Analysis

Cosmos: One last hurdle to clear before reclaiming June high

Cosmos’ uptrend was solid, but it approached a key bearish area which could derail bulls from crossing $10.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- ATOM’s recovery was approaching a bearish OB.

- Trading volumes and development activity eased.

Cosmos [ATOM] is fixated on reclaiming the $10 psychological level. But some fundamental and technical indicators were out-of-sync, casting doubts over short-term capacity to exceed $10.

Is your portfolio green? Check out the ATOM Profit Calculator

In the meantime, Bitcoin [BTC] continues to fluctuate between $29.5k and $31.4k, with $30.8k being a key faltering line for bulls in the past few days.

Can bulls invalidate this bearish OB?

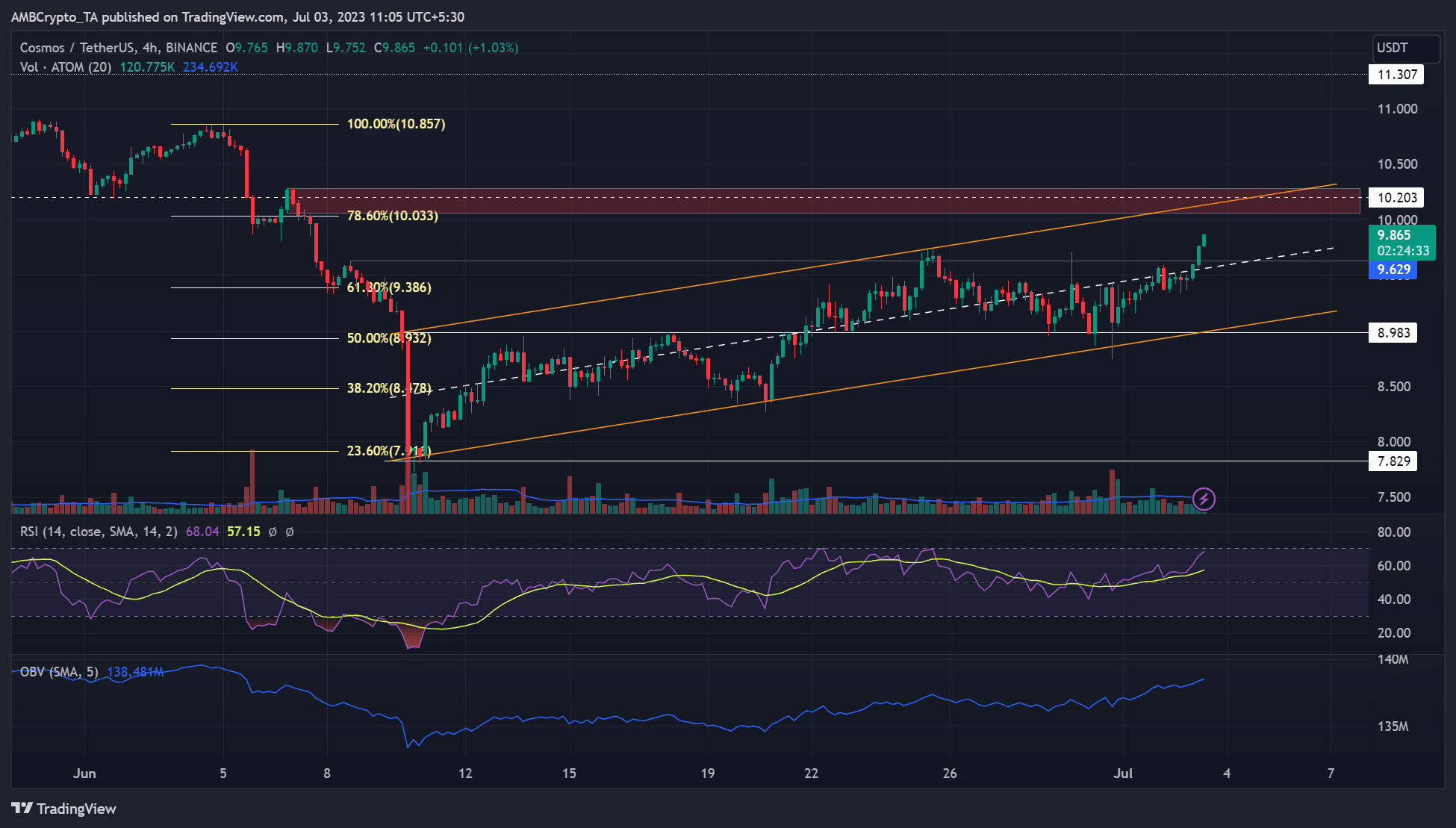

Since the massive slump on 10 June, ATOM rebounded and has been steadily making higher lows and highs on the 4-hour chart – uptrend. At the time of writing, the pullback retested at $8.93, and the range-low saw it bounce back and clear the previous high near $9.63. The move flipped the H4 structure to bullish.

Bulls will need to worry about the range-high of the ascending channel near $10.1. The range-high aligns with a bearish order block (OB) of $10.1 – $10.28 (red) formed on 6 June on the 4-hour chart. Collectively, it could make the area a bearish stronghold unless bulls invalidate it by swinging to $10.5.

However, sellers could gain entry at the bearish OB if bulls falter in the area. In such a scenario, sellers could extend gains to the mid-range ($9.6) or range-low ($9).

The RSI hit the overbought zone while the OBV edged higher, denoting increased buying pressure and demand in the past few days.

Volumes eased; Development activity flattened

According to Santiment, ATOM’s volume peaked at 123 million after the price hit $9.2 on 30 June. After that, volume eased to about 67 million at the time of writing. This was a considerable drop which means buying pressure eased despite the rally.

How much are 1,10,100 ATOMs worth today?

The development activity flattened out in the same period, which could spook long-term investors’ confidence. Besides, the funding rates flashed red at the time of writing, reinforcing further headaches for near-term bulls.

Bulls could wait for a pullback retest on the mid-range or the range-low for re-entry if ATOM falters at the bearish OB.