Could Bitcoin skyrocket to $160k? BTC’s NUPL hints at…

- BTC has declined by 2.44% over the past 24 hours.

- Bitcoin’s NUPL suggest a potential to a record high of $130k-$160k.

Bitcoin [BTC] has struggled to maintain an upward momentum since hitting $108,364. Since then, the crypto has faced downward pressure hitting a low of $92,118. Thus, over the past weeks, BTC has consolidated between $92k and $107k.

In fact, as of this writing, Bitcoin was trading at $96,298. This marked a 2.44% decline on daily charts.

Despite the recent struggles, stakeholders remain optimistic and see the decline as a mere market correction before another uptrend. Inasmuch, Cryptoquant analysts have predicted a rally to between $130k to $160k citing Bitcoin’s NUPL.

Bitcoin NUPL indicates a sustained bull rally

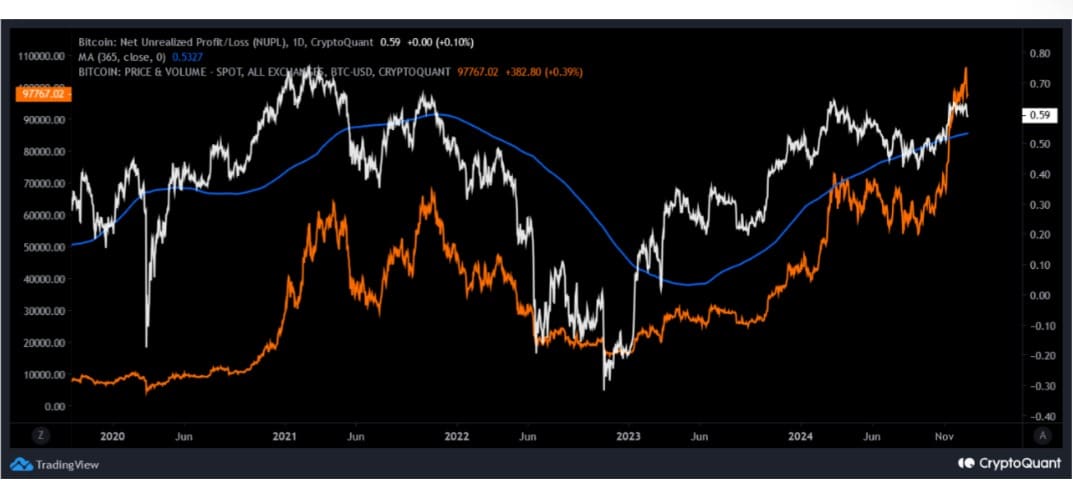

In his analysis, Cryptoquant analyst Baro Virtual posited that the NUP indicates that Bitcoin is in its final stages, with a target range of $130k-$160k.

This means that Bitcoin is nearing the top of its bullish cycle, where prices historically see a massive rally before peaking. In this phase, market participants are highly profitable, and speculative buying drives prices up.

According to him, the unrealized profit/loss index has formed a cup and handle pattern which is expected to push BTC into the target range of $130k to $160k.

When NUPL forms a cup and handle pattern, it implies that unrealized profits are consolidating with a slight dip suggesting a temporary slowdown in market sentiment before a strong continuation upward.

In addition, Bitcoin made a successful breakout through the NUPL index’s 365-day MA signaling a potential uptrend in both the medium and long term.

What BTC charts suggest

While Bitcoin has struggled to maintain, an upward momentum, long-term prospects are still in favor of a strong upswing.

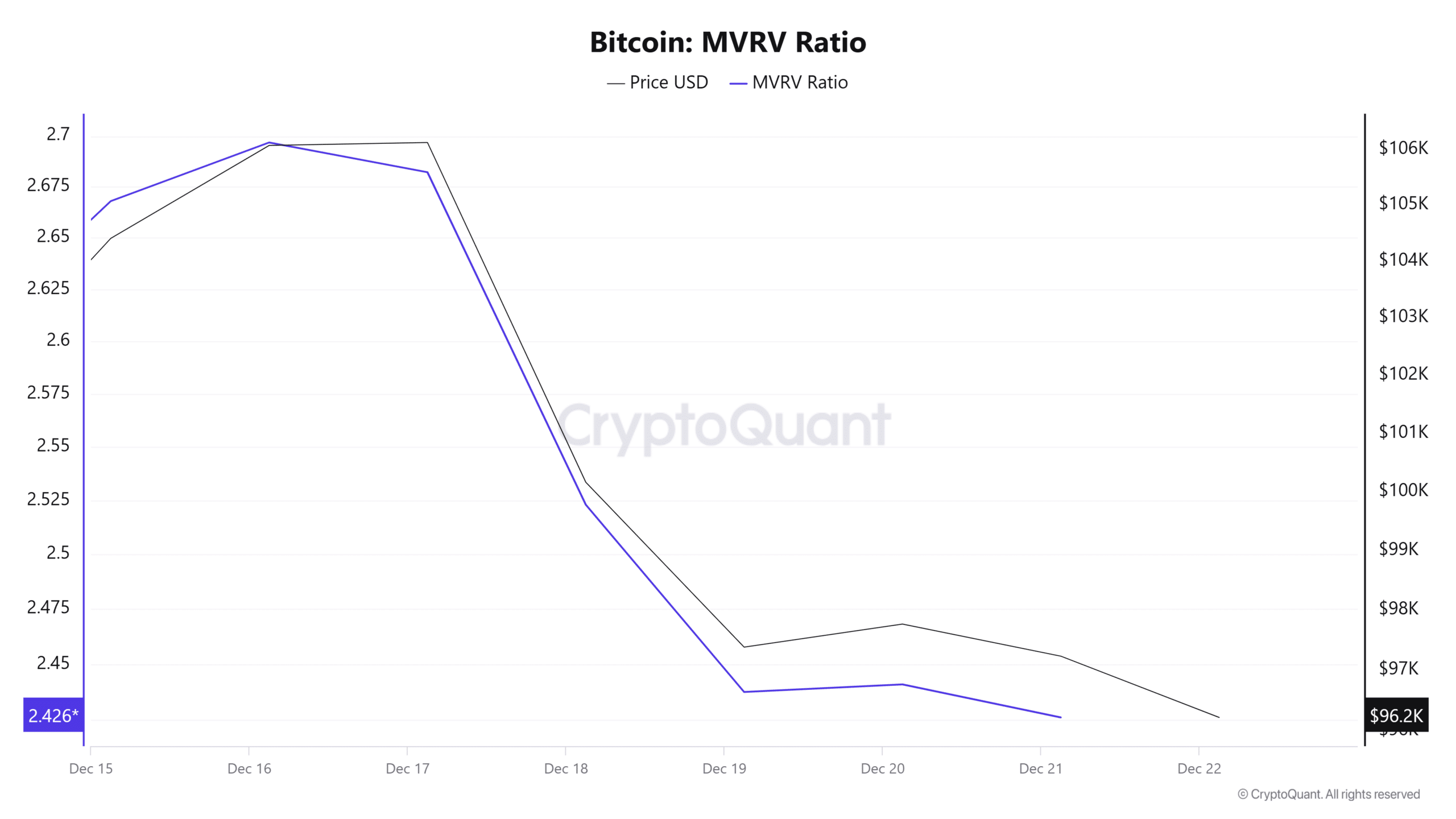

For starters, Bitcoin’s MVRV ratio has dropped over the past week to 2.42. Historically, an MVRV ratio between 2-3 is considered bullish and neutral.

Thus, market is not overheated and buyers find a reasonable balance between risk and reward. This indicates market stabilization and potential price recovery.

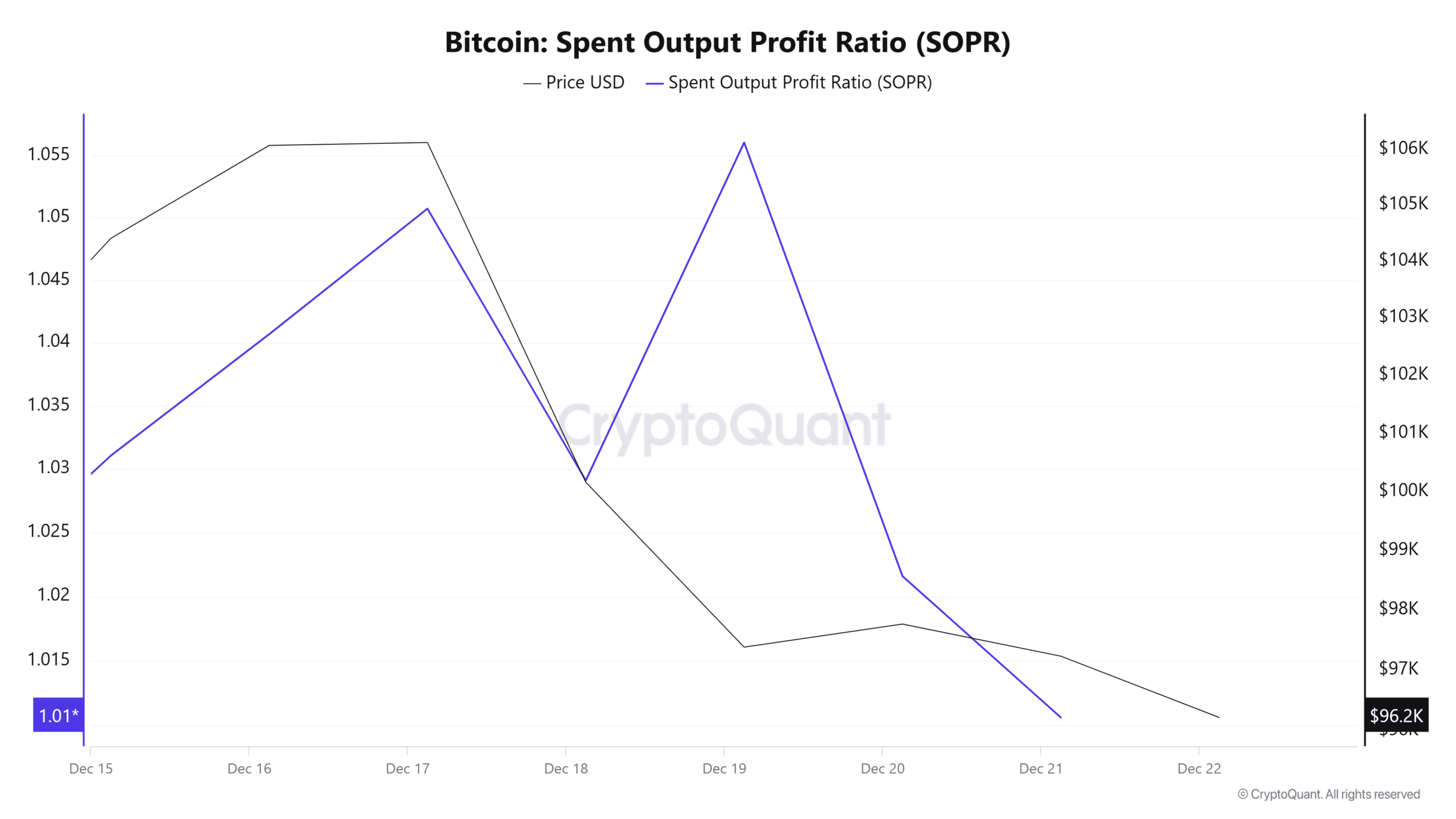

Additionally, Bitcoin’s SOPR has declined but it has stabilized at 1.01. When SOPR stabilizes around 1, it suggests that BTC is testing a break-even point where the market is neutral. Thus, long-term holders see it as an opportunity to accumulate BTC sold by weaker hands.

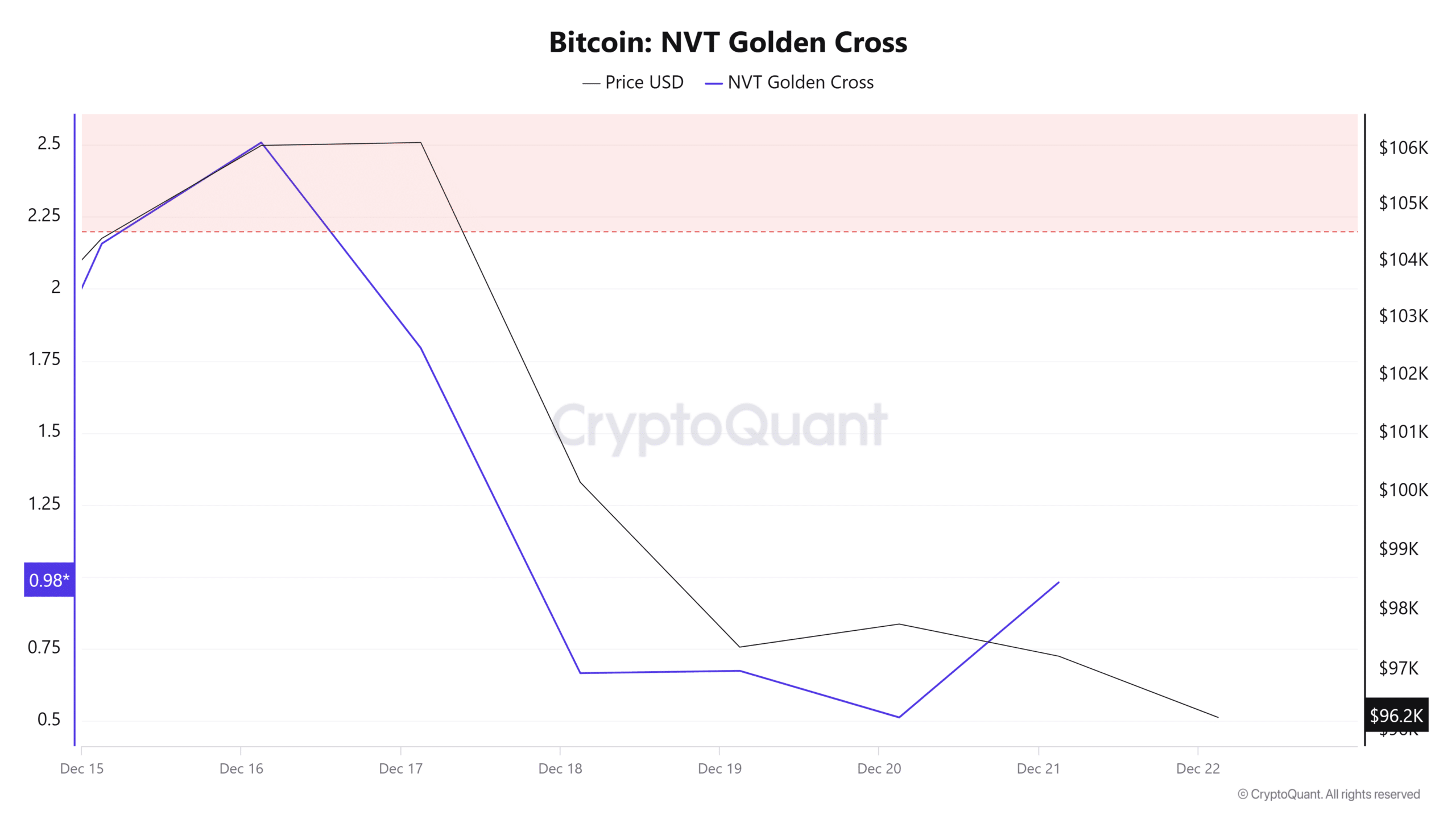

Finally, Bitcoin’s NVT Golden Cross has declined to 0.98 indicating a bullish divergence where increasing transaction activity reflects growing confidence in the network activity.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Simply put, although Bitcoin has retraced over the past week, long-term fundamentals signal a potential recovery after the correction.

Therefore, these conditions point towards a potential trend reversal. If it happens so, we could see BTC reclaim $99790 resistance. However, if bears continue to strengthen, Bitcoin will drop to $95600.