Crypto lender Celsius sues liquid staking platform StakeHound to…

- Celsius has instituted an action against StakeHound to recover its staked tokens.

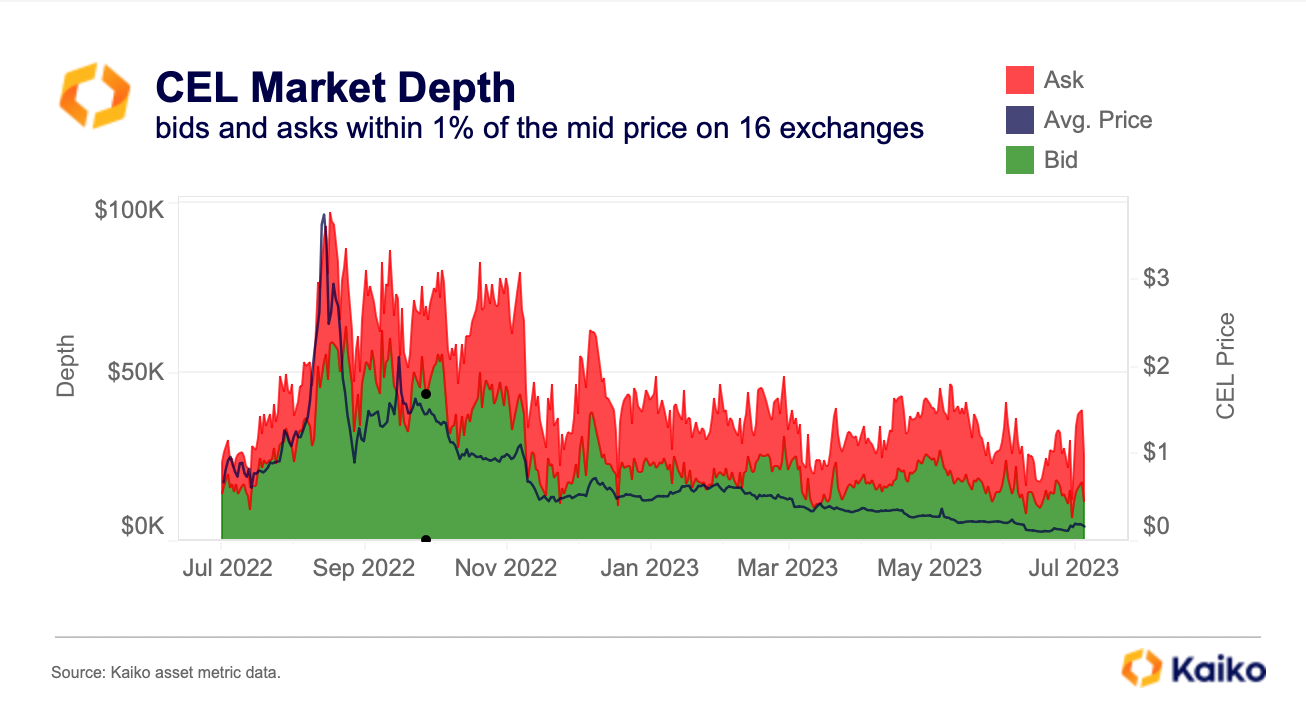

- Its native token, CEL, now has zero market liquidity.

In a court filing dated 11 July, bankrupt crypto lender Celsius Network [CEL] instituted a lawsuit against liquid staking platform StakeHound. The lawsuit claimed that StakeHound failed to return tokens valued at $150 million that rightfully belong to Celsius Network.

Read Celsius Network’s [CEL] Price Prediction 2023-2024

Celsius alleged that at different times between January 2021 and April 2021, it “entrusted to StakeHound” 25,000 staked native ETH (worth over $50 million), 35,000 native ETH (worth over $70 million), 40 million native MATIC tokens (worth over $30 million) and 66,000 native DOT tokens (worth over $300,000), for which it received “stTokens.”

According to Celsius, these stTokens were “supposed to be able to deploy in other investments, and present to StakeHound when the customer demands return of its Native Tokens (plus Rewards).”

Per the filing, when the network made demands for its staked tokens, StakeHound instituted an arbitration proceeding in Switzerland. The company claimed that it “has no obligation to exchange native ETH for the stTokens that it previously issued to Celsius.”

Celsius alleged further that StakeHound’s arbitration proceeding violated Section 362 of the United States Bankruptcy Code. It prohibits creditors from taking legal action against or collecting debt from a company that filed for bankruptcy.

Poor liquidity conditions might put the market in jeopardy

Last month, Celsius received approval from a U.S. Bankruptcy Court to initiate the sale or conversion of its crypto holdings. An assessment of the company’s portfolio on Nansen revealed that it began moving its pre-owned altcoins into new wallets on 5 July.

Is your portfolio green? Check the Celsius Network Profit Calculator

In a new report, research firm Kaiko noted that Celsius altcoin liquidations could put pressure on crypto markets in the short term. Its altcoin holdings which consist of assets such as Bitcoin Cash (BCH), Litecoin (LTC), Stellar (XLM), Solana (SOL), etc., have all seen their values decline significantly in the last year.

According to Kaiko:

“While there are no details about buying and selling rates or the execution venues, the market impact could be significant, especially considering liquidity for these tokens has dropped over the past year. The aggregated market depth for Celsius’ altcoin holdings has declined by 40% since 2022, totalling around $90mn in early July.”

Regarding the troubled lender’s CEL tokens, Kaiko stated:

“There is virtually no liquidity for CEL as measured by market depth, which has collapsed to just $30k, concentrated mostly on OKX and Bybit.”