Charting the crypto week ahead as investors wait for Bitcoin’s ATH

- A key indicator revealed that BTC might go above $90k.

- If BTC reaches an ATH, altcoins like ETH and SOL are likely to follow.

The recent price uptrend sparked hopes among investors about Bitcoin [BTC] reaching an all-time high.

Therefore, AMBCrypto planned to have a better look at what’s going on to see what the crypto week ahead might look like.

Bitcoin road to an ATH

Bitcoin bulls gained control over the market as they pushed BTC towards the $70k. Since this value was much closer to its all-time high, BTC could retest that mark or even go above it in this week.

According to CoinMarketCap, BTC’s price had risen by more than 2% in the last 24 hours. At the time of writing, BTC was trading at $69,630.41 with a market capitalization of over $1.37 trillion.

AMBCrypto’s look at Glassnode’s data revealed an indicator that suggested that it was very likely for the king of cryptos to reach a new high.

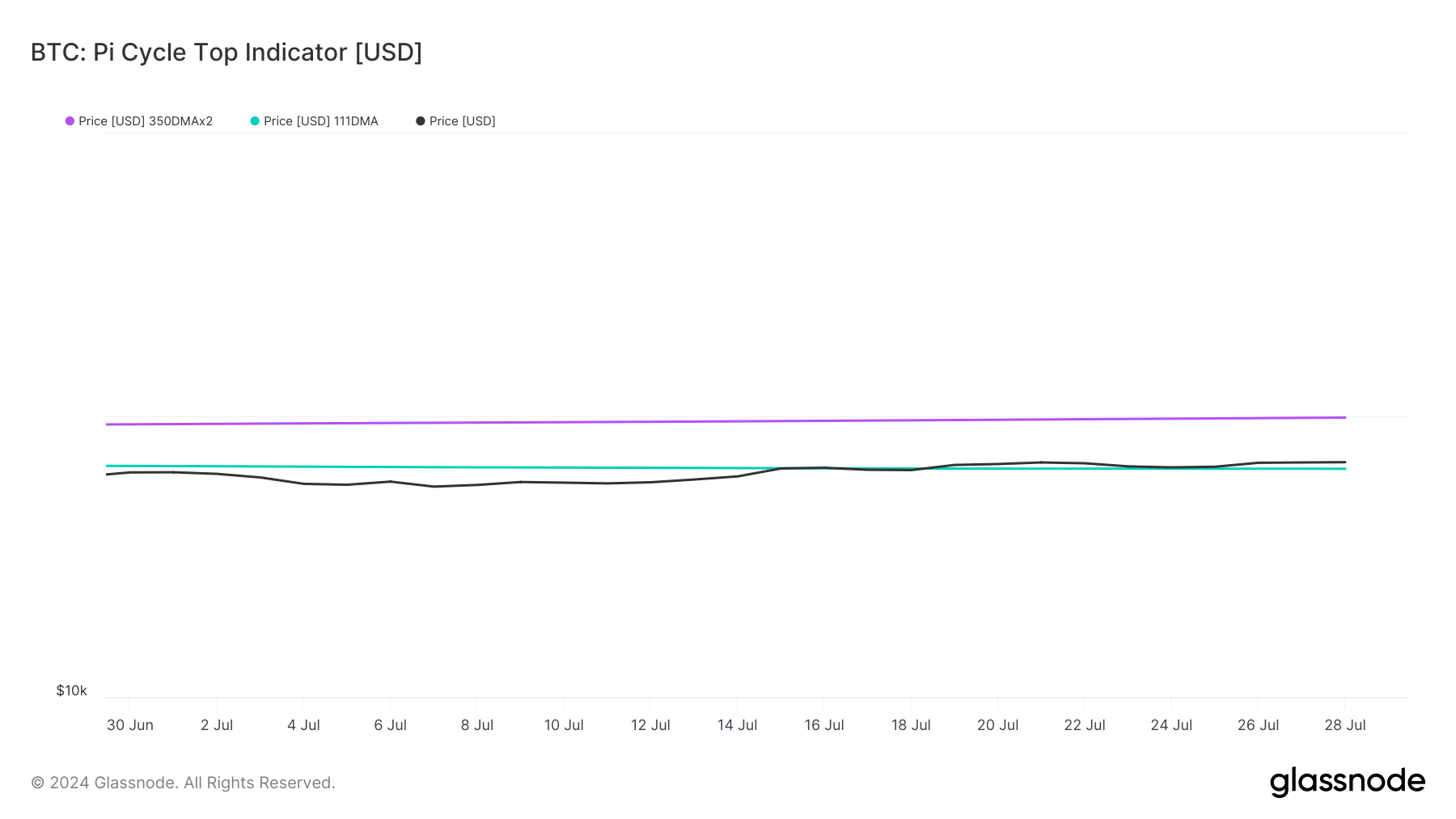

BTC’s Pi Cycle Top indicator pointed out that BTC’s price was resting just near its possible market bottom.

If the indicator is to be believed, then BTC’s possible market top was $98k, further suggesting a breakout above its current ATH.

What metrics suggest

Our analysis of CryptoQuant’s data revealed that BTC’s net deposit on exchanges was dropping compared to the last seven days’ average. This meant that buying pressure was rising.

Apart from investors, BTC miners were also reluctant to sell their holdings. BTC’s Miners’ Position Index indicated that miners were selling fewer holdings compared to its one-year average.

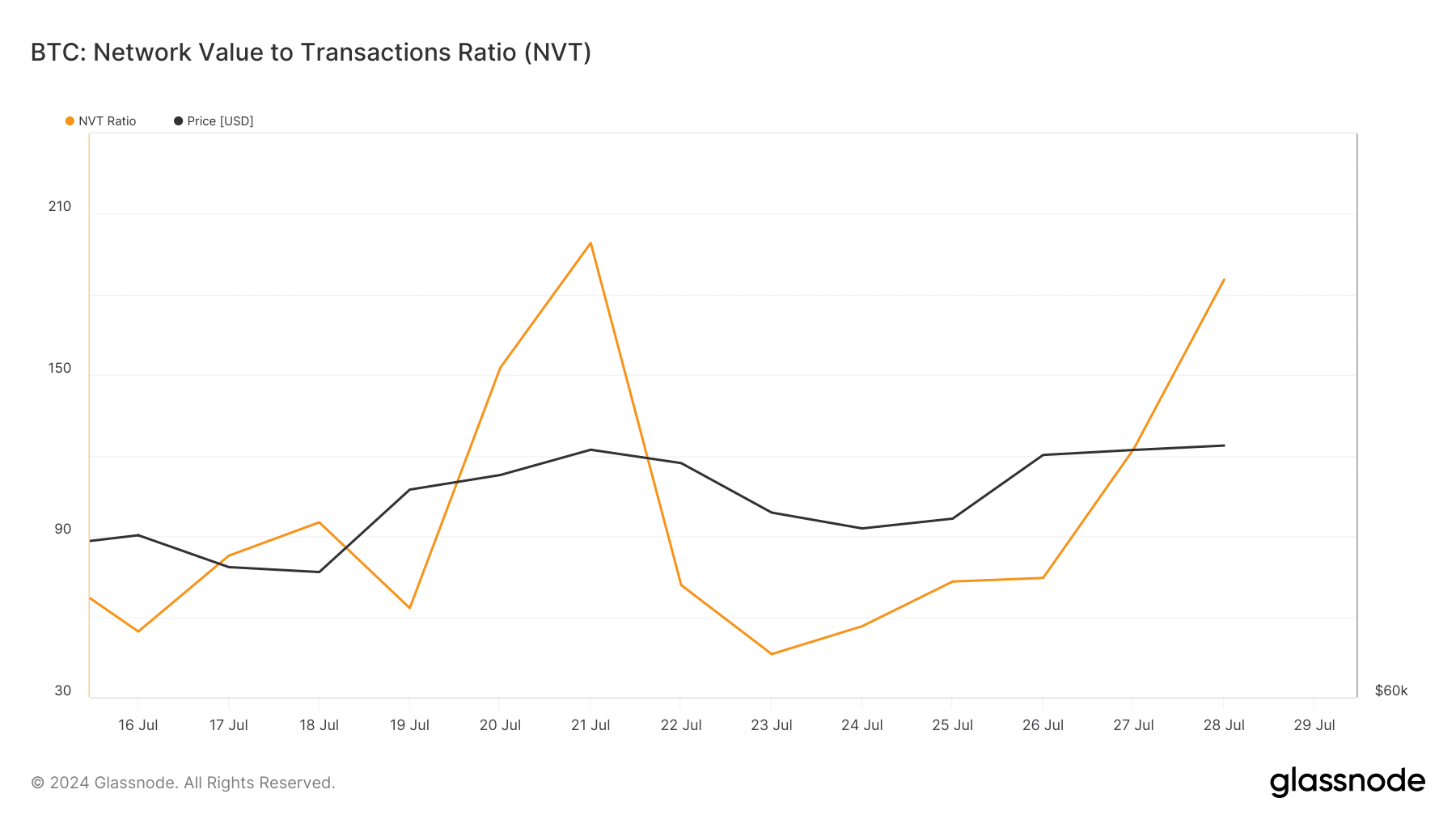

However, not everything looked optimistic. The king of cryptos’ NVT ratio registered a sharp increase. A rise in the metric means that an asset is overvalued, which generally results in price corrections.

If that happens, then BTC might take longer to reach an ATH.

Moreover, at the time of writing, BTC’s Fear and Greed Index had a value of 71%, meaning that the market was in a “greed” phase. Whenever the metric hits that level, it suggests that the chances of a price correction are high.

How will the market be affected?

Considering a utopian situation in which BTC reaches an ATH this week, there is no doubt that the entire market would be affected.

Historically, altcoins have, the majority of the time, followed Bitcoin’s price trend. On this occasion, top altcoins like Solana [SOL] displayed promising performance as its value surged by over 6% last week.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Other top alts like Ethereum [ETH] also looked bullish. If BTC manages to reach an ATH, it’s likely that these tokens will also remain bullish.

However, top memecoins like Dogecoin [DOGE] and Shiba Inu [SHIB] weren’t following the trend, as their weekly charts remained in the red at the time of writing.