Could this ‘Curve-beating’ alt’s 63.3% uptick be a sign of surefire recovery

Convex Finance is known to face stiff competition from Yearn.Finance. However, it seems like its explosive growth has outdone the latter. Registering a significant hike on 2 March, the DeFi protocol token crossed $1.2 billion in market cap. In doing so, it beat out Curve DAO, the very cause of its existence.

Convex finance beats Curve

It is well known that Convex Finance’s entire purpose is to absorb the liquidity of CurveDAO and to incentivize investors to stake more of their CRV.

Before Convex Finance, Yearn.Finance was already bidding to dominate that space. However, it couldn’t succeed.

Consequently, on 2 March, Convex Finance became the fifth-largest DeFi protocol with a market cap of $12.55 billion. On the contrary, Yearn.Finance was positioned well below at the fourteenth spot with just $3.54 billion in TVL.

Difference of TVL between Convex Finance and Yearn.Finance | Source: DeFi Llama – AMBCrypto

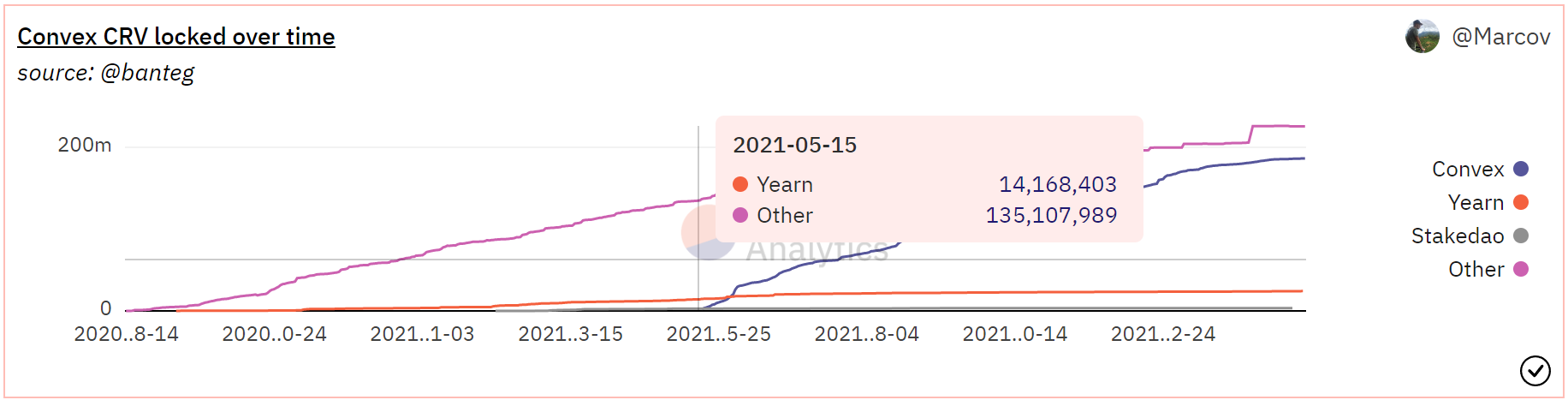

In fact, Convex staking data revealed that in less than a year since its launch in May, the dApp has managed to outperform YFI by a mile.

In May, YFI had about 14 million CRV locked when CVX launched. Interestingly, staking on Convex grew rapidly, and the DeFi protocol managed to dominate 50% of all CRV locked. Currently, it has 186 million CRV.

YFI, on the contrary, has thus far only managed to acquire 24 million CRV.

CRV locked on Convex Finance vs Yearn.Finance | Source: Dune – AMBCrypto

Convex Finance’s facilitator CurveDAO, the biggest dApp and decentralized exchange, is only $5.8 billion ahead in TVL.

The growing demand and staking in Convex Finance have led its token’s value to shoot up high. In fact, it saw a major uptick on 1 and 2 March.

Even so, adhering to the broader market cues, CVX fell by 65.1% over the last two months. Down from its all-time high of $49.9, the altcoin traded at $17.4 until three days ago.

Since then, the altcoin has recovered by 26.54%. In fact, CVX was up by over 63% at one point in the day on 2 March.

Convex Finance price action | Source: TradingView – AMBCrypto

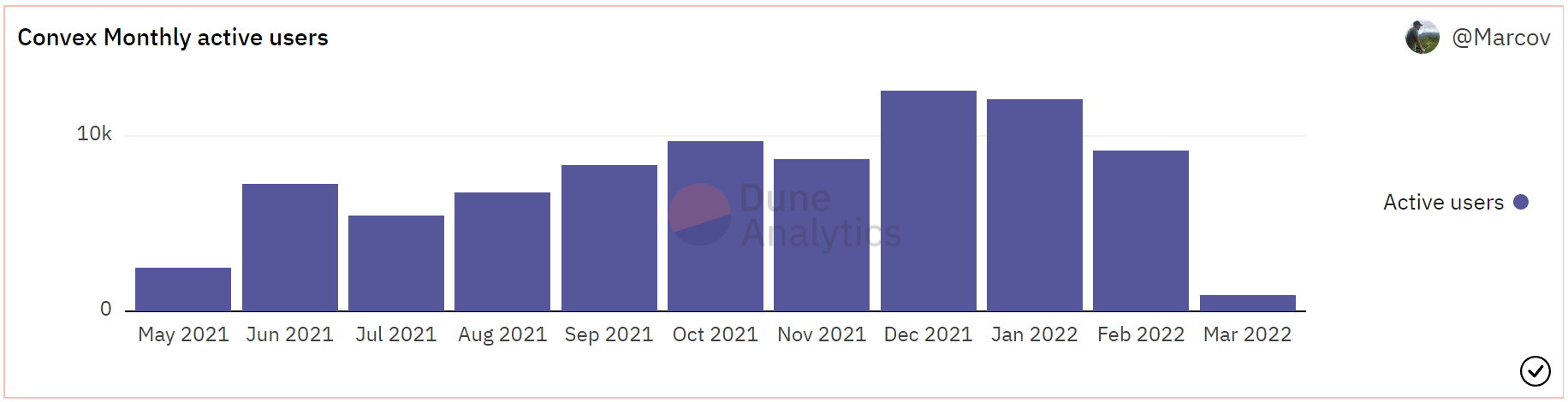

Now, the market’s bearishness over the last two months has stunted the growth of Convex Finance users. February, for instance, has recorded a 27% decrease in monthly users from December’s high of 12,566 users.

However, it could change this month as the market is potentially heading towards recovery.

Convex Finance monthly active users | Source: Dune – AMBCrypto