Chainlink: Why whales cannot save LINK from bears

- LINK was the 10th most purchased crypto among the top 100 ETH whales.

- LINK was down by over 1%, and a few on-chain metrics turned bearish.

Chainlink [LINK] registered an increase in its price over the last two days, which caused an increase in whale activity. Santiment’s latest tweet pointed out that whales increased their accumulation during that period.

How much are 1,10,100 LINKs worth today

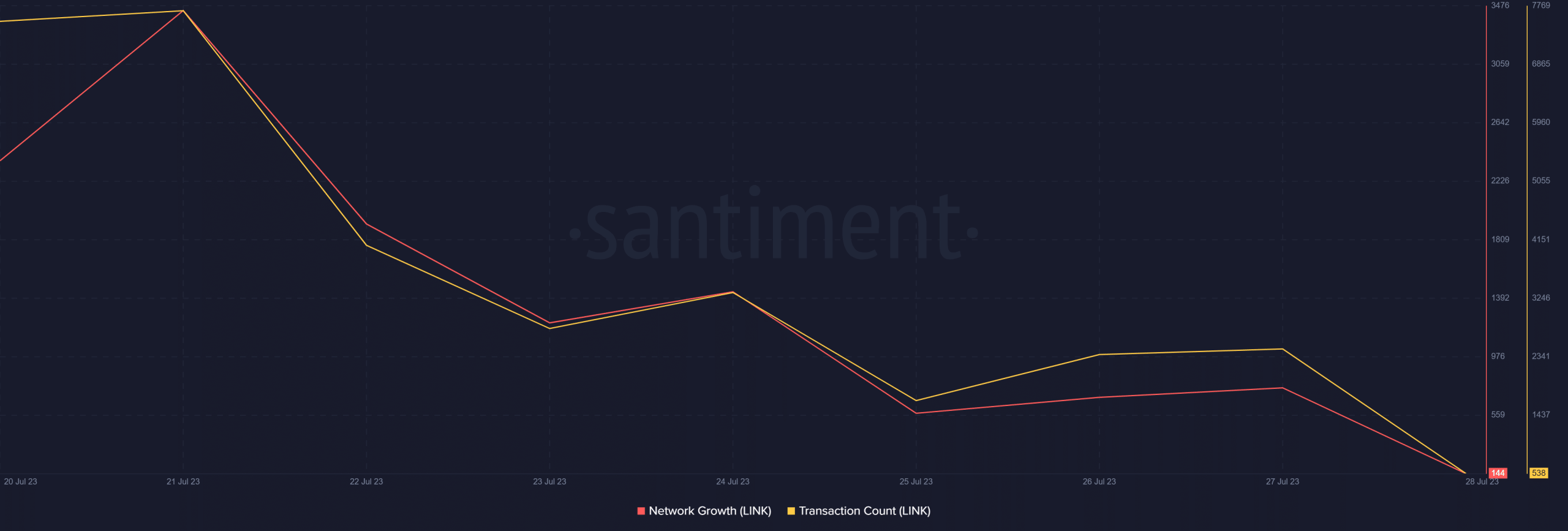

However, the increase in accumulation was not enough for LINK to maintain its uptrend, as its daily chart again turned red. Additionally, the token’s transaction count and network growth have also plummeted over the last few days.

Chainlink whales are quite active

Chainlink’s price witnessed an uptick on 26 and 27 July, which might have sparked excitement in the community. As a result of the uptrend, LINK whales increased their accumulation.

As per Santiment’s tweet, whale and shark addresses holding 10 thousand – 10 million LINK reached a seven-month high. Additionally, LINK transactions worth more than $1 million also registered a similar surge during that period.

?? #Chainlink has jumped ahead of the #altcoin pack Thursday. And prices appear to be powered by heavy whale accumulation, with the highest amount of transactions valued at $1M+ this year. Wallets holding 100K-10M $LINK are accumulating rapidly as well. https://t.co/U1vV7JmyNJ pic.twitter.com/gkIm6lhMie

— Santiment (@santimentfeed) July 27, 2023

It is also interesting to note that, as per Whalestats, LINK was the 10th most purchased token among the top 100 ETH whales in the last 24 hours. CryptoQuant’s data also suggested high accumulation, as evident from LINK’s declining exchange reserve.

A drop in exchange reserves meant that buying pressure was high. Additionally, Chainlink’s supply on exchanges declined slightly while its supply outside of exchanges increased – also a positive signal.

The weather is changing

Though LINK accumulation increased because of the uptrend, things were quick to change. As per CoinMarketCap, LINK was down by over 1.23% in the last 24 hours. At the time of writing, it was trading at $7.85 with a market capitalization of more than $4.2 billion, making it the 21st largest crypto.

The token’s MVRV Ratio declined sharply over the last seven days. Its one-week price volatility also sank, decreasing the chances of a sudden uptrend. Interestingly, Chainlink’s funding rate was green, reflecting its demand in the derivatives market.

Realistic or not, here’s LINK’s market cap in BTC’s terms

A look at Chainlink’s daily chart also gave a bearish notion, as most indicators were supporting the sellers. For example, the MACD displayed the possibility of a bearish crossover.

Additionally, LINK’s Relative Strength Index (RSI) registered a downtick and was heading towards the neutral mark. Another bearish indicator was the Money Flow Index (MFI), which also declined, indicating increased chances of a downtrend.