Cosmos: New ‘interchain security developments’ has had this effect on ATOM

ATOM has so far rallied by more than 30% from its latest local low. The cyptocurrency extended its downside during last week’s cryptocurrency market crash, and the healthy recovery might be a sign of things to come.

ATOM traded at $11.78 at the time of writing, a slight drop from its 24-hour high of $12.48. However, it is up by roughly 31% from its 12 May low of $8.55. The last time that ATOM’s price was that low was in August 2021. It also represents an 80% discount from its all-time-high at $44.56.

The heavy discount makes ATOM an attractive purchase especially within the lower price range achieved last week. Some, seem to think so, given the healthy accumulation that took place in the last few days. A zoomed out look at the charts reveals that ATOM’s latest trend reversal took place at a major support line.

Aside from the support retest, ATOM’s dip pushed well into the RSI’s oversold zone. The reversal took place courtesy of healthy accumulation according to the MFI indicator. ATOM bears have also been losing their momentum ever since it dipped into the oversold, hence paving the way for a recovery.

Can ATOM’s interchain security developments contribute to the rally?

ATOM’s rally has unfortunately not been as pronounced as one would expect, given the magnitude of the dip. This is likely because there is still uncertainty especially on the likelihood of more downside.

The Cosmos blockchain is drawing closer to the launch of its interchain security. The latest update about the launch was announced prior to the Terra UST attack which contributed to the entire crypto crash.

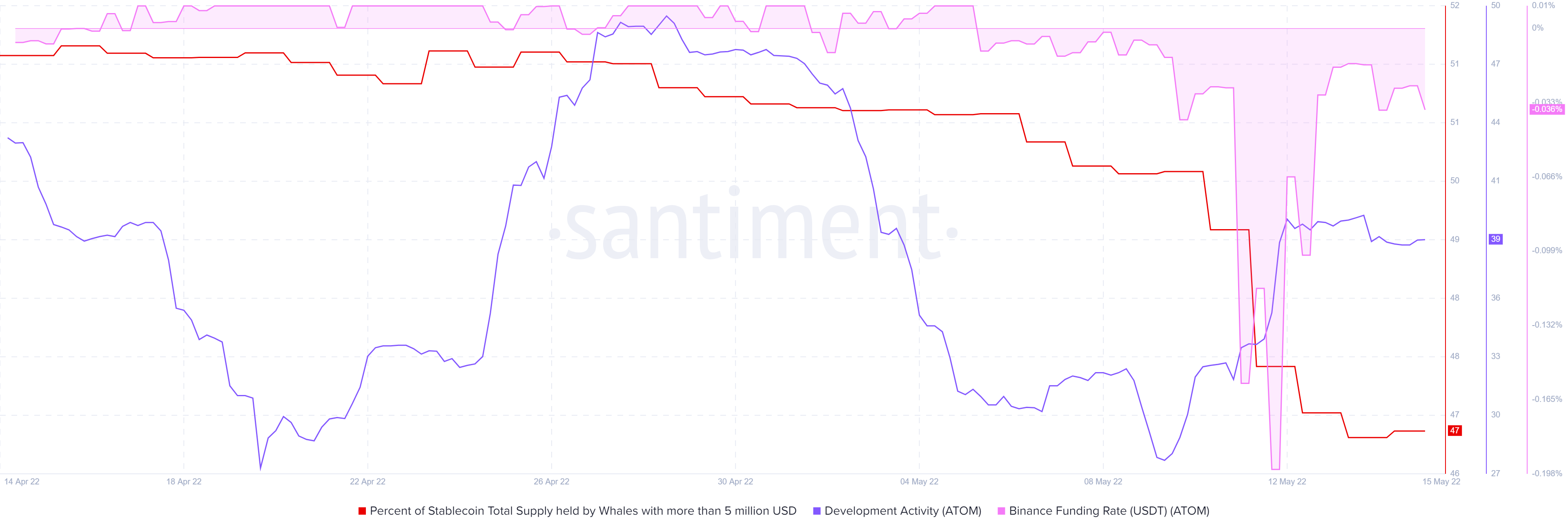

The interchain security launch can potentially contribute to more investor confidence, thus potentially strengthening its recovery. ATOM’s developer activity metric on Santiment shows a significant increase in developer activity a day after the interchain security update was released.

ATOM’s supply held by whales metric registered a slight increase in the last 24 hours. This might be a sign of improving investor confidence. The recovery in the Binance derivatives funding rate enforces the same observation, signifying a return of investor interest.

Conclusion

ATOM’s rally in the last few days might signify the start of more upside in the next few weeks. However, this is not a guarantee that the market will recover. There is still significant risk of additional downside and a potential bear trap, hence the need to tread cautiously.

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://ambcrypto.com/wp-content/uploads/2025/07/XLM-Featured-400x240.webp)