Crypto investments see inflows amidst Fed rate cut hype – What about BTC?

- Bitcoin ETFs saw significant inflows as the market reacted to potential Fed rate cuts.

- BlackRock increased Bitcoin holdings, reflecting growing institutional interest amid shifting economic conditions.

Recent trends revealed a notable uptick in Bitcoin [BTC] Exchange-Traded Funds (ETFs), Inflows reached $202.6 million as of the 26th of August, according to Farside Investors.

Despite this positive momentum in the ETF market, BTC itself was struggling to surpass the $65,000 threshold, trading at $62,898 after a 1.11% decline in the past 24 hours, as reported by CoinMarketCap.

What’s at play?

This discrepancy highlights a broader confusion among investors regarding the interplay between central bank interest-rate policies and their impact on the valuation of risk assets such as cryptocurrencies and stocks.

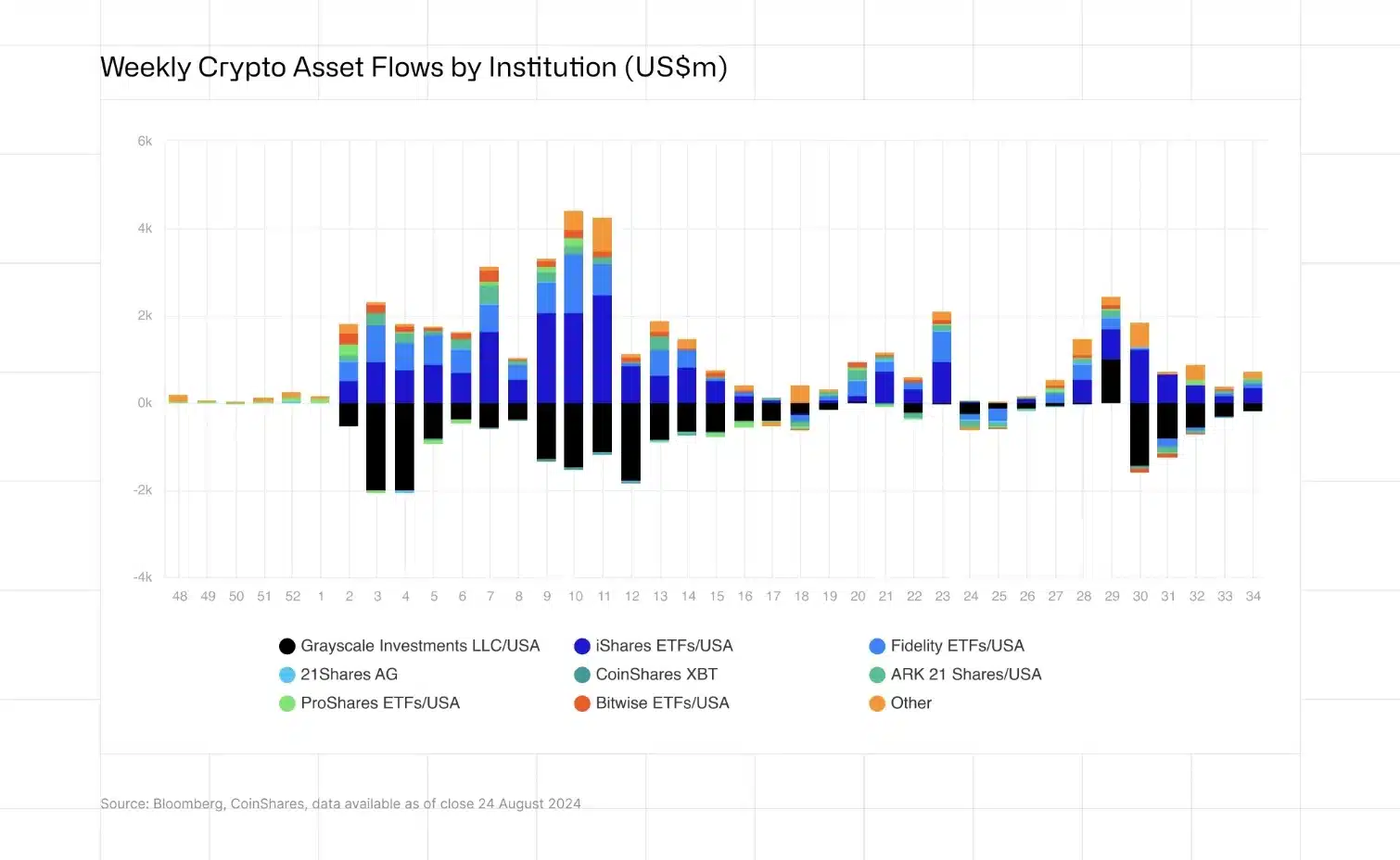

Highlighting the interplay in the crypto market, a recent report published on 26th August by CoinShares titled — Digital Asset Fund Flows suggested,

“Last week, digital asset investment products saw inflows totalling US$533m, marking the largest inflows in five weeks.”

For context, this recent surge in Bitcoin ETFs came in the wake of Jerome Powell’s comments at the Jackson Hole Symposium, where he hinted at the possibility of an initial interest rate cut in September.

This prospect has sparked a renewed interest in risk assets. Despite a slight dip in trading volumes compared to recent weeks, activity remained robust, with weekly trading reaching $9 billion.

Impact of Fed rate cut on digital assets

The report further stressed on the performance of Bitcoin and noted,

“Bitcoin was the primary focus, seeing US$543m of inflows, interestingly, the majority of those inflows were on Friday [23rd August], following the dovish comments from Jerome Powell, indicating Bitcoins sensitivity to interest rate expectations.”

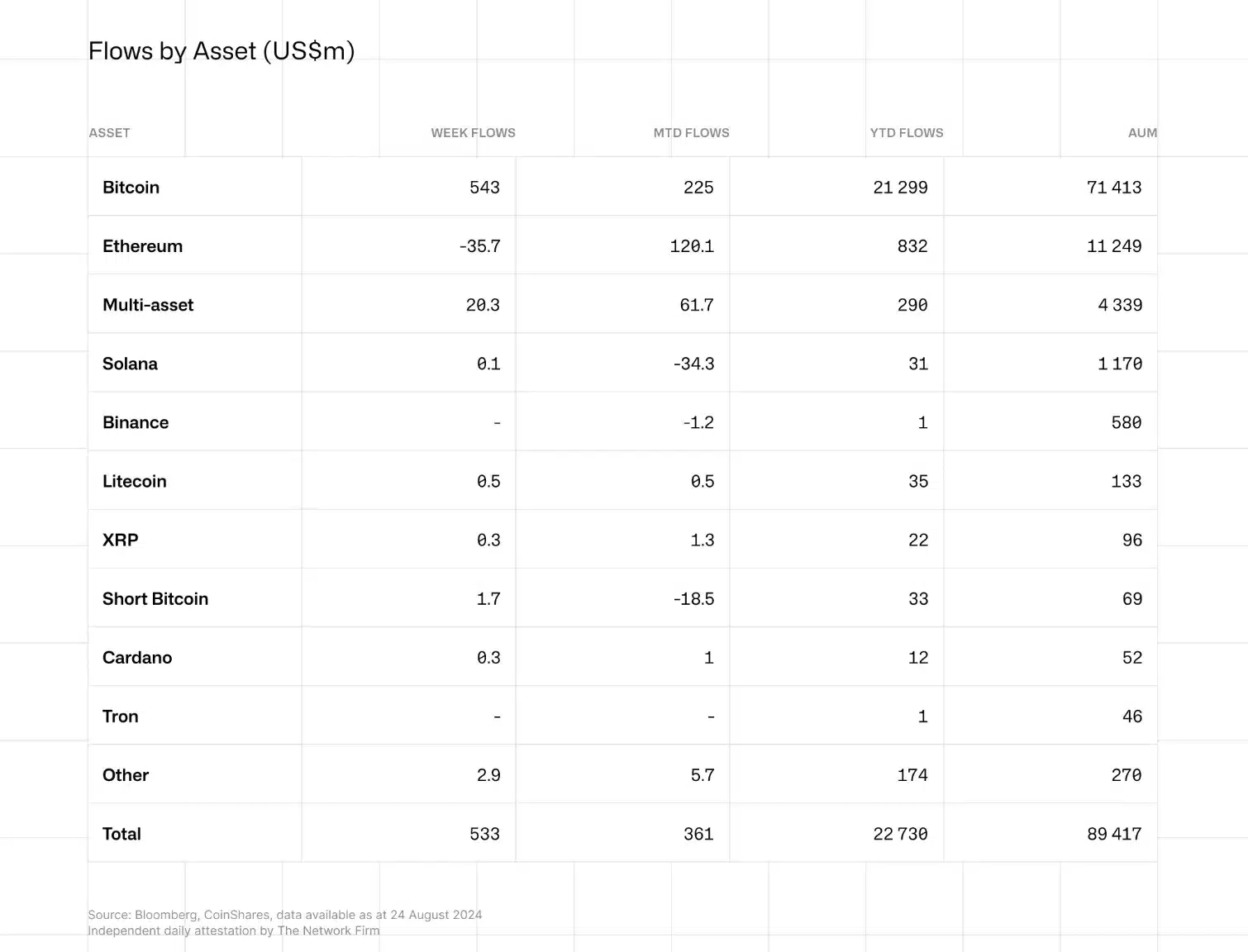

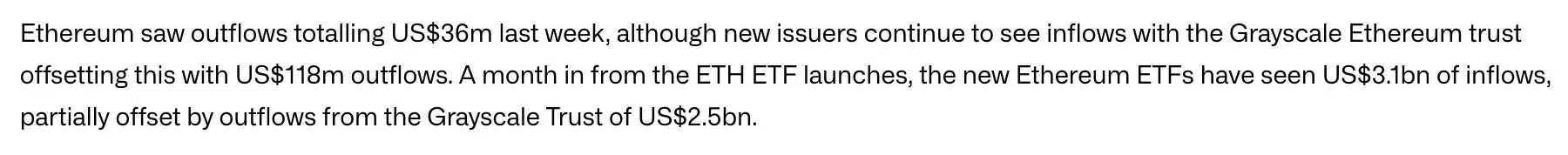

Needless to say, the report also highlighted Ethereum [ETH] ETFs, noting significant withdrawals from the Grayscale Ethereum Trust.

This saw $118 million in redemptions and contributed to a total of $2.5 billion in outflows over the past month.

What’s more to it?

Also, Wall Street anticipates a significant reduction in Federal Reserve interest rates from 5.33% to 3.33% over the next 18 months.

This anticipated easing will lower borrowing costs for households, businesses, and asset managers, leading to increased liquidity and investment opportunities.

As a result, digital assets are expected to see a rise in value, driven by the broader availability of capital.

Seeing this coming, many institutions have started increasing and are gearing up.

First, BlackRock recently disclosed an updated portfolio for its Strategic Global Bond Fund, revealing an increase in its holdings of iShares Bitcoin Trust shares.

As of the 30th of June, the fund held 16,000 shares, up from 12,000 shares reported in May, indicating growing investment in Bitcoin.

Thus, it remains to be seen how the Fed’s rate cuts will unfold and significantly impact asset prices.