Crypto fear and greed index shifts bullish: What’s driving this change?

- The fear and greed index shifted from fear to neutral as the market shows resilience.

- Institutional adoption surges as US states push crypto reserve bills, boosting long-term confidence.

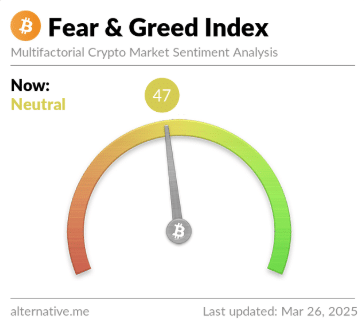

The fear and greed index has shifted to the “neutral” zone with a value of 47 after lingering in “fear” for the past seven days.

This change signals a growing sense of confidence among investors. When the index remains in fear, traders hesitate to enter positions, causing slow market movements.

As it moves towards “greed,” buying pressure could intensify, often leading to price surges. Therefore, this shift could be the first step toward a bullish breakout if momentum continues to build.

Total market cap chart reveals a breakout setup

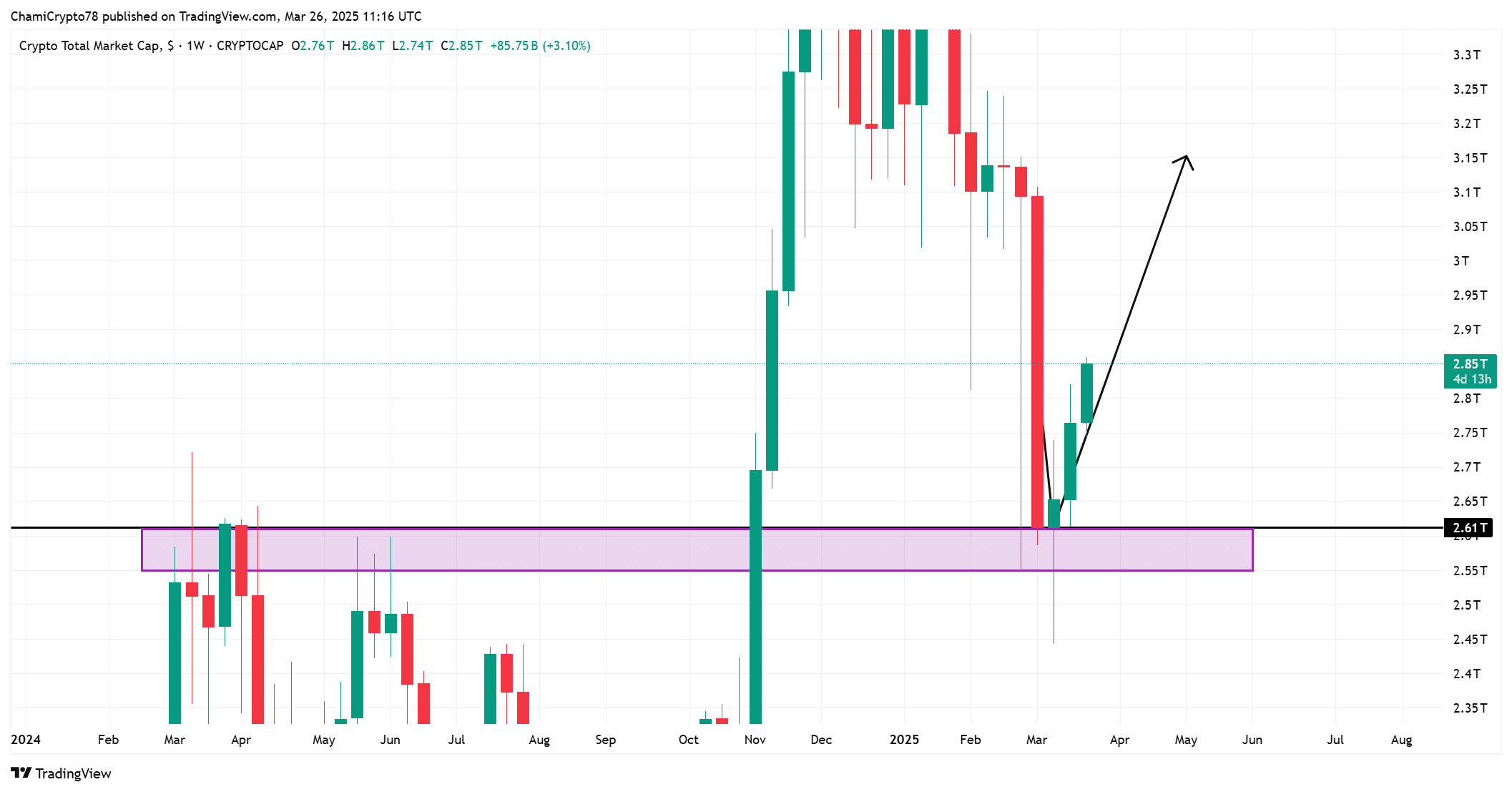

The total crypto market cap chart confirms this growing optimism, showing a perfect retest at the $2.61T level.

Previously, this zone acted as a major resistance but has now flipped into support, leading to a strong rebound. This kind of retest often serves as a launchpad for upward movements.

Additionally, the weekly chart reveals a steady recovery after the market briefly dipped below this level. If this structure holds, a return to the $3T mark and beyond seems increasingly likely in the coming weeks.

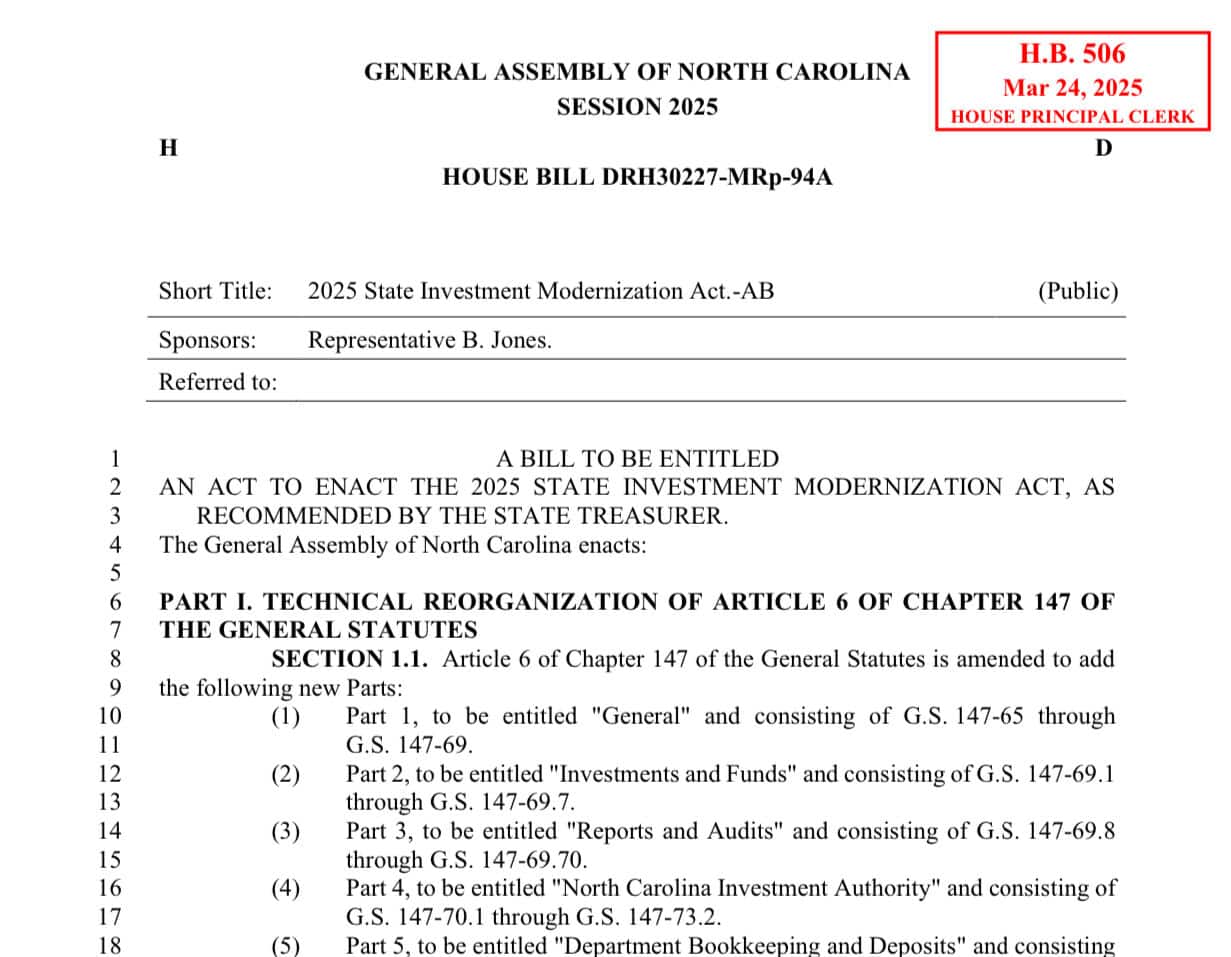

North Carolina’s pension plan bill

North Carolina’s introduction of bills to allow crypto in pension plans could be a major turning point for the market.

Institutional money has always been a key driver of long-term growth, and pension funds represent a massive pool of capital. This move could increase demand, significantly boosting liquidity in the crypto space.

Moreover, such legislation adds a layer of legitimacy, making crypto a more acceptable investment for traditional institutions.

If more states follow suit, this could lead to a nationwide shift in how retirement funds allocate capital, further strengthening crypto’s position.

What else could spark a supply shock?

The bullish momentum does not stop with North Carolina. Over 25 U.S. states have introduced Bitcoin reserve bills, with most proposing to invest 10% of state funds in crypto.

This development is a massive confidence boost for the market. Governments holding Bitcoin would significantly reduce supply, leading to a long-term price increase.

Additionally, such adoption signals that state institutions view Bitcoin as a reliable store of value, reinforcing investor trust.

If these bills get approved, they could trigger a domino effect, encouraging more states and even countries to follow suit.

Conclusively, the market is showing strong bullish signs. The shift in the fear and greed index, a perfect technical retest, and massive institutional interest all point to a potential rally.

If these trends continue, the total market cap could soon reclaim $3T, marking the beginning of another explosive phase for crypto.