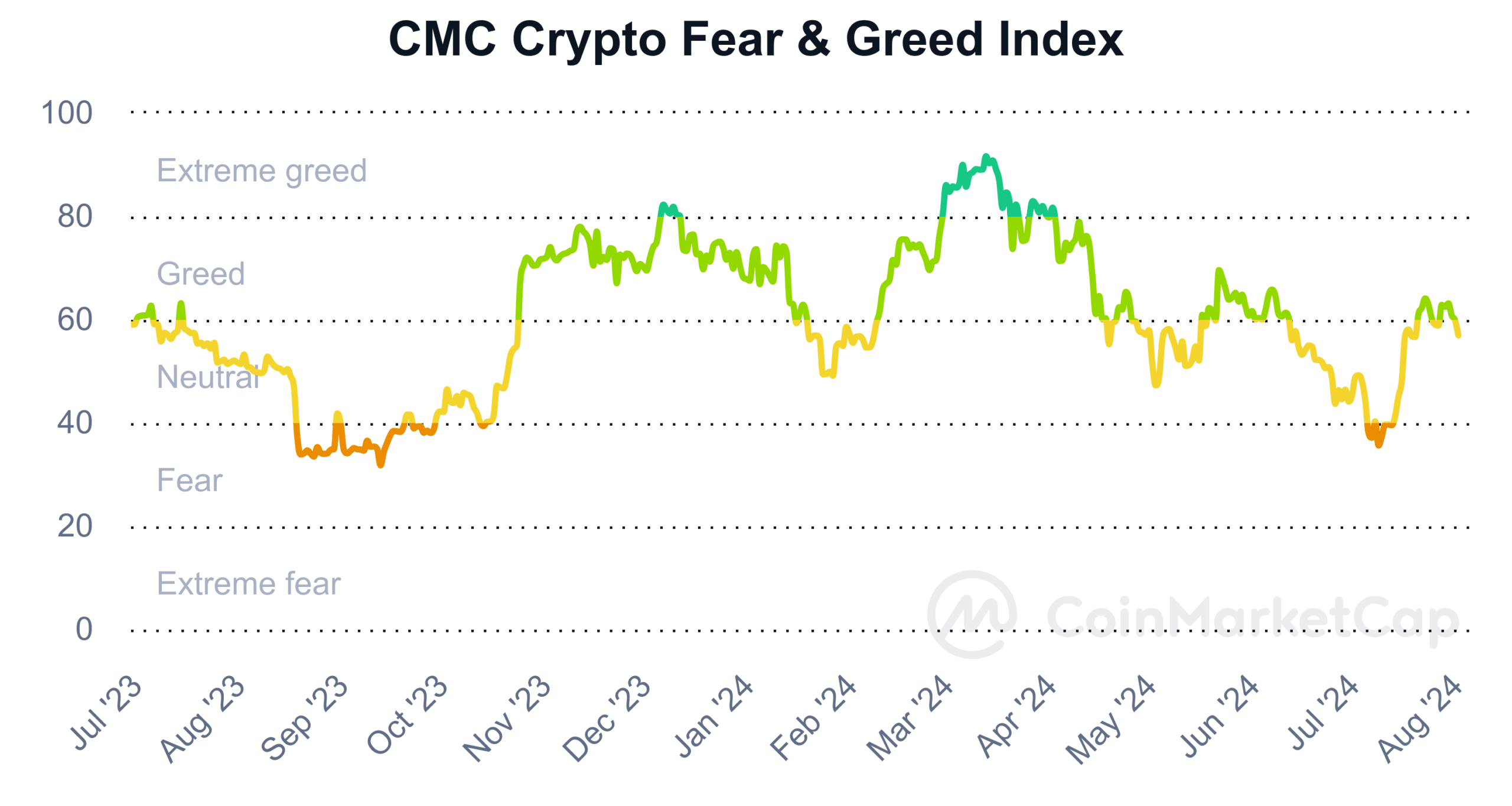

Crypto Fear and Greed Index hints at where Bitcoin’s new price bottom lies

- Greedy sentiment from last week quickly soured after Bitcoin’s swift price drop.

- The bearish weekly structure showed further lows can’t be ruled out.

Bitcoin [BTC] has fallen by 9.74% from Monday’s swing high at press time. The Crypto Fear and Greed Index, according to CoinMarketCap, was at 56, a neutral reading.

This Index gives an idea about the sentiment in the crypto market.

Source: CoinMarketCap

Extreme fear can be a signal to buy, and extreme greed can be a sell signal. Some sites use factors such as market volatility, momentum, social media, and Bitcoin Dominance to calculate the index values.

The rejection from $70k follows a bearish structure

On the 1-week chart, a trading session close below $56.5k flipped the market structure bearishly. The rally later in July to $69.5k was unable to climb past the lower high at $72k.

Such a move was required to achieve a bullish market structure break.

Instead, on Monday the 29th of July, the price of Bitcoin swelled to $70.1k before a brutal downturn. Data from Coinglass showed that $343 million worth of liquidations came in just the past 24 hours.

The Fibonacci retracement levels at $56.1k and $52k might be an attractive buying opportunity in the coming weeks. However, as things stand, $52k might be too far south to be tested.

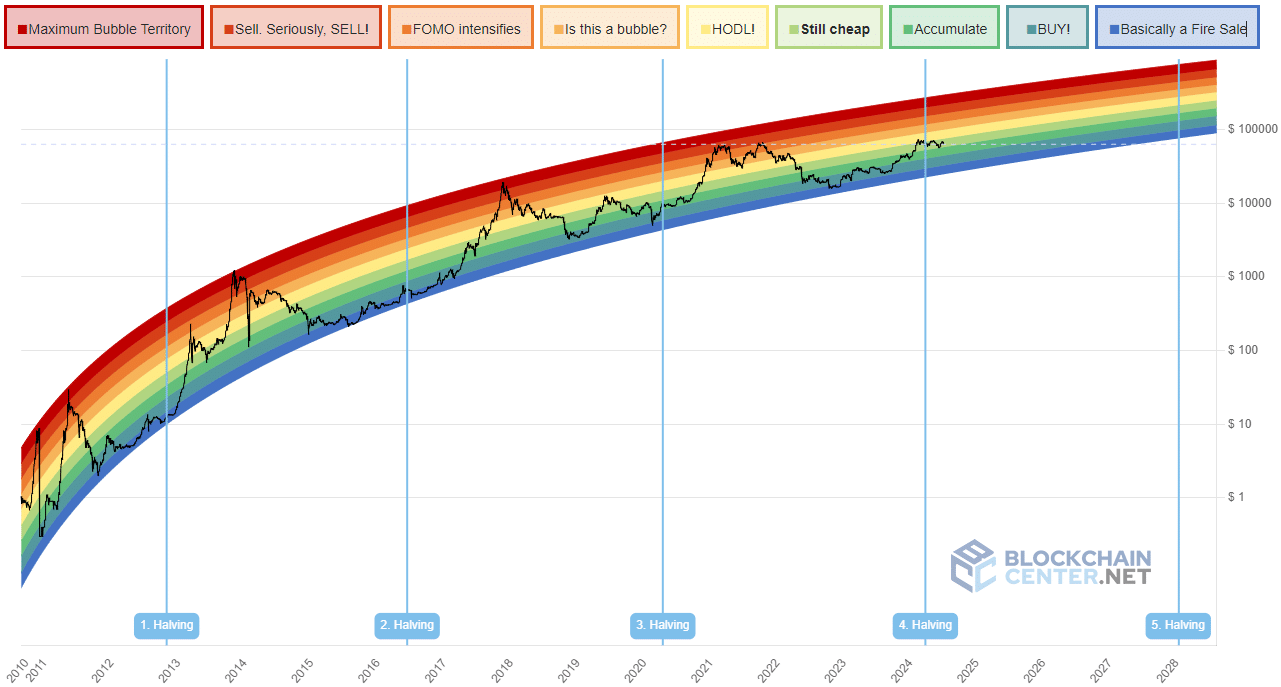

The long-term investor has little to fear from volatility

Source: Blockchain Center

People with a greater investment time horizon would welcome such price drops. Panic creates price bottoms, and a plunge below $60k could be ideal. The Bitcoin Rainbow chart noted that it was within the “still cheap” zone.

Is your portfolio green? Check out the BTC Profit Calculator

The Crypto Fear and Greed Index was not yet at the extremes below 30 or above 70, meaning that a trend reversal might not be imminent.

The neutral value at press time suggested that more pain might be necessary before a genuine run higher could begin.