Ethereum

Could Ethereum [ETH] see more downside as withdrawals heighten

![Could Ethereum [ETH] see more downside as withdrawals heighten](https://ambcrypto.com/wp-content/uploads/2022/11/po-2022-11-12T102632.017-1000x600.png)

Ethereum [ETH] could risk a further decline despite losing over 23% of its value to trade at $1,261 in the last seven days. The reason for this possibility was the high deviation of on-chain withdrawals of the altcoin.

Onchain Edge, in a 11 November post on CryptoQuant, noted the state of these withdrawing transactions. In addition, he suggested that ETH investors might expect another price correction due to these actions.

Read AMBCrypto’s Price Prediction for Ethereum 2023-2024

According to the publication, the possibility was on the higher side. Further, a correction at the current stage was not a bad omen for Ethereum in the long-term. While backing up his argument, he also pointed out that similar circumstances occurred in May and November 2021. The most recent one took place in May 2022.

Onwards, what transpires?

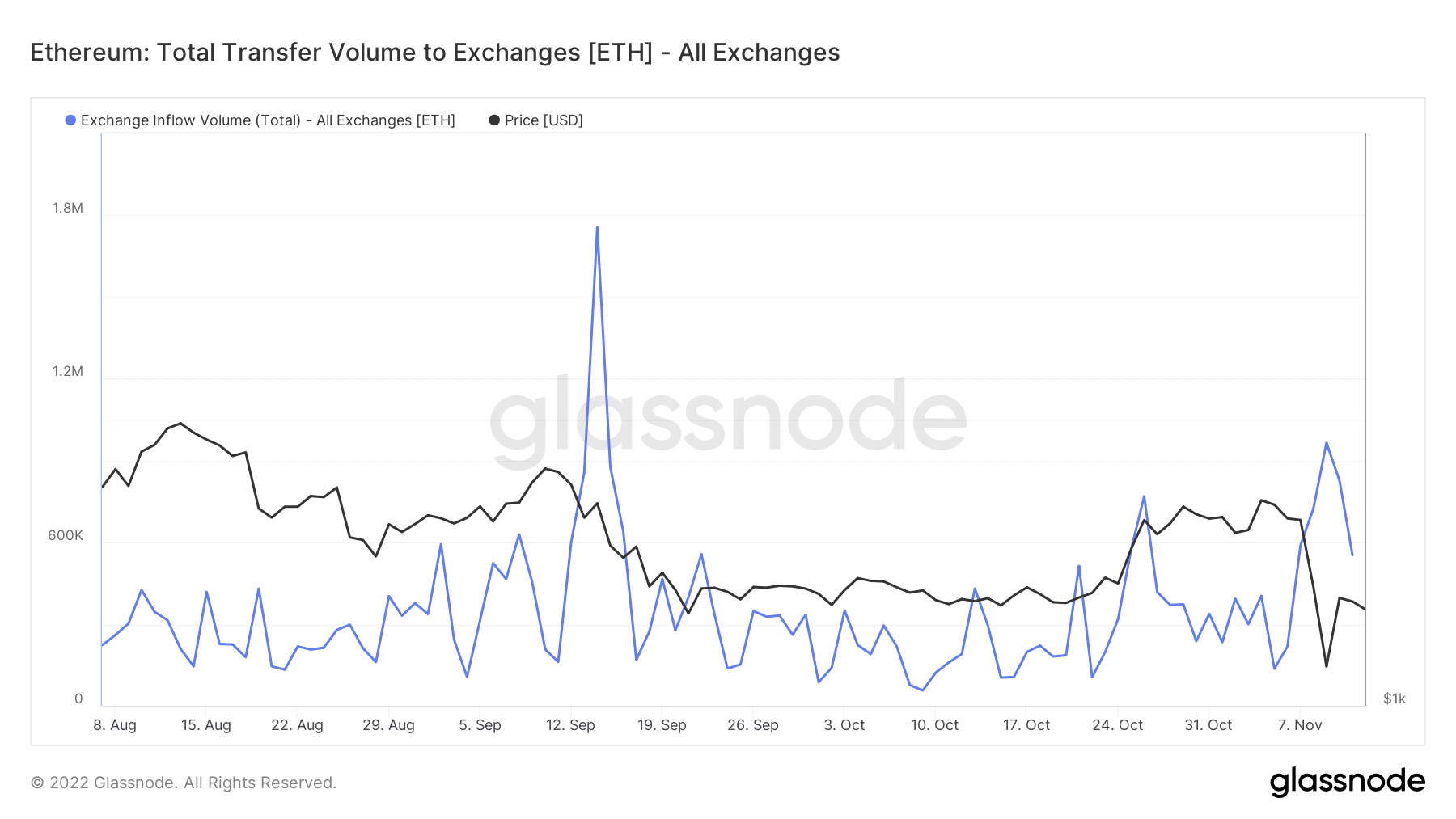

Per on-chain data, Glassnode revealed that Ethereum’s total inflow volume had significantly declined since 9 November. The decrease was definitely not void of the distrust that has rocked the ecosystem since the FTX collapse. With these low exchange deposits, it implied that more investors were looking at other options to store their ETH. While this data might indicate less selling pressure, it was likely that much less activity was the reason for this decline.

In addition to this disinterest in trading on exchanges, the derivatives market was not left out. Further Glassnode revelation showed that the futures volume in the last 24 hours was an extremely negative value across all exchanges. At press time, Binance futures volume had shredded $8.31 billion within the aforementioned period.

This indicated one of the worst interest levels since 2022 began. Hence, this on-chain status, if not improved in the coming days, could align with the premonition of a further price decrease.

To a greater extent,

Santiment showed that the possibility was not out of the question. As of this writing, the on-chain data analysis platform revealed that the 30-day Market Value to Realized (MVRV) ratio was -7.723%. At that value, it implied that ETH investors had recently been in losses.Additionally, profits gathered earlier, especially on exchanges, were now in ruins. Similarly, the MVRV Z-score was negative at -0.0263. Hence, the realized cap value had high potential to be worth more than the undiluted market capitalization.

Get ready for more rip ups

However, indications from the Exponential Moving Average (EMA) showed that it could be time for a correction. This was due to the 50 EMA (yellow) already in pole position to go above the 20 EMA (blue).

On the occasion it finally crosses, sellers might finally take control of the market and the price decreases lower than the current $1,200 current region. In the mid to long term, the 200 EMA (purple) indicated that the correction would eventually lead to a price revival. Nevertheless, it might be necessary to exercise caution before assuming the decline would be an inevitable event.