ChainLink

Chainlink’s next move: Why $12 could be around the corner

After a week long of price corrections, Chainlink might finally turn bullish and touch $12 in the coming days or weeks.

- Despite bearish price action, LINK’s number of long-term holders has increased.

- Metrics revealed that buying pressure was high and hinted at a price rise.

While several cryptos registered promising gains in the last 24 hours, Chainlink [LINK] couldn’t perform that well. However, the latest analysis suggested that LINK would reclaim $12.10.

Let’s have a look at LINK’s current state to see how likely it is for it to reclaim that mark in the short term.

Bulls to take over?

Chainlink bulls took a step back in the last 24 hours as its price only increased in decibels. In fact, the token witnessed an 8% price decline last week.

At press time, the token was trading at $10.7 with a market capitalization of over $6.5 billion.

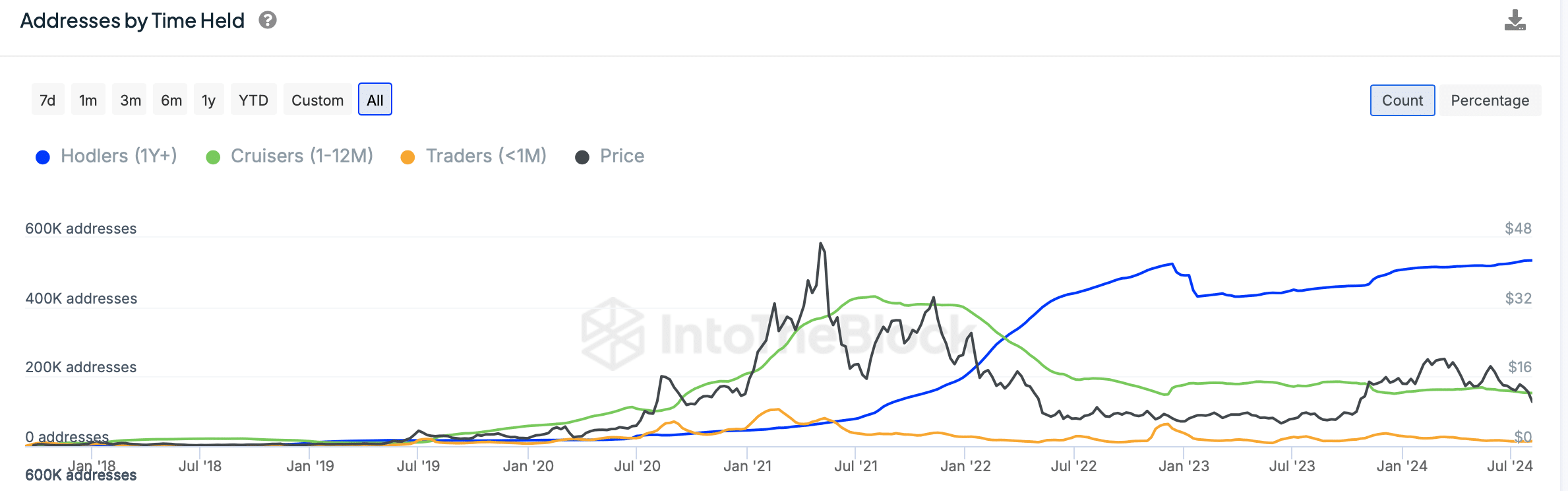

AMBCrypto’s look at IntoTheBlock’s data revealed that only 35% of LINK investors were in profit. However, the better news was that the number of wallets holding LINK for more than 1 year has been on the rise.

This suggested that long-term investors were confident in LINK going up.

The latest data suggested that LINK might as well turn bullish. Crypto Tony, a popular crypto analyst, recently posted a

tweet mentioning that if Chainlink reclaims $12.1, then the analyst would enter again.Therefore, AMBCrypto planned to assess LINK’s on-chain data to find out about the likeness of the token reclaiming $12.1.

What to expect from LINK

AMBCrypto’s analysis of Santiment’s data revealed that buying pressure on the token was high. This is the case as its supply on exchanges dropped while its supply outside of exchanges increased.

Another bullish metric was the MVRV ratio, which improved substantially over the last week, hinting that Chainlink might begin a bull rally soon.

Nonetheless, its network growth dropped. This meant that fewer new addresses were created to transfer the token.

However, at press time, LINK’s fear and greed index was in a “greed” phase. Whenever the metric hits that level, it indicates that there were chances of a price decline.

Therefore, we checked its daily chart. Thankfully, the MACD displayed the possibility of a bullish crossover. Chainlink’s Money Flow Index (MFI) also registered a slight uptick, further hinting at a price increase.

Read Chainlink’s [LINK] Price Prediction 2024-25

As per our analysis, Chainlink must go above $11.28 in the coming days before it eyes at $12.

The reason behind this was an upcoming rise in liquidation, which often results in price corrections. Nonetheless, if the bears take over, then LINK might plummet to $9.3.