Crypto market crash: Analysts predict a bull run similar to post-Covid

- The recent crypto crash will likely have the same effect as that of Covid-19 crash.

- Will the FED reduce rates as many analysts have anticipated?

Kyle Chasse, a popular market analyst on X, has advised investors not to panic over the latest crypto market crash.

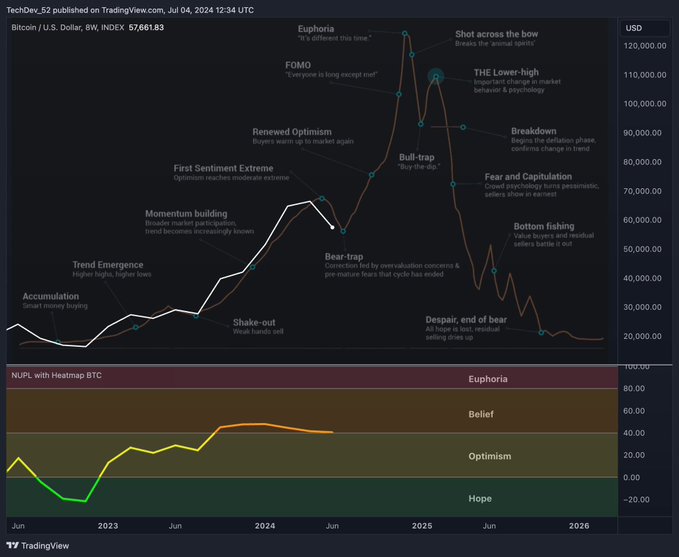

He pointed out that the NUPL indicator, which tracks Bitcoin [BTC] sentiment, still shows the market is in the belief stage, indicating we haven’t reached the exit point.

Chasse emphasized that investors shouldn’t be deterred from potential long-term gains since the market is only experiencing a bear trap and that today’s crash may have set the stage for the next upward movement.

Will the latest crypto crash have the same effect as that of Covid 19?

The recent crash marks one of the worst market days, with over $1 billion liquidated from cryptocurrencies in the past 24 hours.

The crash resembled the 2019/20 that happened during the COVID-19 cycle resulting into a bull run in 2021. The patterns are similar, indicating a potential opportunity for investors.

Another factor that suggests now is the right time to buy bitcoin and other cryptocurrencies.

Big players capitalize on Fear and Greed Index

Fears of a potential world conflict have caused instability in financial markets, but some in the crypto industry believe the crash is more due to recession worries.

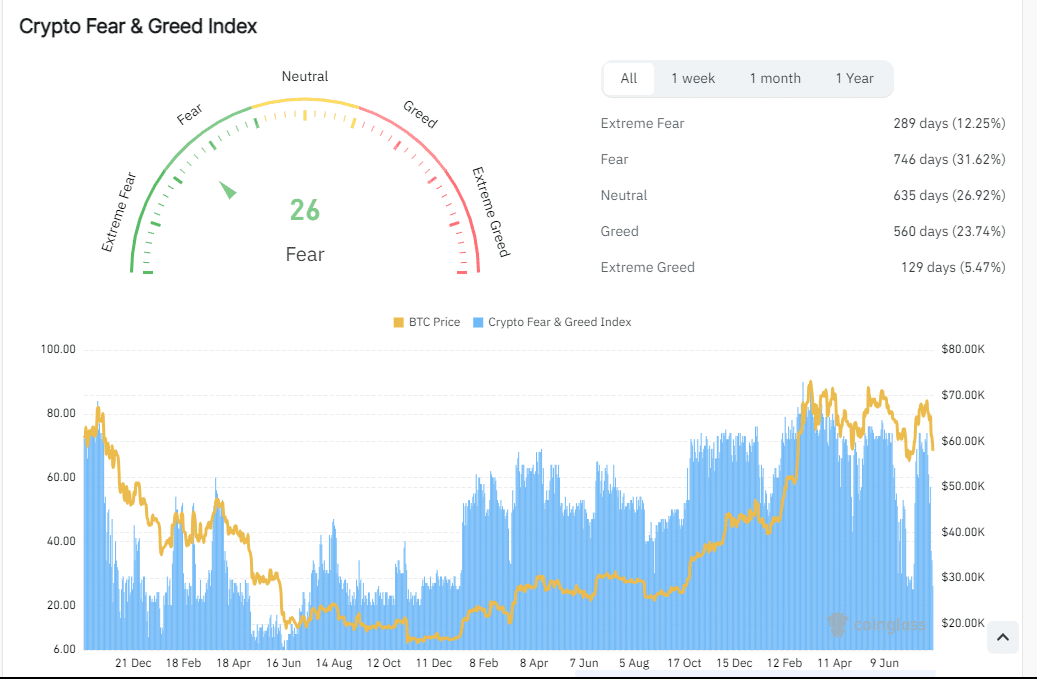

The Fear & Greed index was at 26 at the time of writing, indicating that big institutions are likely to buy now, taking advantage of low prices and selling when market peaks.

This situation further states that this could be your last chance to invest in your crypto portfolio before prices go up.

Impact of FED cutting interest rates

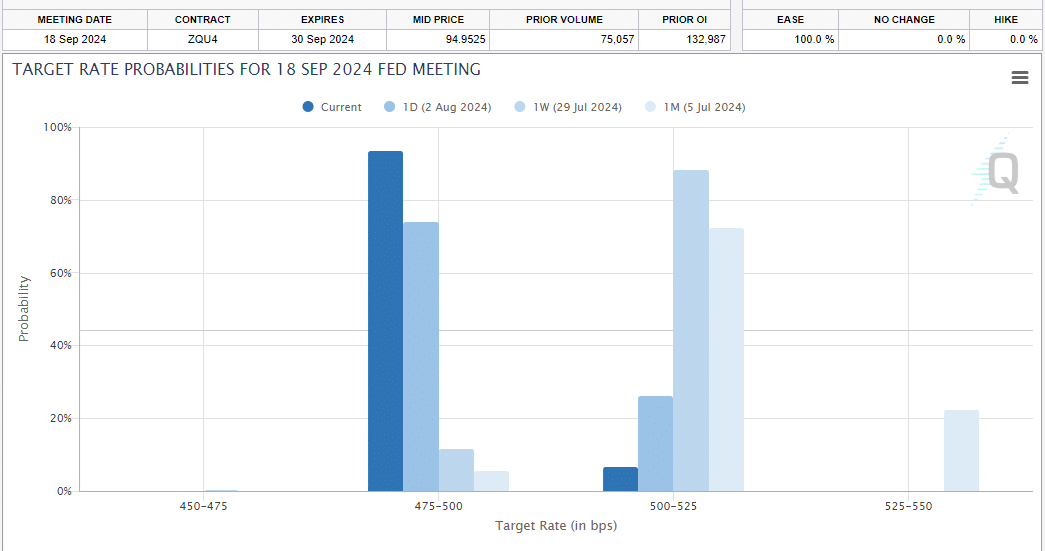

Lastly, the Federal Reserve is expected to cut interest rates in September, with a 93.5% chance according to Fedwatch.

This prediction follows a significant drop in Japan’s stock market. If the Fed does cut rates, it could stabilize financial markets and benefit assets like cryptocurrencies.

With markets potentially at their lowest point in this cycle, investing now might offer substantial long-term gains, as current conditions could represent the lowest levels before a possible recovery

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)