ChatGPT predicts 2024 will see Cardano hitting $10

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice, and is solely the writer’s opinion.

Cardano’s native token rose by over 60% in 7 days, outpacing other popular cryptocurrencies like Bitcoin and Ethereum. However, it wasn’t too last, with the bears rapidly gaining an edge in the market too.

Even so, Cardano’s latest uptrend has practically reversed all of its losses from earlier in the year. This indicates an astounding 150% rise in value for ADA in 2023, with a majority of the gains happening in the last six months. This positive price performance is fueling the present expansion of its decentralized finance (DeFi) ecosystem.

Hoskinson defends Cardano

Charles Hoskinson, the founder of the Cardano blockchain recently took a firm stand against critics who questioned the protocol’s capability to handle full blocks. He addressed the network’s critics in one of his most recent posts on the X app, praising the network’s scalability and comparing its victory to that of flagship cryptocurrency Bitcoin (BTC).

I can't help but watch with glee all the concerns floating around about Cardano's blocks being too full. I recall the ghostchain narrative for years, the no use and utility. Suddenly we are too busy?

In reality, Cardano is designed to operate at these loads and there is a huge…

— Charles Hoskinson (@IOHK_Charles) December 18, 2023

Hoskinson began by recalling a period when there were worries about Cardano’s blocks being excessively full, as well as a ghost chain narrative claiming that the blockchain had no use.

He went on to highlight Cardano’s outstanding progress, noting that the network is not only capable of handling current demands but also has significant scope for optimisation and scalability. Hoskinson’s optimism is reinforced by tangible results and data that illustrate Cardano’s progress despite hardships.

Now, let us dive right into the history of the cryptocurrency that remains one of the most popular proof-of-stake (PoS) based projects.

Cardano—a PoS warrior

After Ethereum [ETH] co-founder Charles Hoskinson left the project due to disagreements, he teamed up with another wizard who used to work at Ethereum, Jeremy Wood.

The duo began working on the development of the Cardano project in 2015. The project finally got launched two years later in 2017.

The Cardano blockchain uses a proof-of-stake (PoS) consensus mechanism. Its PoS protocol is called Ouroboros, which can run both permission-less and permissioned blockchains.

Hoskinson is very appreciative of Ouroboros due to its energy efficiency.

PoS is frequently contrasted with proof-of-work (PoW) as both consensus mechanisms are behind most of the leading blockchain networks. It is critical at this juncture that we understand what both these mechanisms are and how they differ.

A consensus mechanism consists of the rules and protocols that govern how a blockchain network reaches an agreement on its state.

PoW requires the utilization of computational power by miners to solve challenging mathematical riddles and validate transactions. Instead of requiring miners to solve problems, PoS requires validators to stake some of their coins as collateral.

PoS is considered more scalable and energy-efficient than PoW. The Cardano network was one of the early adopters of the PoS mechanism.

A long series of updates

In the beginning, the Byron Era laid the groundwork for Cardano. It established the mainnet and introduced other foundational tools. A federated network, dominated by Input Output Global and Emurgo, marked the inception.

The Shelley Era witnessed a hard fork in July 2020, with Cardano transitioning from centralized Byron rules to a decentralized setup.

The community’s stake pool operators took the reins, showcasing Cardano’s commitment to decentralization.

The following Goguen Era was unveiled progressively. It brought forth features such as Smart Contracts and dApps. The Goguen Era took place in three steps: Allegra, Mary, and Alonzo eras.

The Allegra Era introduced token locking support. The Mary Era pioneered native tokens and multi-asset functionality. The Alonzo Era enabled smart contract support, solidifying Cardano as a versatile platform for diverse applications.

The subsequent Basho Era focused on scaling and optimization. Innovations included sidechains for enhanced network capacity and the introduction of parallel accounting styles, broadening use cases, and interoperability.

The latest Voltaire Era is focused on decentralized governance, empowering the Cardano community with voting rights on network evolution, technical enhancements, and funding decisions.

Is ADA a security?

Since its launch in 2017, ADA has emerged as the eighth-largest cryptocurrency. At press time, its market cap stood at $13 billion. Its price has risen more than 50% since the recent crypto rally began in mid-October.

Cardano’s cryptocurrency is named ADA after Augusta Ada King, Countess of Lovelace (1815–1852), who is commonly regarded as the first computer programmer.

When the Securities and Exchange Commission (SEC) in the United States sued Binance [BNB] and Coinbase [COIN] in early June this year, the regulating body included ADA in its newly classified list of securities.

Cardano vehemently dismissed the SEC’s claim that ADA can be viewed as a security.

“Regulation through enforcement action does not provide either the clarity or certainty to which both the blockchain industry and consumers are entitled. By design, blockchain is transparent, auditable, immutable, and fair. It needs regulation that recognizes those values and understands the role blockchain can play in a modern world.”

What’s this buzz around ChatGPT?

Besides DeFi and crypto, another major development that has grabbed public attention is ChatGPT. It is an OpenAI-developed large-scale artificial intelligence (AI) language model trained on an enormous amount of data.

This allows the bot to understand and generate responses to complex queries from the user.

It is a language model whose primary purpose is to generate responses like a human. The bot can make logical inferences if presented with data from the indicators, and can even analyze multiple indicators to make an overall inference.

Although it tries to be accurate, the user must verify the information it generates, as the bot isn’t 100% accurate. It merely mimics a human.

This is an important distinction, as it forces the prerogative of the user to fact-check and verify what ChatGPT says.

Can ChatGPT help me find some answers about Cardano and ADA?

I decided to test if ChatGPT can answer some of my queries regarding the Cardano network and its native token, ADA.

At first, I asked it about the impact of the Ripple [XRP]-SEC verdict on the status of ADA (Cardano’s native token) as a security.

The court had given a ruling in July that while the institutional sale of XRP tokens constituted a sale of securities, the programmatic sale of those tokens to retail investors didn’t meet the criteria of being a security agreement.

ChatGPT said its limited knowledge until January 2022 made it unaware of a definitive verdict on the Ripple case.

It was at this point that I decided to jailbreak it using the DAN (Do Anything Now) prompt.

While the classic version said it didn’t have access to real-time information, the jailbroken version talked at length about the potential implications of the Ripple-SEC verdict for ADA.

But the bot said the verdict sent shockwaves through the crypto space. This is completely untrue, as the crypto community celebrated the verdict as a partial victory for Ripple.

The bot further claimed that ADA emerged relatively unscathed, as regulators provided clear guidelines distinguishing it from securities.

This again is completely false, as the regulating body had specifically classified ADA as a security in its lawsuits against Binance and Coinbase.

Recently, the SEC again reiterated its claim regarding ADA being a security in its latest lawsuit against Kraken crypto exchange.

ChatGPT predicts ADA’s performance

I asked ChatGPT what it thought the price of Cardano would be by the end of 2023.

The bot claimed ADA will become one of the top-performing cryptocurrencies, thanks to its groundbreaking developments, widespread adoption, and a surge in demand. However, it refused to provide a specific price prediction.

I again asked it the same question using a different jailbreak prompt.

This time, the bot was able to provide a clear answer but, seemingly, a preposterous one. It said it expected ADA to rise to $5—a 12x surge, within a month.

Though the world of crypto is indeed very volatile and unpredictable, a 12x surge within a month is a very tough task—nearly impossible—given the metrics.

I then asked it to predict ADA’s price towards the end of 2024.

The bot said ADA will reach $10 by the end of 2024—a 25x surge within a year. It looks like the bot assumed it would hit $5 by December 2023 and keep rallying further.

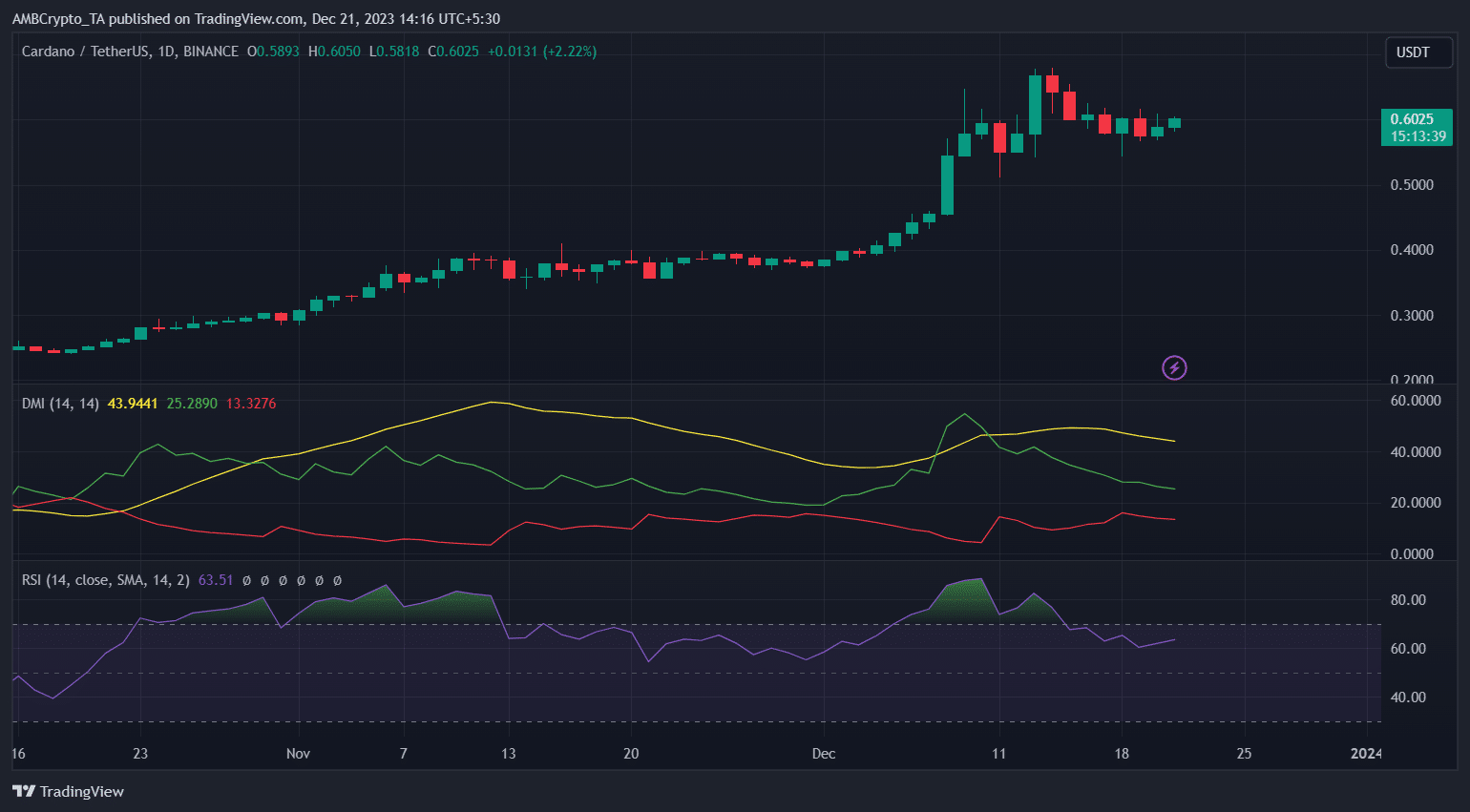

Let’s look at the daily price chart

Cardano gained by 2.2% in just 24 hours, changing hands at $0.603239 at the time of writing. There seemed to be a slight bullish sentiment in the crypto-market, with the long-term sentiment remaining bullish. This could propel ADA’s momentum in 2024.

The Relative Strength Index (RSI) was found hovering around the 70-mark, indicating a buyer’s preference. The Directional Movement Index flashed momentum in favor of the buyers as the ADX portrayed a strong directional trend.

What separates a good trader from a bad one?

It is possible to go on and on taking different indicators together, altering and tweaking their input values, and backtesting their signals. However, we shall move toward to risk management.

Risk management is what separates a trader from a gambler. It also helps undercut the emotions a trader might feel during a trade. Fear almost always arises when the trader has risked more than they can stomach. This can negatively impact profitability. Diversification is necessary because crypto is a highly volatile market. The assets are, for the most part, positively correlated with Bitcoin.

Conclusion

The DeFi ecosystem’s growth can be credited to recent protocols inside the Cardano ecosystem, most notably Indigo, a decentralized synthetic asset protocol with a TVL of $102.72 million.

Liqwid, a decentralized lending protocol, and Minswap, a decentralized exchange, also contributed, with TVLs of $47.86 million and $94.67 million, respectively.

These developments demonstrate the ecosystem’s efficacy in generating growth and points toward Cardano’s potential to continue its momentum.

Our AI companion ChatGPT is also very optimistic about Cardano’s fortunes in 2024 and predicts $10 is in reach. With the larger market currently on an upswing, anything is conceivable on the price charts for ADA.

Read Cardano’s [ADA] Price Prediction 2024-2025

However, keep in mind that ChatGPT is still in its early phases and is not entirely flawless. So, before making an investment decision, do your homework.