Choose ideal jurisdiction for crypto business with Merkeleon

Launching a crypto exchange or a wallet comes with challenges, particularly in handling the complex rules of business jurisdictions. While some nations prohibit digital currencies, restricting their transactional capabilities, forward-thinking regulatory frameworks in selected jurisdictions actively pave the way for all-encompassing guidelines.

The ambiguity in crypto regulations prompts a vital query: which jurisdiction is the best? Let’s discuss it now.

Deciphering Cryptocurrency Jurisdictions

The cryptocurrency jurisdiction governs the authority to interpret and enforce laws related to the crypto sphere. It covers the classification of digital currencies, industry evolution, business legitimization, and more. Given the novelty of cryptocurrency, legal frameworks vary. Leading crypto jurisdictions are Lithuania, the Czech Republic, the United Kingdom, Hong Kong, the United States.

Business Jurisdiction Challenges

The jurisdiction in which you choose to start your crypto business is a key aspect for the success and longevity of your project. Launching a crypto wallet, especially if it involves an ICO for capital generation, brings forth jurisdictional challenges. Depending on the token type and sales model, your activities may fall under the scrutiny of regulatory bodies such as the SEC for the US or the ESMA for the EU, potentially leading to legal complications and disputes.

White label crypto wallet development by Merkeleon offers a broad solution that features legal assistance to maneuver these challenges. This all-inclusive product not only supports the development process but also ensures compliance with regulations, sparing you the effort of delving into legal intricacies.

Insights into European Crypto Regulations

Consider opting for the EU when you establish a crypto wallet. The EU has MiCA, a broad document whose provisions are applied to all member states. Yer, while there is a common legislative framework, each country supplements existing documents with additional provisions.

EU Crypto Regulations Documents

- Regulation (EU) 2016/679 (GDPR). While not exclusively focused on cryptocurrencies, the GDPR sets guidelines for data protection and privacy for individuals within the EU.

- Directive 2009/110/EC. This directive focuses on the issuance of electronic money and outlines the legal framework for electronic money institutions within the EU.

- Digital Finance Package. This document includes measures for crypto assets, the Markets in Crypto-Assets (MiCA), and a pilot regime for market infrastructures based on distributed ledger technology (DLT).

The EU framework provides a baseline for crypto regulators. However, the approach and interpretation within member states vary. For example, the Czech Republic, supports digital currencies, creating a crypto-friendly environment. Conversely, in countries like Finland, cryptocurrencies might not be recognized as standalone payment tools, affecting their treatment within the financial ecosystem.

Top European Jurisdictions for Crypto Business

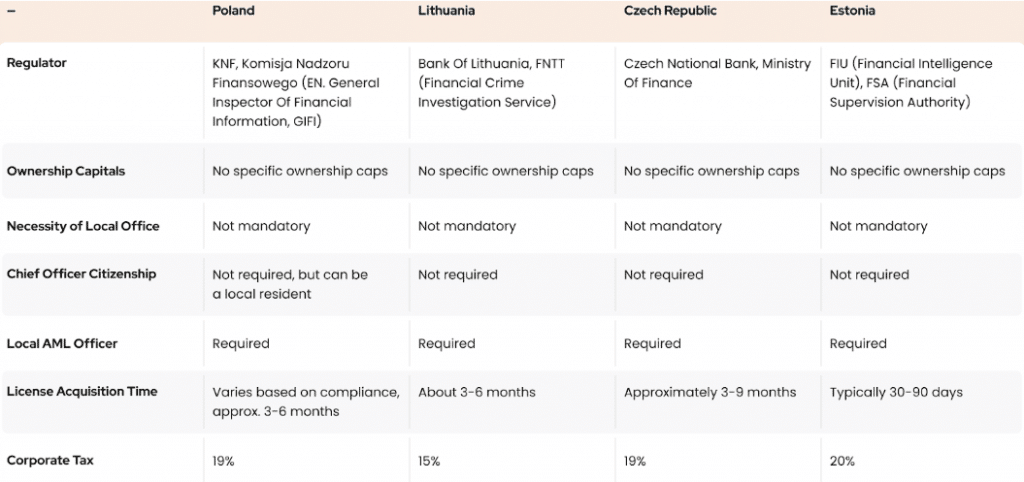

Within Europe, certain nations have made substantial strides in supporting crypto enterprises. Estonia, the Czech Republic, Lithuania, and Poland have emerged as leading crypto-friendly nations that streamlined processes for acquiring business licenses.

Let us say, Estonia boasts the most forward-looking crypto regulation in Europe. Governed by the Money Laundering and Terrorist Financing Prevention Act (MLTFPA, 2017), the country facilitates legally operating cryptocurrency businesses. Furthermore, cryptocurrencies are acknowledged as an additional form of payment.

Similarly, the regulatory landscape in the Czech Republic has propelled the growth of crypto ventures in Europe. As one of the pioneering nations in drafting a legitimate plan for cryptocurrencies, individual crypto transactions here are tax-exempt and don’t require licensing. Moreover, the National Bank encourages other financial institutions to engage with cryptocurrencies, further stimulating their adoption within the country.

Popular European Crypto Jurisdictions: Overview

When determining the most suitable jurisdiction for a crypto wallet, answer these questions:

- What activities does the license encompass?

- Is there an available local regulatory body?

- Does the commercial model offer profitability?

Based on comprehensive legal documents, we’ve assembled a comparative overview of popular European states for starting a crypto project.

Note that the information is subject to change. Please, verify current regulations and requirements with legal and financial professionals before making decisions.

What Is Next?

After you select the most fitting jurisdiction for your crypto business, you should

- Opt for cryptocurrency exchange software. Evaluate its features. Think about relevant add-ons.

- Determine your approach for license application: an independent application, or enlist with the help of consultants.

- Prepare requisite documentation tailored to your application method.

Disclaimer: This is a paid post and should not be treated as news/advice.