Core crypto gains 20.5%, breaks psychological $1 resistance: What now?

- Core crypto’s market structure on the daily chart remained bearish.

- The 32% gains posted earlier this week could see a minor retracement.

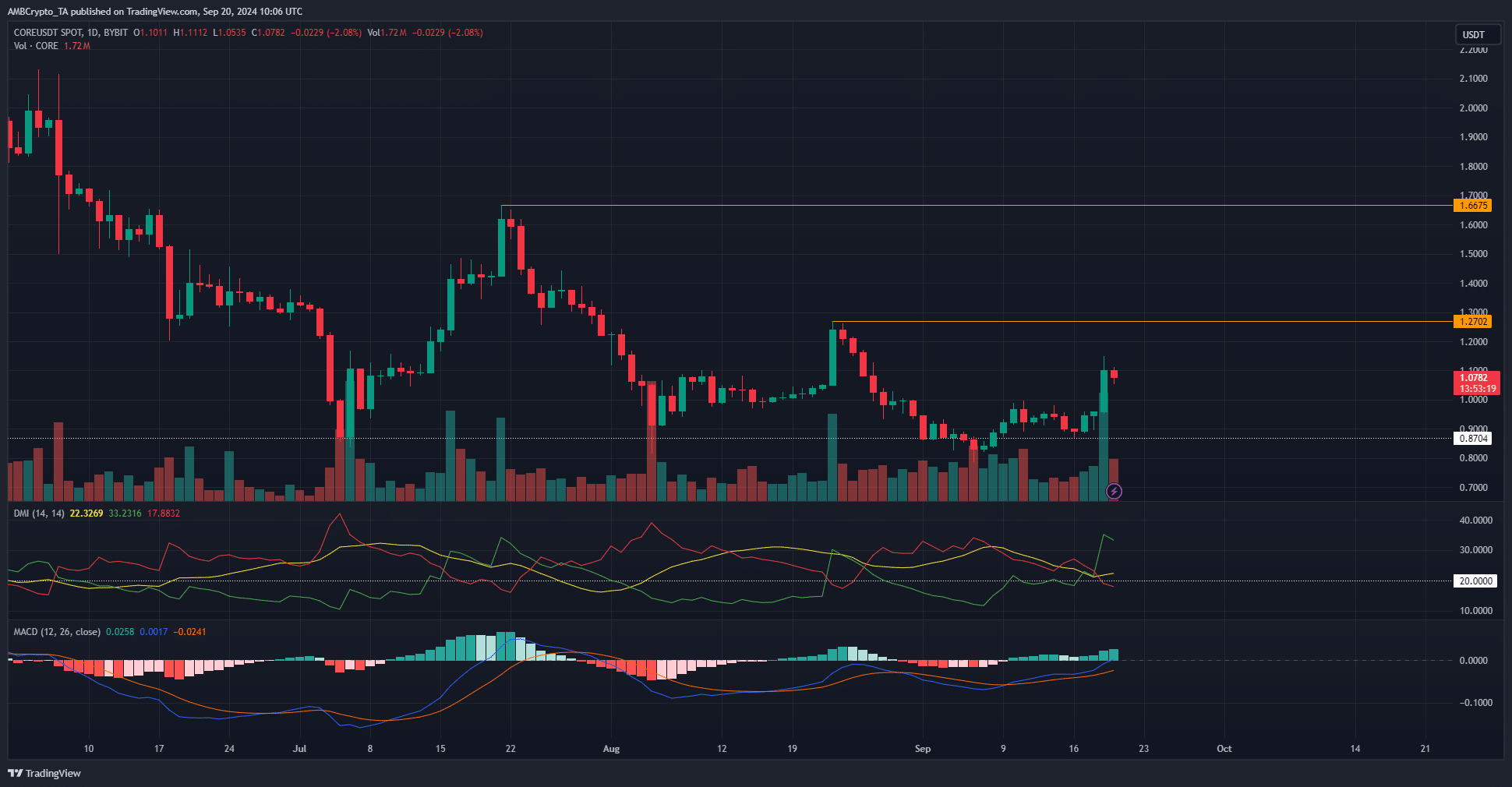

Core [CORE] crypto was on a bullish trajectory once again after breaking past the $1 resistance zone, which was also a psychologically important level. The trend and the volume were also in favor of the buyers.

A retest of the $1 region would present a buying opportunity. Another 30% move higher could be on the cards for Core crypto.

The long-term Core crypto downtrend is unbroken

The daily MACD crossed over above the neutral zero line to show a shift in momentum. Since the 16th of September, the trading volume has steadily increased alongside the price.

This was a positive sign in the short term and increased the chances of more gains.

The Directional Movement Index showed that a bullish trend was beginning. The +DI (green) and the ADX (yellow) were both above 20 to reflect a strong uptrend in progress.

The indicators and the price action showed bullishness for the coming days, but the long-term downtrend has not stopped. A retest of the $1 zone could provide a buying opportunity targeting $1.27.

Futures data agrees with bullish outlook

Source: Coinglass

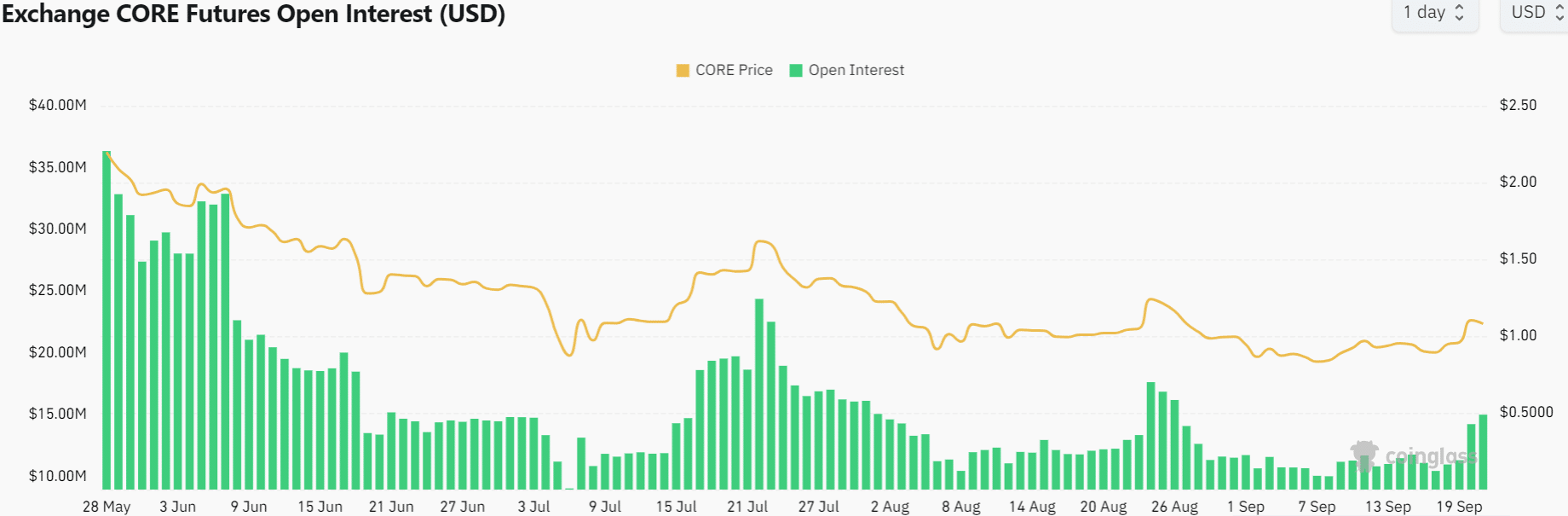

The Open Interest has been in a downtrend since late July. It saw an upward spike in the final week of August and saw an increase once again over the past couple of days.

The OI rose from $10.46 million to $15 million from the 17th to the 20th of September. It came alongside a 23.25% price gain and showed that speculators were willing to go long.

Source: Coinglass

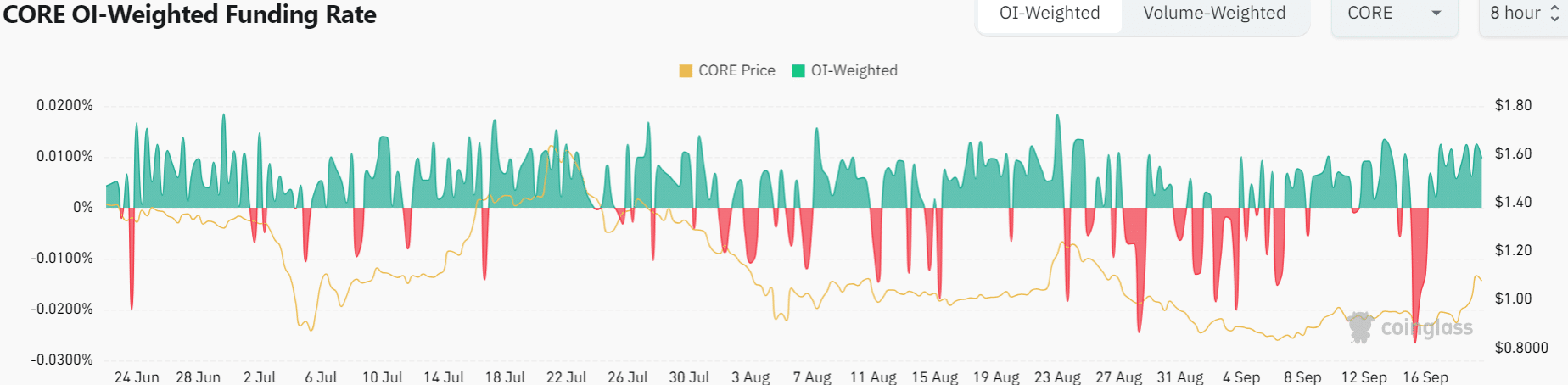

The OI-weighted funding rate fell deep into the negative territory on the 16th of September. It rose back into positive territory the next day, and prices also began to recover.

Read Core’s [CORE] Price Prediction 2024-25

This showed that speculators were entering long positions.

The Futures data showed that in the short term, the sentiment was bullish. A minor dip to $1 will present a buying opportunity that could see a price resurgence to $1.27.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion