Analysis

Cosmos consolidates at range low, is a bearish breakout imminent

ATOM’s price dipped by 3.8% over the past seven days to suggest a bearish breakout might be inevitable.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ATOM bears look ready to break the bullish defense of the key support level.

- Shorts hold a 54.2% advantage in the long/short ratio.

ATOM’s month-long price fluctuation within a compact range looks to be coming to an end with a bearish breakout on the horizon. The altcoin posted losses of 3.8% over the past seven days.

Read Cosmos’ [ATOM] Price Prediction 2023-24

With Bitcoin [BTC] not establishing a clear trend yet, the indicators showed downward momentum was on the rise and ATOM could see lower prices in the coming weeks.

Bearish breakout looks imminent

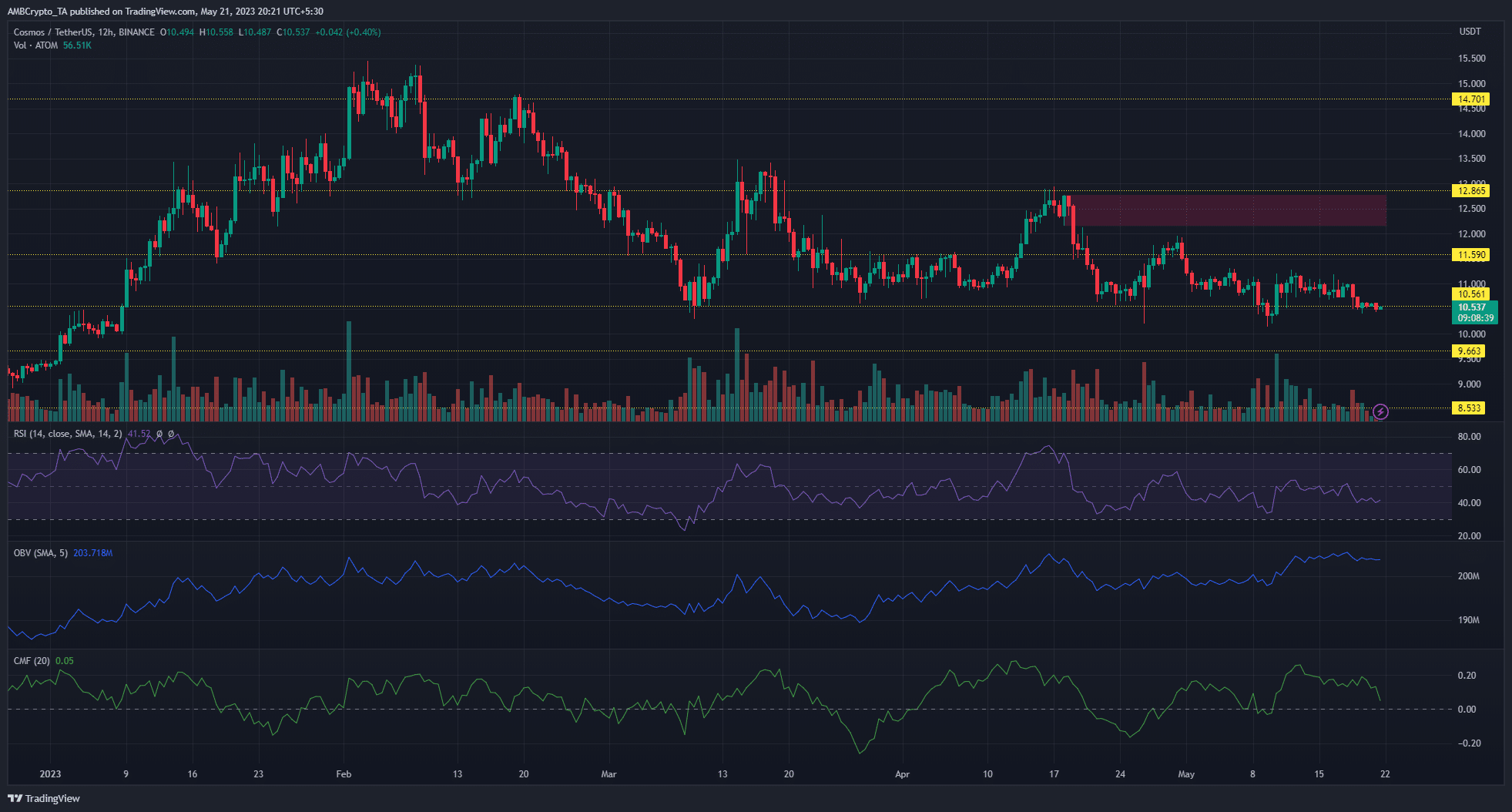

ATOM flipped its structure to bearish in early March after the price broke below the $11.59 support level. Subsequent price movements saw ATOM range between $11.59 and $12.86 before another wave of selling pressure pushed it to the key support level of $10.56.

A look at the 12-hour timeframe showed that the price consolidated around the $10.56 support level, since 1 May with neither bulls having the firepower to rally nor bears having the momentum to go lower. However, on-chart indicators suggested that a bearish breakout could be looming.

The RSI (Relative Strength Indicator) dipped under the neutral 50 and stood at 42.2, as of press time. The OBV (On Balance Volume) also dropped slightly to suggest a decline in demand.

The CMF (Chaikin Money Flow) which had been on a strong up-trend sharply reversed toward the zero level and stayed at 0.05. This combination of key indicators moving in alignment hinted at a price break below the $10.56 support level.

A successful bearish breakout will see bears target the January lows of $9.66. Alternatively, if BTC rallies again, bulls can spring a surprise on bears to rally from the current support level.

How much are 1,10,100 ATOMs worth today?

Shorts prepare to maximize gains

Data from Coinglass revealed the shorts dominance in the futures market with shorts holding $10.49M worth of open positions. This represented a 54.2% advantage in the long/short ratio. It highlighted the leanings of market speculators towards ATOM’s price dipping further.

The aggregated spot Cumulative Volume Delta (CVD) also remained in a massive decline amidst fluctuations in the funding rate. This hinted at market sentiment heavily titled in favor of more bearish activity for ATOM.

Source: Coinalyze