Coinbase and market sentiment – Here’s what can save LINK’s price!

- LINK depreciated by 3.21% in just 24 hours

- Despite the fall in price, however, market sentiment remained largely positive

Over the past few weeks, altcoins have declined considerably on the price charts. Over the same period, LINK registered a sustained consolidation phase. The altcoin wasn’t immune to bouts of depreciation though, with the crypto down by 3% in the last 24 hours alone. And yet, market sentiment remains positive across the board. Is there a reason why?

What’s driving LINK’s market optimism?

Amidst market volatility, various developments have tried to push LINK’s price action in a positive direction. For starters, Coinbase Derivatives filed to list LINK-regulated Futures contracts with the CFTC. As expected, these reports have left everyone optimistic.

Another factor playing a crucial role in changing the market sentiment is the speculation around LINK ETFs. According to Chainlink Red Pill, LINK ETFs may be on the horizon. He shared,

” The road to a $LINK ETF is being put in place. Timing-wise, this could be shaping up well. We want Tradfi to have an easy path to buy $LINK when Sergey starts dropping massive Chainlink utilization for RWAs. It’s all coming together.”

These two developments have played a vital role in shaping the market’s sentiment. By extension, many in the community are also predicting higher price targets for LINK. Popular crypto analyst Swing Tony is among those betting big on the altcoin. According to him,

“$LINK can realistically go to 0.0009 $BTC this cycle. $75k BTC would put LINK over $67. $150k BTC would put LINK at $135.”

What do LINK’s fundamentals suggest?

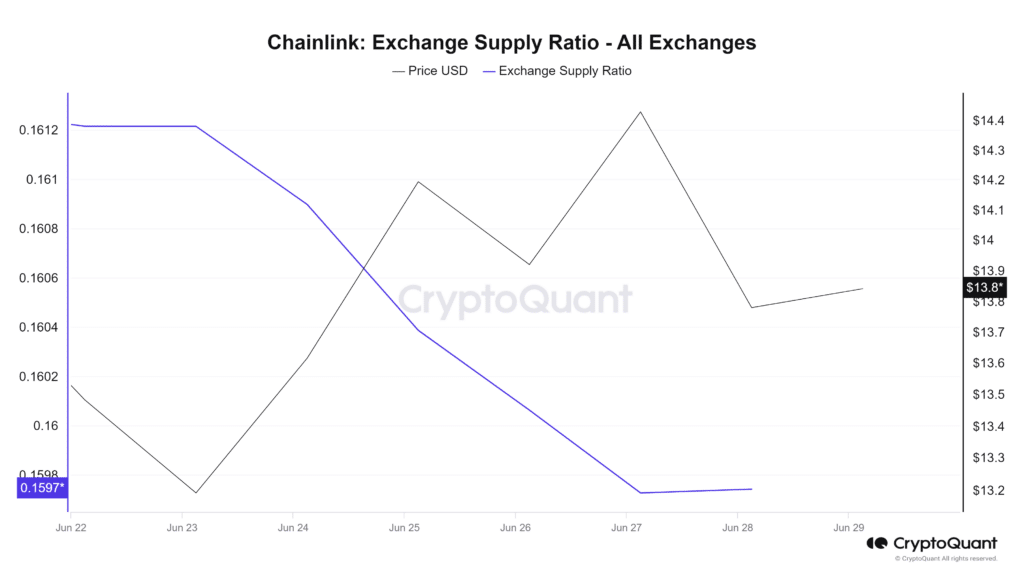

AMBCrypto’s analysis of CryptoQuant revealed that the market has been seeing some positive growth on the charts. In fact, LINK’s exchange supply ratio registered a sustained decline from 0.161 to 0.159 over the course of just one week.

A fall in the exchange supply ratio means that holders are moving assets to external wallets, indicating confidence in the future value of LINK. Equally, it means reduced selling pressure, which drives prices up.

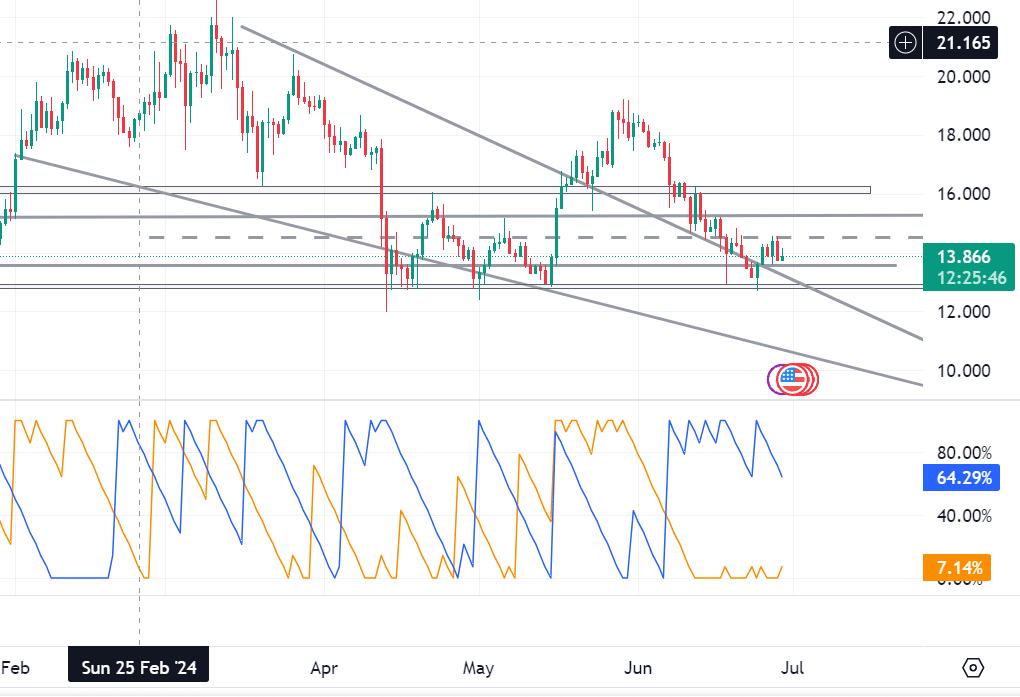

Additionally, our analysis found that the Aroon Up line was above zero at 7.14%. Here, Aroon Up lines measure the strength of a trend while helping understand where the price will reverse. 7.14% means that the prevailing trend is gaining strong momentum.

The Average Directional Index (ADX), which measures trend momentum, underlined a sustained uptrend too.

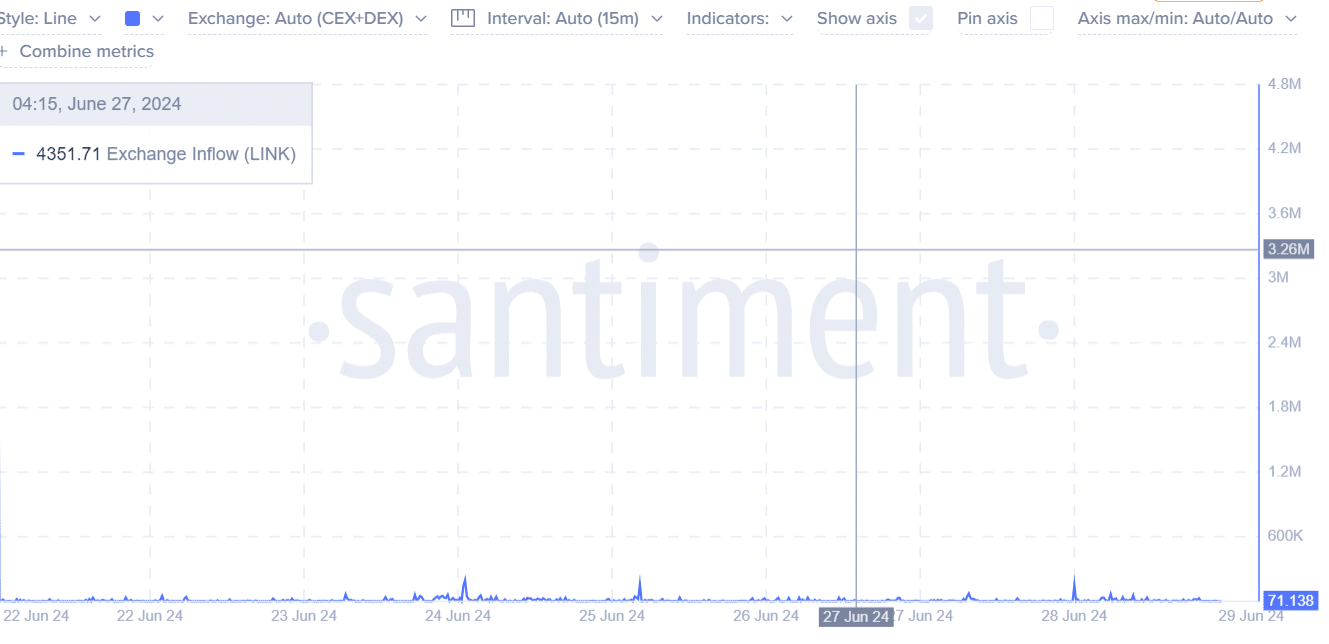

Finally, according to Santiment, exchange inflows declined over the last 7 days. In fact, it fell from a high of 209k to 71.138k. This can be seen as a sign of high accumulation rate, and by extension, reduced selling pressure.

What next for LINK?

At press time, LINK was trading at $13.83 after a breakout from $13.624. LINK will hit the next resistance level of around $14.52 if the positive market sentiment is maintained.

In a very bullish scenario, a breach of this level will challenge the $15.26-level it has attempted before. However, if the market sees a correction, it will decline to the critical support level of around $13.54. Here, a further decline would push it to the local support level of around $12.72.