Could Fantom [FTM] be on the verge of a breakout after…

![Could Fantom [FTM] be on the verge of a breakout after…](https://ambcrypto.com/wp-content/uploads/2023/02/po-2023-02-15T121954.030.png)

- Fantom gained over 10% in the last 24 hours after holding support.

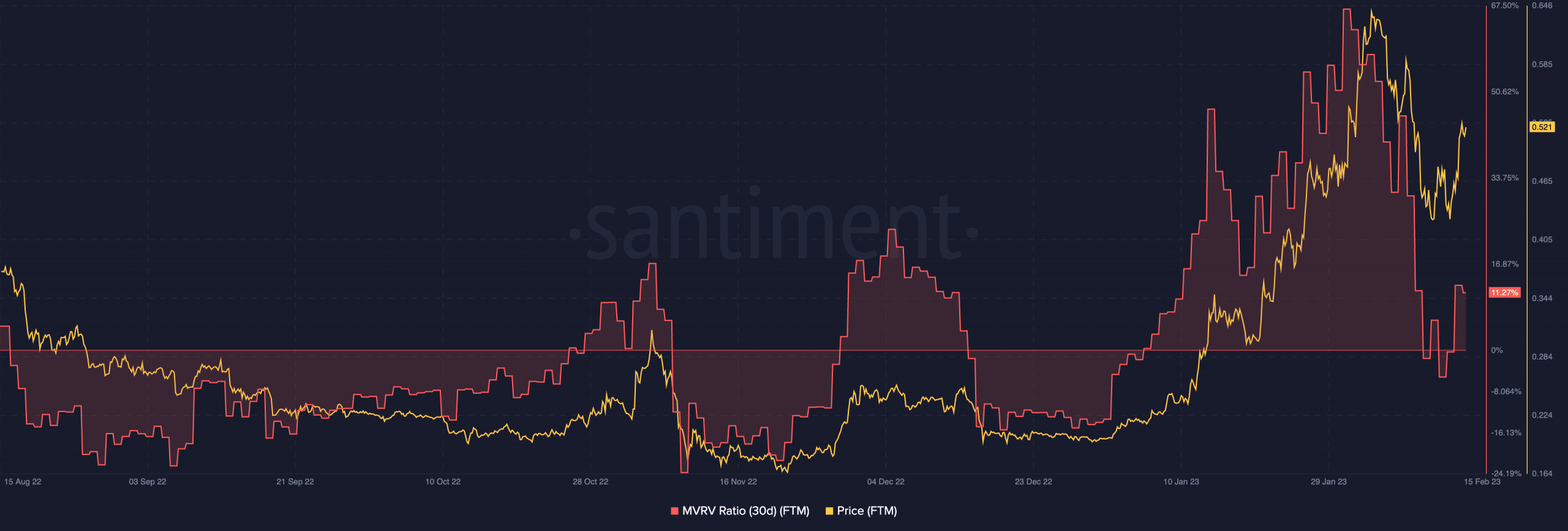

- Investors’ motive towards selling could increase as MVRV ratio spiked.

Fantom [FTM], the smart contract token, could have another shot at a further upswing after it conquered a significant supply level. According to ali_charts, who got the data from IntoTheBlock, there was no resistance barrier that could prevent FTM from going upward.

#Fantom overcame a significant supply wall, turning it into support. Notice that @intotheblock shows no other important resistance barriers ahead of $FTM, which may suggest #FTM is preparing for an important upswing. pic.twitter.com/dvMgXgmkPn

— Ali (@ali_charts) February 14, 2023

How many are 1,10,100 FTMs worth today?

Getting back to the DeFi hack amid…

Since the aforementioned tweet, FTM rallied, and gained 10.24% in the last 24 hours. The performance was averagely higher than other DeFi tokens within the same period.

However, the gains did not result in massive selling pressure from FTM investors. This was because Santiment’s data revealed that the exchange inflow was down to 293,000. A spike in this metric would have translated to potential sell off from investors who have recently made profits.

Its opposite number, the exchange outflow, was, however, higher at 899,000. Since the difference was this large, it implied that FTM enjoyed more accumulation than the intention to dump the token.

The days of splendor may be over for FTM

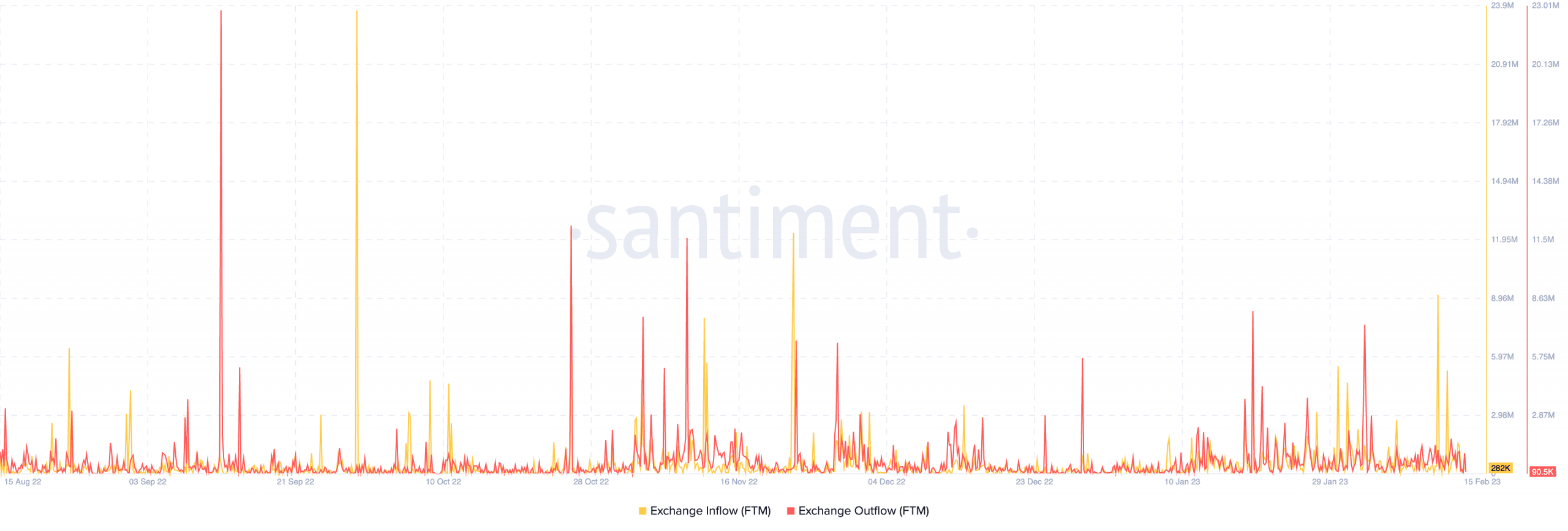

So, does FTM have the capability to stay the green course? Well, the technical outlook shown by the Directional Movement Index (DMI) puts FTM in the midst of potential consolidation. This inference was because the +DMI (green), although higher than the -DMI (red), did not have the support of the Average Directional Index (ADX).

The ADX (yellow) measures the directional strength of an asset. And, a value higher than 25 indicates a strong directional movement and vice versa. At the time of writing, the ADX was 38.39.

But the trend faced a massive downturn. Hence, could drive FTM to swing around the $0.5 region. For the Awesome Oscillator (AO), it seemed that the glory days of bullishness would soon be over. The context leading to this conclusion was because of the repeated red bars — signaling an impending bearish momentum.

Despite the potential fall, the surge seems to have helped investors’ portfolio. At press time, the Market Value to Realized Value (MVRV) ratio revived from its lows to hit 11.27%.

Is your portfolio green? Check out the Fantom Profit Calculator

The MVRV ratio compares that realized capitalization to the market capitalization while determining if an asset is at a fair value. The rise in the metric points to a motive for selling FTM and revealed that the realized cap outpaced the market cap.

So, from all indications, FTM could have hit the highest of its breaking point, and a price reversal could follow. However, it was worth noting that market sentiment might change, and the token remained in the green.

![Fantom [FTM] price action](https://ambcrypto.com/wp-content/uploads/2023/02/FTMUSD_2023-02-15_11-42-05.png)