CoinFLEX: Amid liquidity crisis, the cryptocurrency exchange had this to say

In a recent announcement dated 29 July, co-founders of CoinFLEX, Sudhu Arumugam and Mark Lamb, provided an important update. The updated surrounded what the cryptocurrency exchange had been up to manage its current liquidity crisis in the last week. This update came a month following the suspension of withdrawal on the exchange as a result of a liquidity crisis. The organization cited “extreme market conditions and continued uncertainty involving a counterparty.”

In the new announcement, CoinFLEX provided an update on its staff reduction. It also mentioned intentions to launch new products and the distribution of the CoinFLEX composite.

We regret to inform you…

According to the blog post, CoinFLEX informed users that in the last week that the exchange went through the arduous process of letting some of its staff members go.

“The staff cuts and non-staff costs that we have made will reduce our cost base by approximately 50-60%”, the exchange noted.

Hinting at a possibility of a future acquisition, Arumugam and Lamb stated that,

“We will monitor costs to ensure we operate as efficiently as possible and scale as volumes come back. The intention is to remain right-sized for any entity considering a potential acquisition of or partnership opportunity with CoinFLEX.”

We have more to offer…

The exchange also noted stated plans to resuscitate its dying business and regain customer trust. It further intends to distribute rvUSD, equity, and FLEX Coin – referred to as CoinFLEX Composite – to depositors who have assets in the exchange

According to the exchange:

“We continue working with lawyers and the significant creditor group on the details around the distribution of the CoinFLEX Composite (inclusive of rvUSD, equity, and FLEX Coin) and expect to have numbers around this next week so that we can put this to a vote from all depositors as soon as possible thereafter.”

In addition, CoinFlex informed aggrieved depositors that in the next week, it plans to offer the trading of locked balances versus against unlocked balances. According to the announcement, with an understanding of the range of CoinFLEX Composite distributions a depositor is entitled to, they can decide if they desire to place orders of unlocked assets against locked assets.

“To be aware of all, or as accurate a range, of the CoinFLEX Composite you are likely to receive. Everyone needs to know the range of their CoinFLEX Composite distributions to have all the necessary information to decide if you want to place orders of unlocked versus locked assets. The estimated range of any further normal distribution that will be made available alongside the issuance of the CoinFLEX Composite”, CoinFLEX informed its depositors.

Unflexed muscles

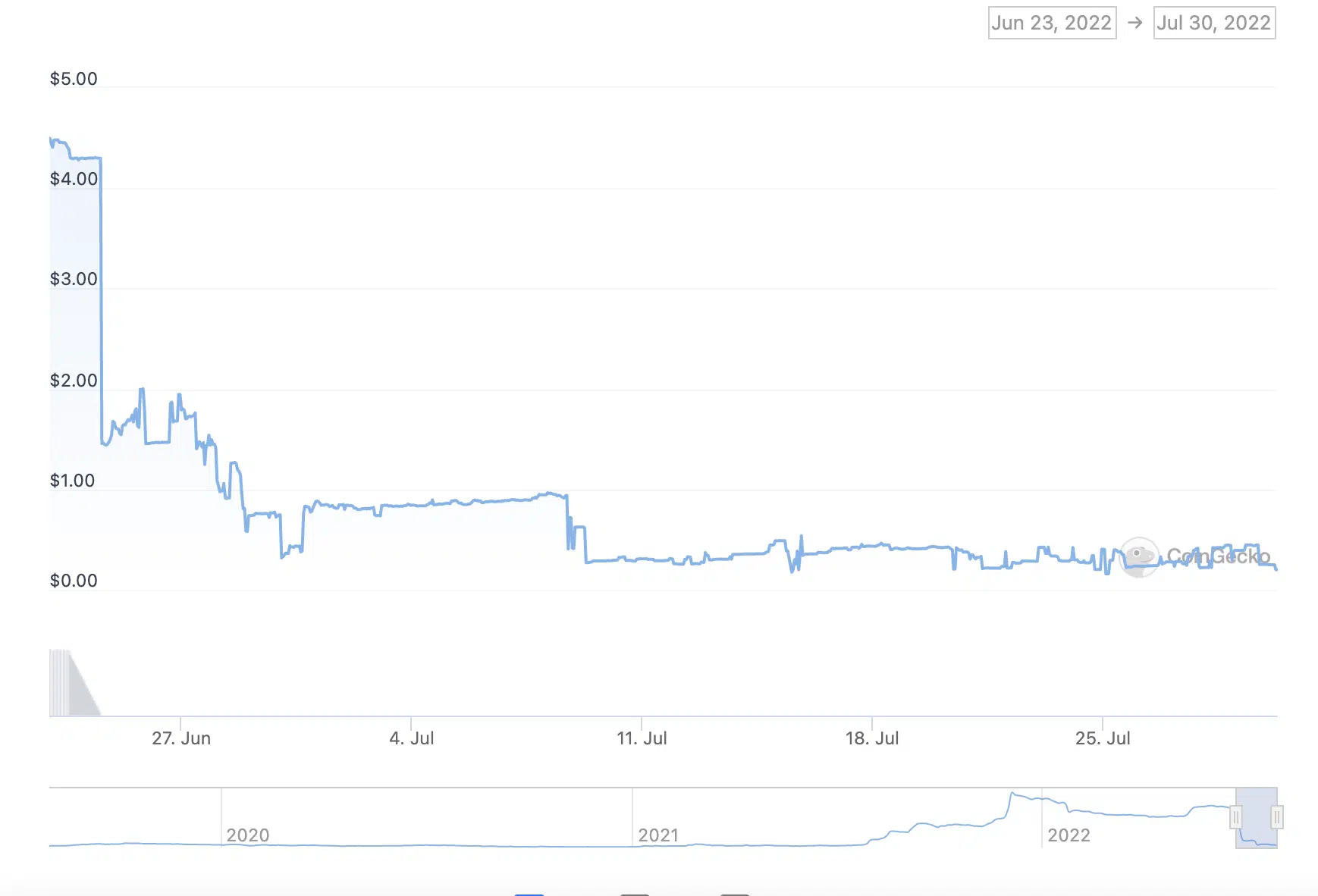

A month after withdrawal was suspended on the exchange, CoinFLEX’s FLEX logged a 96% decline in price. At press time, the token exchanged hands at $0.162868 at a 63% loss in the last 24 hours.