving OI upwards.

However, if LINK falters and dips below $22.01, OI could decline as traders liquidate positions to minimize risk. This trend emphasizes the importance of monitoring OI alongside price action to effectively predict potential breakouts or breakdowns.

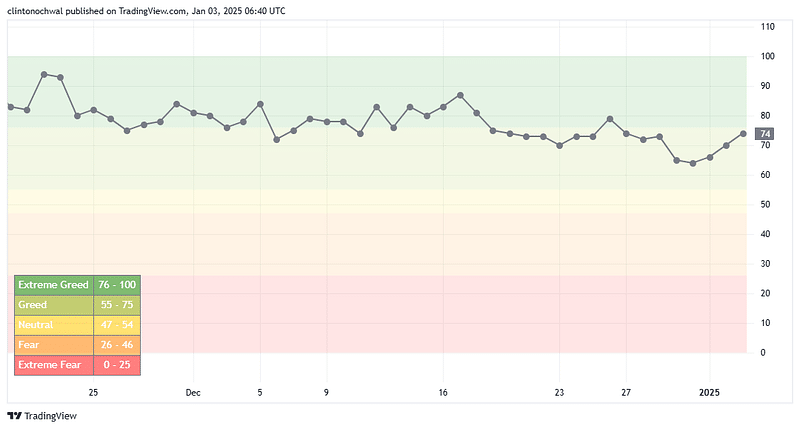

Market sentiment remains neutral

The Crypto Fear and Greed Index recently registered a reading of 64, indicating heightened bullish sentiment. This marks a shift from previous neutral readings, reflecting growing optimism among market participants.

Historically, scores above 60 suggest increasing confidence, often aligning with price surges or asset accumulation. For LINK, this growing greed sentiment might lead to sustained buying pressure, potentially pushing the price above its current resistance of $24.52.

However, traders should remain cautious. Elevated greed mostly precedes short-term corrections, as profit-taking tends to increase in overheated conditions.

If sentiment pushes further into the extreme greed zone (above 76), LINK may attempt to challenge the $26.90 level or higher. Conversely, a pullback in sentiment toward neutral levels could coincide with a re-test of $22.01 or lower.

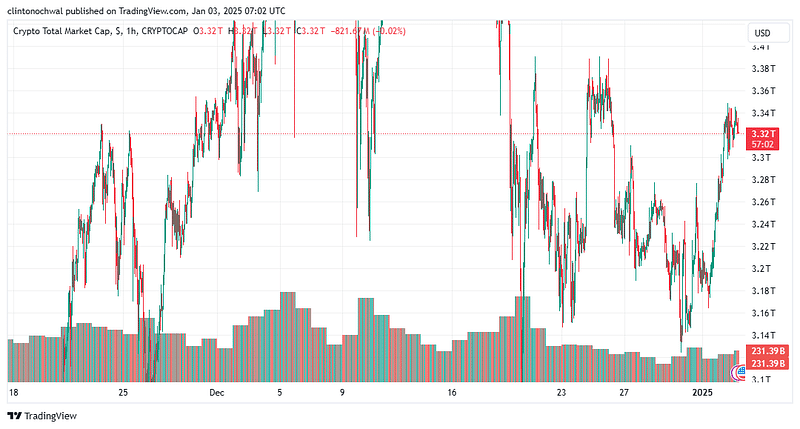

Broader market trends

The Total Crypto Market Cap, a key metric for evaluating the overall health of the cryptocurrency market, recently rebounded from $3.2 trillion and now sits around $3.3 trillion.

This recovery aligns with the broader market’s cautious optimism, supported by growing institutional interest in altcoins such as LINK, Solana’s [SOL], and Ethena [ENA].

However, the Total Market Cap remains below its previous high of $3.65 trillion, signaling the market is still in a corrective phase.

Chainlink’s performance mirrors the broader market dynamics. The coin’s consolidation around the $22.54 support level reflects the market’s hesitancy to make significant upward moves.

A sustained increase in the Total Market Cap above $3.65 trillion could serve as a bullish catalyst for LINK, pushing it toward $26.90 and potentially $30+. Conversely, a decline below $3.2 trillion may reinforce bearish sentiment, causing LINK to re-test lower levels.

Is your portfolio green? Check out the LINK Profit Calculator

External factors, such as regulatory developments and macroeconomic trends, continue to influence the Total Market Cap and, by extension, LINK.

The UK government’s recent filings revealing Chainlink’s doubled revenue in 2023 underscore the growing real-world utility of blockchain technologies, potentially attracting more capital into the market.

Chainlink remains one of the most promising projects in the crypto space, with robust revenue growth and increasing institutional interest. While the current technical setup and market sentiment suggest consolidation, the potential for a breakout cannot be ignored.