Dogecoin

Could Dogecoin be poised for a pullback after a week of gains? Data suggests…

Dogcoin bulls made a strong appearance this week, but how much longer can the rally continue before an inevitable pullback?

- Dogecoin has found its favor with the bulls over the past week.

- On-chain data reveals robust whale or large holder involvement.

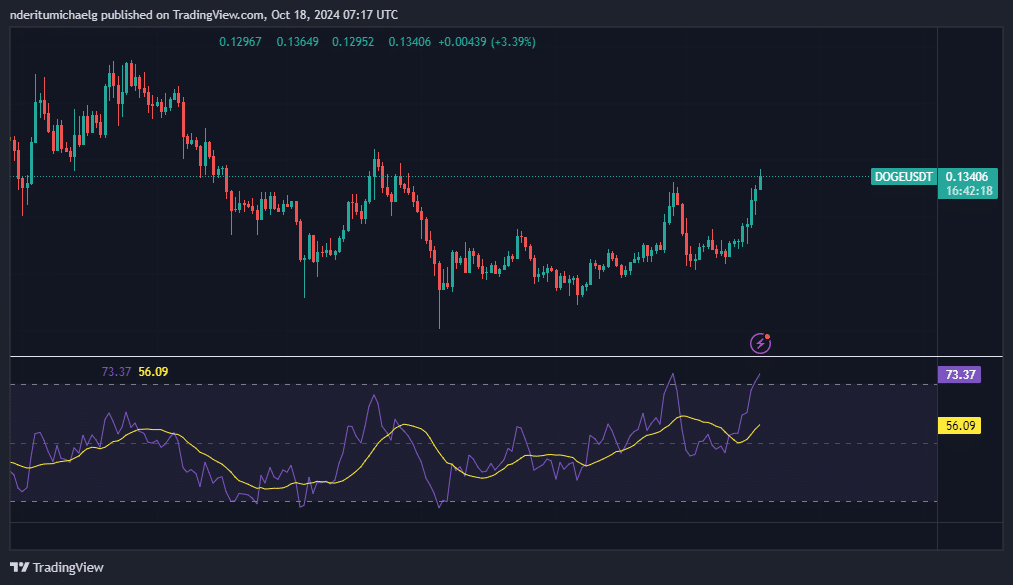

Is Dogecoin [DOGE] due for a bearish retracement after its impressive upside this week? The memecoin validated bullish interest courtesy of its recent performance but it is now approaching notable zones where sell pressure is likely to start manifesting.

Exactly a week ago we observed that Dogecoin had struggled to secure momentum after the sell pressure that kicked off at the end of September. However, it found favor with the bulls since Friday last week.

To put things into perspective, DOGE extended its upside in the last 24 hours, to a $0.135 press time price level. This marks the 8th consecutive day of being in the green.

However, this momentum is bound to slow down and potentially give in to profit-taking by those who bought at or near the bottom.

The higher Dogecoin prices have now pushed into the overbought zone according to the RSI. It also pushed past the first resistance level near the $0.128. The next resistance zone is at or near the $0.140 price level.

Assessing whether Dogecoin sell pressure is building up

The latest Dogecoin performance is no fluke. On-chain data reveals robust whale or large holder involvement. For instance, DOGE large holder flows registered a massive surge on Thursday, with inflows peaking at 1.17 billion DOGE.

Meanwhile, large holder flows peaked at $640.1 million DOGE during the same session.

The difference means there was net positive flows worth over $71 million from the large holders alone. The surge in large holder inflows confirms that there was still robust demand despite the rising prices. This indicates potential for more upside, provided that sell pressure does not intensify.

Dogecoin balance by time held may offer important insights regarding the possibility of profit taking. HODLer balances dipped from 72.97 billion coins on 12th October to 72.17 billion DOGE on 18th October.

Cruiser balances also drew down from 74.89 billion coins to 73.77 billion coins during the same period.

Source: IntoTheBlock

Despite these outflows, retail trader balances absorbed any potential downfall. Their balances grew from 8.75 billion DOGE to 10.74 billion DOGE from 12th to 18th October.

Realistic or not, here’s DOGE market cap in BTC’s terms

The above findings suggest that some whales and swing traders have been taking profits on the way up. However, strong demand from the retail segment has supported Dogecoin’s upside.

The bullish momentum may thus not have much upside left without strong accumulation by whales. Nevertheless, these observations confirm the growing confidence among Dogecoin holders in Q4 2024.