Cronos breaks $0.0975 resistance – Can CRO possibly rally above $0.1?

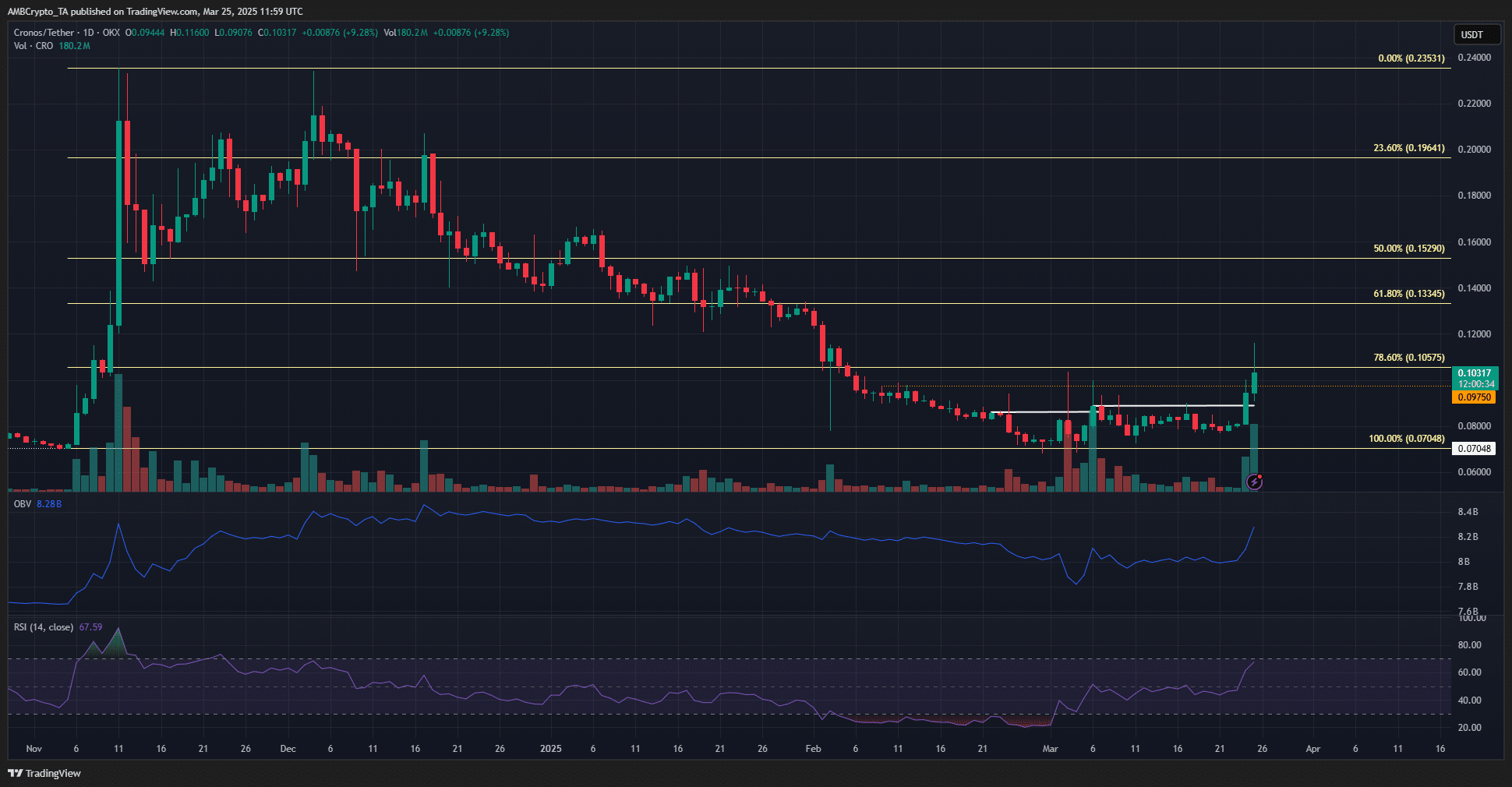

- Cronos has a bullish market structure on the daily chart and was trying to flip $0.1 to support.

- The strong buying pressure alongside the price breakout meant further gains were likely in the coming weeks.

Cronos [CRO], formerly known as Crypto.com Coin, saw strong gains in the past 36 hours. It was up by 27.7% at press time, but there were signs of a pullback. This minor price dip was expected to be roughly 5% in magnitude.

The 1-day price action for Cronos was strongly bullish. With rising buying pressure, it appeared likely that the CRO bulls could initiate a recovery.

Cronos: Second bullish market structure break

In white, the two daily timeframe market structure breaks were marked. Moreover, the price was above the local resistance level at $0.0975 and attempted to scale the $0.105 resistance.

The OBV saw a strong uptick as the trading volume in the past couple of days was high. The breakout beyond the local resistance on the back of high volume was an encouraging sight for the bulls.

The 1-day RSI also surged past neutral 50 to show strong bullish momentum.

If the current demand can be sustained, Cronos has a good chance of initiating a rally higher. Yet, if it sinks below $0.1 and $0.0975 in the coming days, the recent price surge would turn out to be a fake-out.

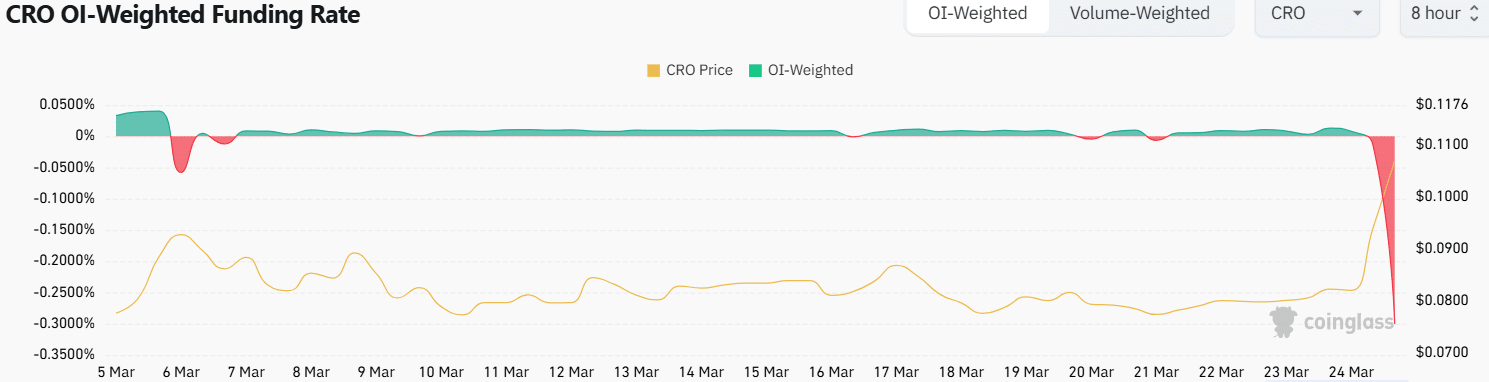

Source: Coinglass

The Funding Rate was steeply negative, standing at -0.3% at press time. It last fell to negative territory on the 6th of March, falling to -0.05%. It happened to mark the local price top at $0.093.

With short sellers crowding the derivatives market, the recent surge might mark the local top again. However, a local top does not subtract from the bullish market structure on the daily chart.

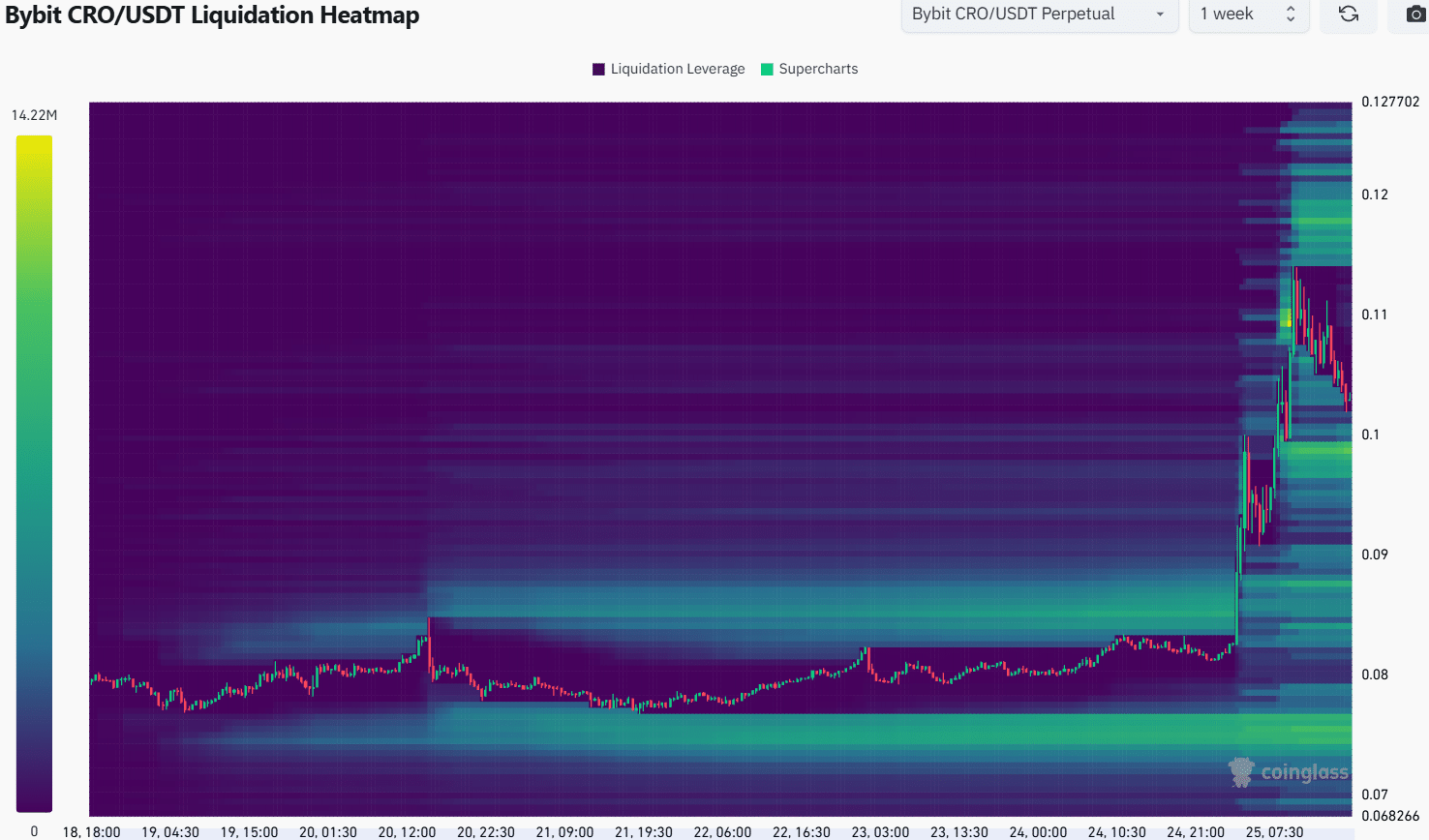

Source: Coinglass

The 1-week liquidation heatmap noted two magnetic zones of interest at $0.098 and $0.118.

The negative Funding Rate combined with overbought conditions in the lower timeframes meant that a CRO price dip to $0.098 was possible.

Hence, swing traders can look to buy the token upon a retest of the nearby demand zone, targeting the $0.118-$0.12 liquidity cluster.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

![Ethereum's [ETH] short-term price targets - Is the $2,300 resistance too strong?](https://ambcrypto.com/wp-content/uploads/2025/03/Evans-1-min-400x240.png)