‘Confident’ Bitcoin whales fuel $1.7 billion accumulation at the cost of…

- Trading at around $60,000, BTC seemed to be on the verge of a death cross

- Over $1.7 billion worth of BTC was withdrawn from exchanges despite the price decline

Recently, Bitcoin registered significant price declines, falling below the $60,000 mark — A level long regarded as a stable and safe range. This unexpected drop triggered panic across the market as traders and investors reacted to the sudden shift.

However, contrary to the general market response, large holders, often referred to as ‘whales,’ appeared to move in a different direction.

Bitcoin whales move against market trend

The recent significant declines in Bitcoin’s price have elicited a range of responses from traders and investors. While many opted to sell off their holdings in an attempt to secure profits or cut losses, a notable trend of accumulation was also seen, particularly among large-scale investors or “whales.”

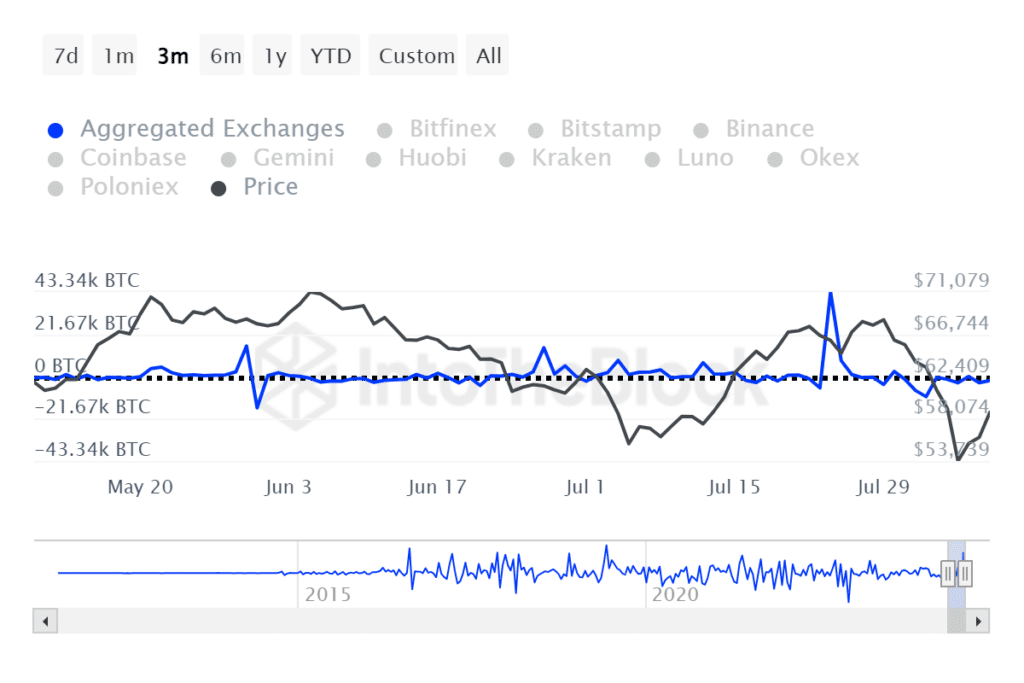

According to Netflow data from IntoTheBlock, Bitcoin noted net outflows from exchanges totaling over $1.7 billion over the past week. Here, this figure represents the largest volume of outflows in over a year, underscoring significant movement of BTC away from exchanges.

Such outflows are typically interpreted as a sign of accumulation as investors move their holdings to private wallets. The movement is for long-term holding, rather than leaving them on exchanges for potential sale.

What could this mean for the broader market?

This trend suggests that despite the market’s downturn, confidence among some investors remains high, with significant buying activity seen as the price dips. These large holders likely view the current lower prices as strategic buying opportunities. They expect that the market will rebound in the long term.

For the broader market, the significant outflows and associated accumulation by whales could stabilize or even push prices back up if this trend continues. It is a sign of bullish sentiment among some of the market’s most influential players, which might help mitigate recent bearish pressures.

Trend of Bitcoin balance on exchanges

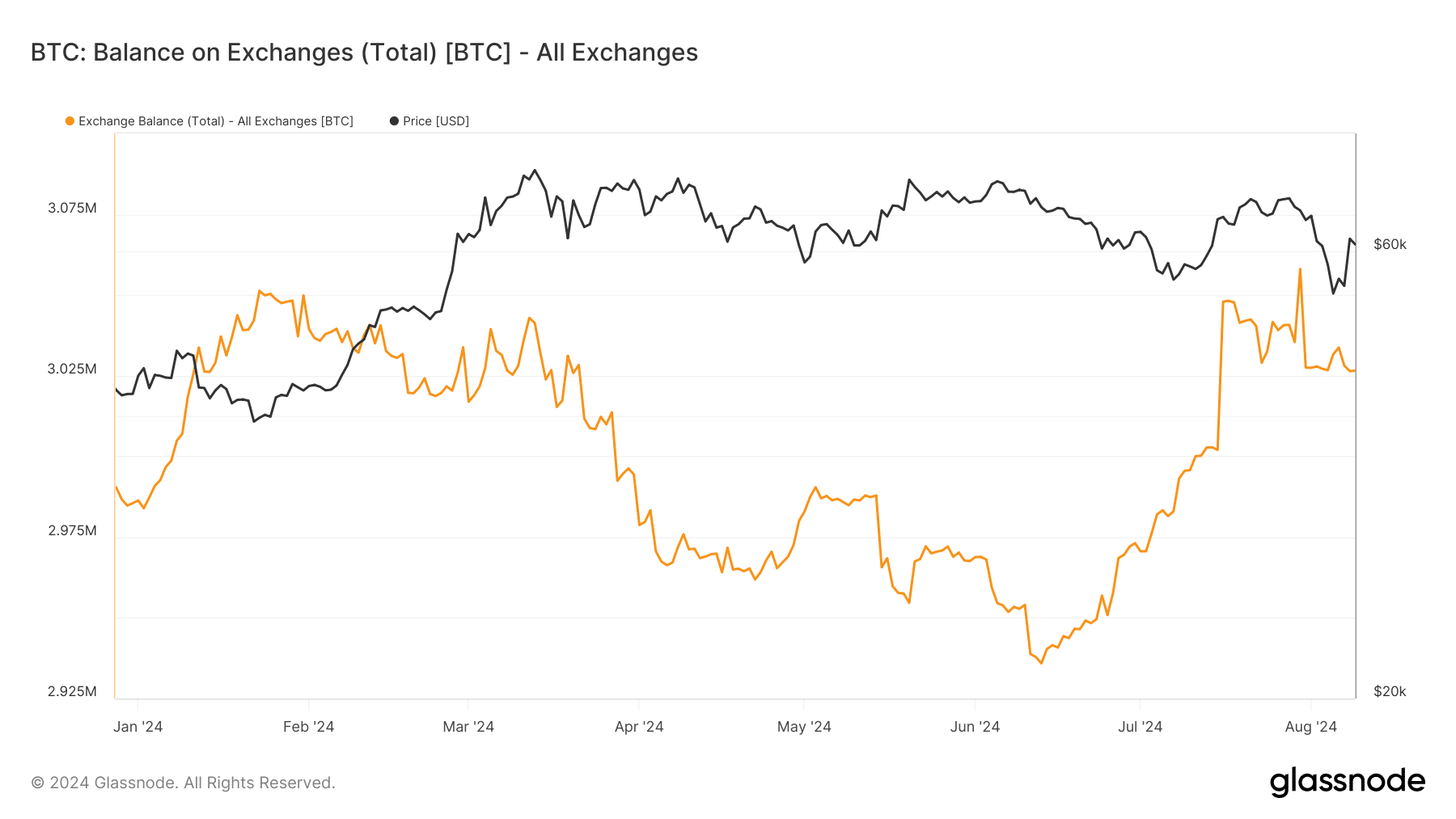

An analysis of Bitcoin’s balance on exchanges, according to data from Glassnode, revealed a significant decrease in recent weeks. Despite hovering around the 3 million mark for some time, there has been a sharp decline in the balance held on exchanges.

Specifically, the balance was approximately 3.057 million BTC on 30 July. However, this fell to around 3.026 million BTC at press time.

This reduction in Bitcoin balance on exchanges aligns with findings from Netflow analyses over the past few weeks, which have indicated a trend of BTC moving off exchanges.

Such movements are generally interpreted as a sign of accumulation among investors.

MVRV shows negative trend

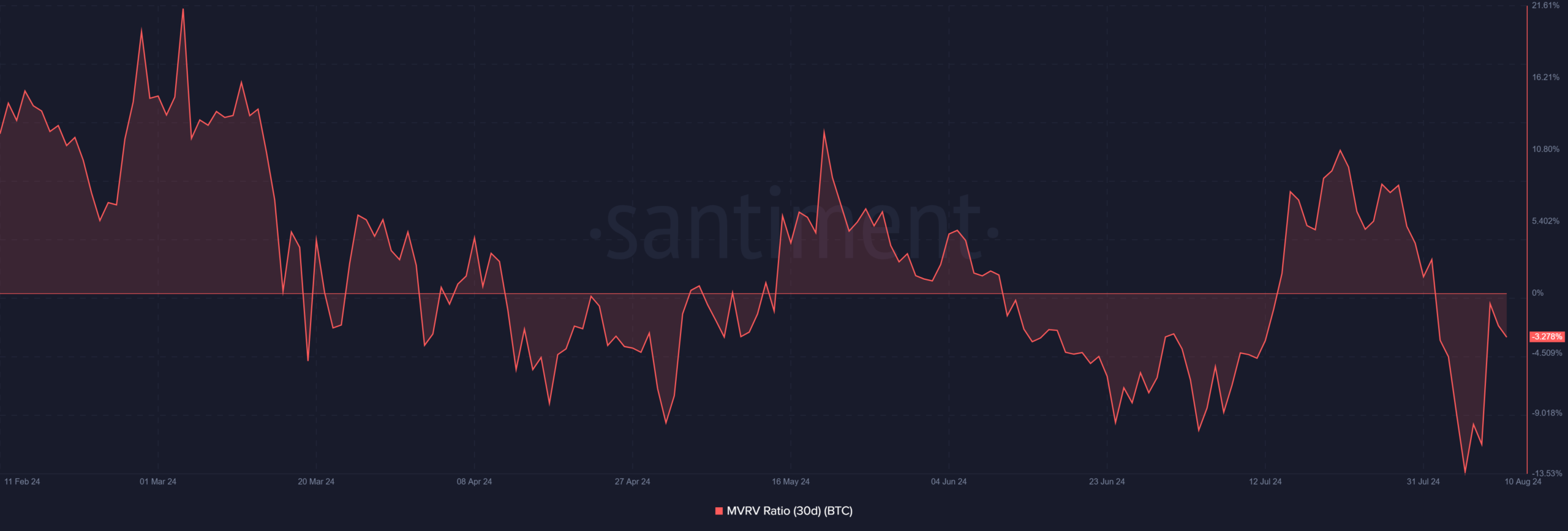

Finally, an analysis of the MVRV ratio chart revealed that Bitcoin’s 30-day MVRV, at press time, was at -3.278%.

This indicates that the average holder over the past month has been at a loss. This negative value also means that BTC might be undervalued, as holders hold at prices lower than their purchase cost.

– Read Bitcoin (BTC) Price Prediction 2024-25

Historically, such low MVRV levels have often been seen as potential buying opportunities. The chart aligns with the recent trend of large investors accumulating Bitcoin during market downturns.

Overall, it means that the current market sentiment may be shifting towards accumulation, in anticipation of a future price recovery.