Crypto – gold on edge: Will Trump’s tariffs trigger a Bitcoin sell-off?

- Bitcoin’s market value has crossed $2 trillion, raising the stakes of Trump’s tariff plan even higher.

- With gold and the dollar surging, is the crypto market about to face its biggest sell-off yet?

Trump’s sweeping tariff plan has investors on edge. What began as a 10% import tax on Canada, Mexico, and China is now just the start of a much bigger strategy.

With Q1 unfolding, is the crypto market well-positioned to absorb the pressure, or is a major sell-off looming?

What’s at stake?

With the total crypto market valued at over $3 trillion and Bitcoin [BTC] holding 60% of the market share, the stakes are sky-high.

Even a small shake in BTC’s price could leave even the most established coins in the red. In such a climate, a long-term strategy might be the safest bet.

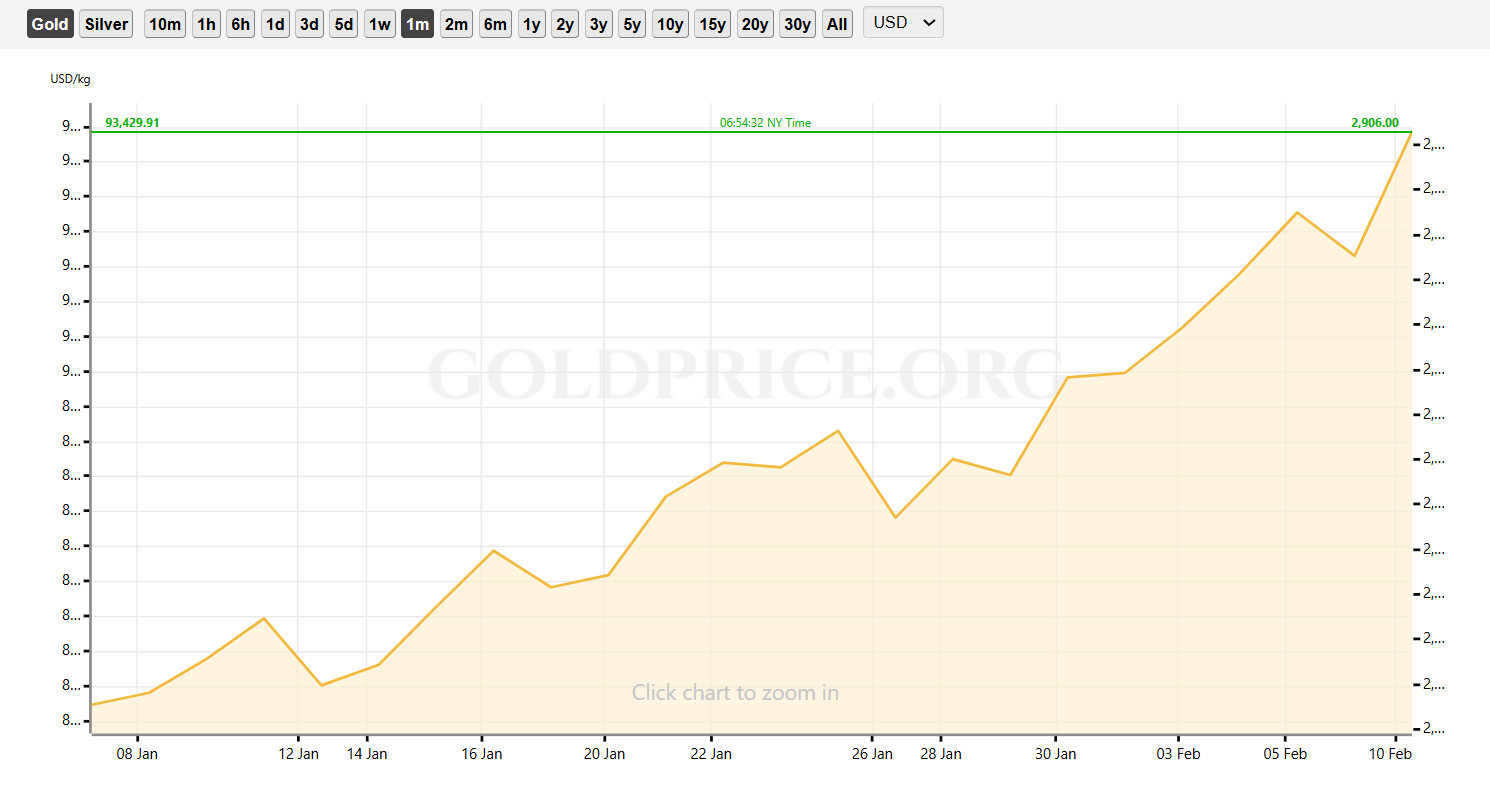

But right now, many investors are chasing quick gains, and gold seems to be the go-to safe haven. Its 30-day valuation has surged by a massive 247.18%, with 4% of that jump coming just in February.

As capital flows into traditional assets, Bitcoin has felt the pressure, posting a 4% decline in the same timeframe. While its recovery has been swift, its status as a “risk asset” is clearly back in the spotlight.

What does this mean for crypto? With Trump’s tariffs on key suppliers signaling a deeper shift, investors might pivot to short-term gains, putting long-term HODLing at risk.

Assessing Bitcoin’s long-term outlook

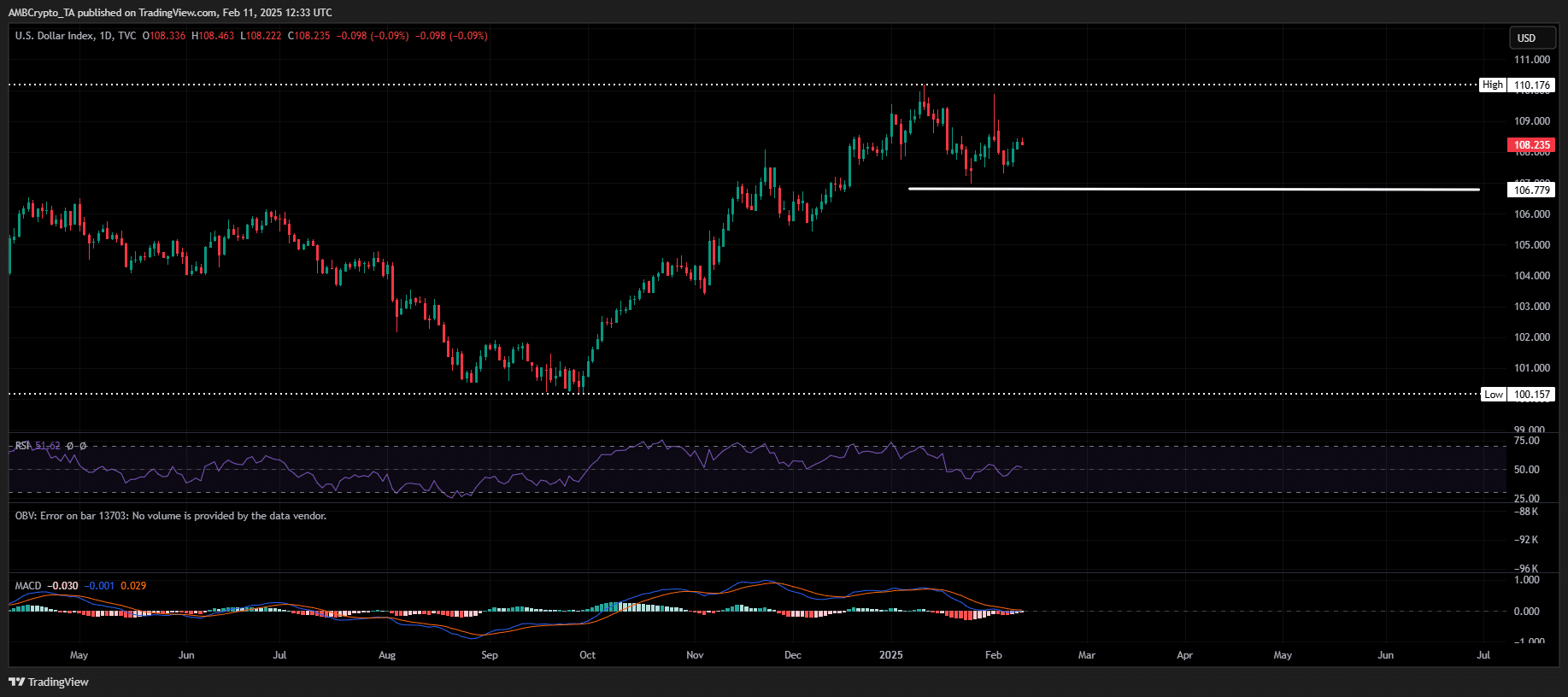

With crypto increasingly tied to macro trends, keeping an eye on key metrics is crucial. The U.S. dollar index (DXY) just reclaimed 108 after Trump’s 25% tariff on key metals – putting Bitcoin in a vulnerable spot.

Historically, DXY and BTC move inversely. With DXY still climbing and just 1% off its yearly peak, Bitcoin could face renewed pressure.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

Flashback to mid-December – when DXY last hit 108, BTC plunged 15% in two weeks to $89K.

As Bitcoin fights to reclaim $100K, is the market shifting from long-term conviction to short-term profit chasing? The signs are hard to ignore.