News

Cross-chain protocol Orbit Chain attacked on New Year’s Eve

Orbit Chain admitted to “an unidentified access” to the cross-chain bridge.

- Orbit Bridge saw losses worth $81.5 million in stablecoins and cryptos.

- Orbit Chain team announced compensation for users.

The New Year’s Eve doled tears rather than cheers to the users of the cross-chain protocol Orbit bridge, which became yet another victim of crypto exploits.

Orbit Chain gets robbed off

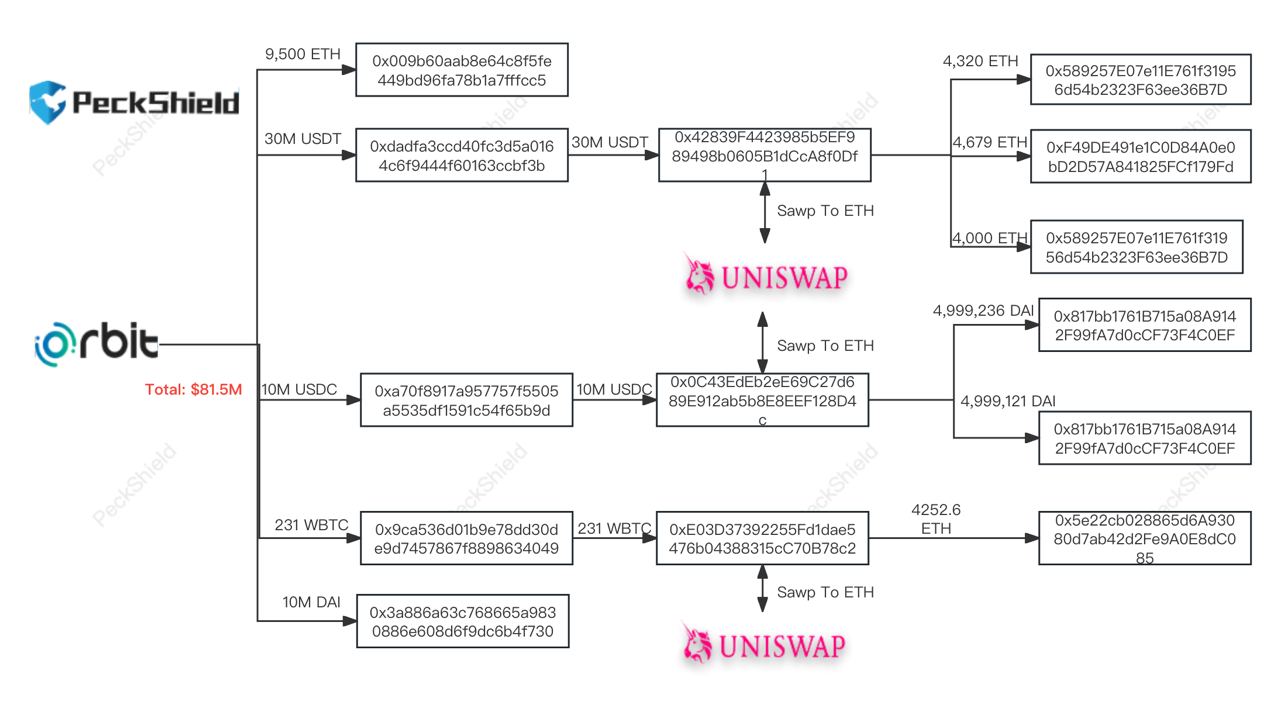

A preliminary investigation by blockchain security firm PeckShield Inc. revealed losses worth $81.5 million in stablecoins and cryptocurrencies across five separate transactions.

Stablecoin losses totaled $50 million, including $30 million in Tether [USDT], $10 million in USD Coin [USDC], and $10 million in DAI.

About $10 million in Wrapped Bitcoin [wBTC] was lost while 9,500 Ethereum [ETH], equating to $21.5 million at the prevailing market price, was drained out of the cross-chain bridge.

The list of addresses where the funds were seen moving to were flagged. Users were asked to proceed with caution.

Within five hours of the detection, Orbit Chain admitted to “an unidentified access” to the cross-chain bridge on social platform X (formerly Twitter).

The team assured the protocol users that they were actively seeking assistance from law enforcement agencies and that an investigation was underway to determine the root cause.

Orbit Chain also announced a compensation distribution for users. Users were asked to complete a verification process and claim refunds based on their eligibility.

For the curious, Orbit chain is a multi-asset blockchain facilitating cross-chain transfer through its decentralized Inter-Blockchain Communication (IBC).

The ordeal continues

The unfortunate event added a few more millions to the total money lost to blockchain hackers in 2023. As per popular Web3 security firm SlowMist, a total of 462 hacks resulted in outflows of more than $2.4 billion throughout the year.

While this was a significant figure when seen in isolation, a comparative study from previous years signaled optimism. More than $9 billion was lost in 2021 while losses in 2022 reached $4.3 billion.

Typically, an increase in hacks seemed to have coincided with periods of interest in the crypto industry. On the contrary, bear markets leave comparatively much less for criminals to target and earn.