Circle Reserves worth $3.3B at SVB to be ‘fully available’ soon

- $3.3B in USDC reserve deposits held at the failed SVB will be fully recovered when banks reopen in the U.S

- Circle also announced new partnership with the Cross River Bank

Popular stablecoin issuer Circle has announced that the $3.3 billion in USD Coin (USDC) reserve deposits held with Silicon Valley Bank will be fully recovered when banks reopen in the United States on Monday.

Circle released a press statement underlining the same, adding that the $3.3 billion accounts for approximately 8% of the total USDC reserves.

It has no cash reserves at Signature Bank, which were also taken over by the Federal Deposit Insurance Corporation over the weekend.

Circle has also announced its new partnership with Cross River Bank in New Jersey. Through the same, automated USDC minting and redemption for customers will start, beginning today.

Commenting on these updates, Circle’s Jeremy Allaire tweeted,

“100% of USDC reserves are also safe and secure, and we will complete our transfer for the remaining SVB cash to BNY Mellon. As previously shared, liquidity operations for USDC will resume at banking open tomorrow morning.”

The price of Circle’s USDC stablecoin fell to $0.8774 over the weekend after it revealed its reserves at Silicon Valley Bank. However, at the time of writing, it had recovered to $0.99.

Silicon Valley Bank and Signature Bank, two key crypto-lenders, were closed down and taken over by regulators to stop a systemic threat to the banking industry as a whole. Silicon Valley Bank, which had assets worth more than $200 billion, is the largest banking failure since the 2008 financial crisis.

SVG’s failure fuels USDC Crisis

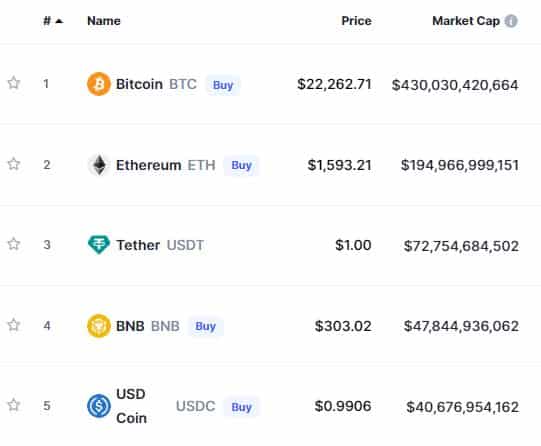

With a market capitalization of more than $40B, USDC is currently the fifth largest cryptocurrency and the second largest stablecoin in the market.

Source: CoinMarketCap

Following the Federal Reserve’s announcements, asset prices have significantly appreciated. In fact, the total crypto-market capitalization now exceeds $1 trillion, following a sharp decline to $961 billion on Saturday.

The recent failures of Silicon Valley Bank and Signature Bank have certainly shook the crypto-industry. Though the fate of USDC remains unknown, Circle is still attempting to restore its stablecoin’s peg to the U.S. dollar.