Crypto market inflow sinks to 2-year low as fear grips investors: What now?

- Inflows in the crypto market slump to $1.8B, the lowest since 2023, signaling lack of fresh capital.

- Fear & Greed Index remains in “Fear” territory, reflecting ongoing investor hesitancy despite price stability.

Capital rotation in the cryptocurrency market appears to be fading fast, with total inflows plunging to their lowest in two years.

The sharp decline in realized value net position change raises red flags for market momentum, with many investors opting to stay on the sidelines amid heightened uncertainty.

Crypto market realized inflows slump

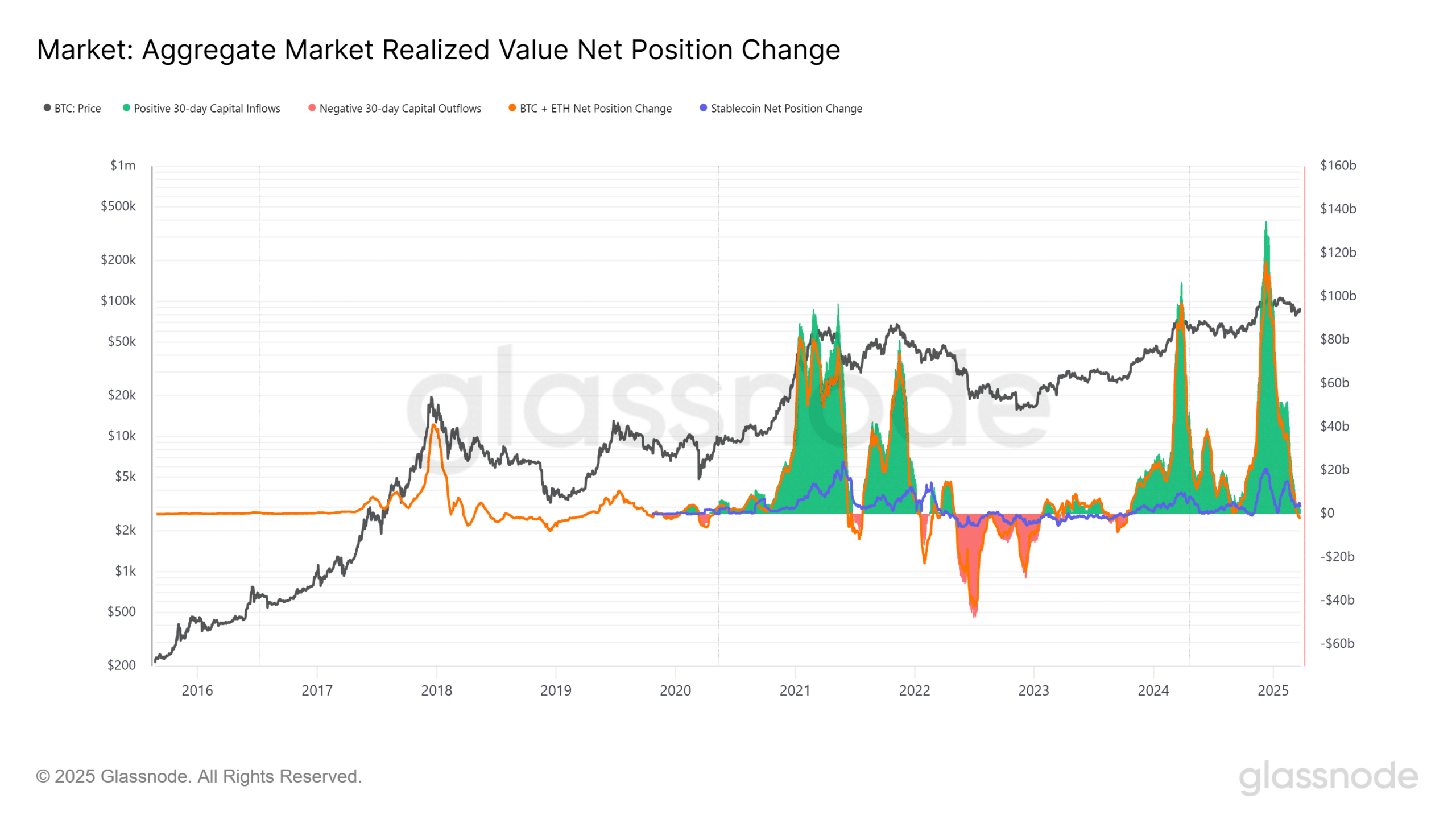

The Aggregate Market Realized Value Net Position Change chart highlighted a dramatic slowdown in capital inflows into BTC and ETH. The combined net inflows are hovering around $1.8 billion, a level not seen since 2023.

Historically, such low inflow periods in the crypto market have coincided with prolonged consolidation or even bearish trends.

While Bitcoin’s price remains relatively stable, this muted inflow shows a lack of conviction from new capital.

Capital outflows also remain subdued, suggesting that current holders are not rushing to exit but are equally cautious about adding exposure.

Fear dominates crypto market sentiment despite recovery from lows

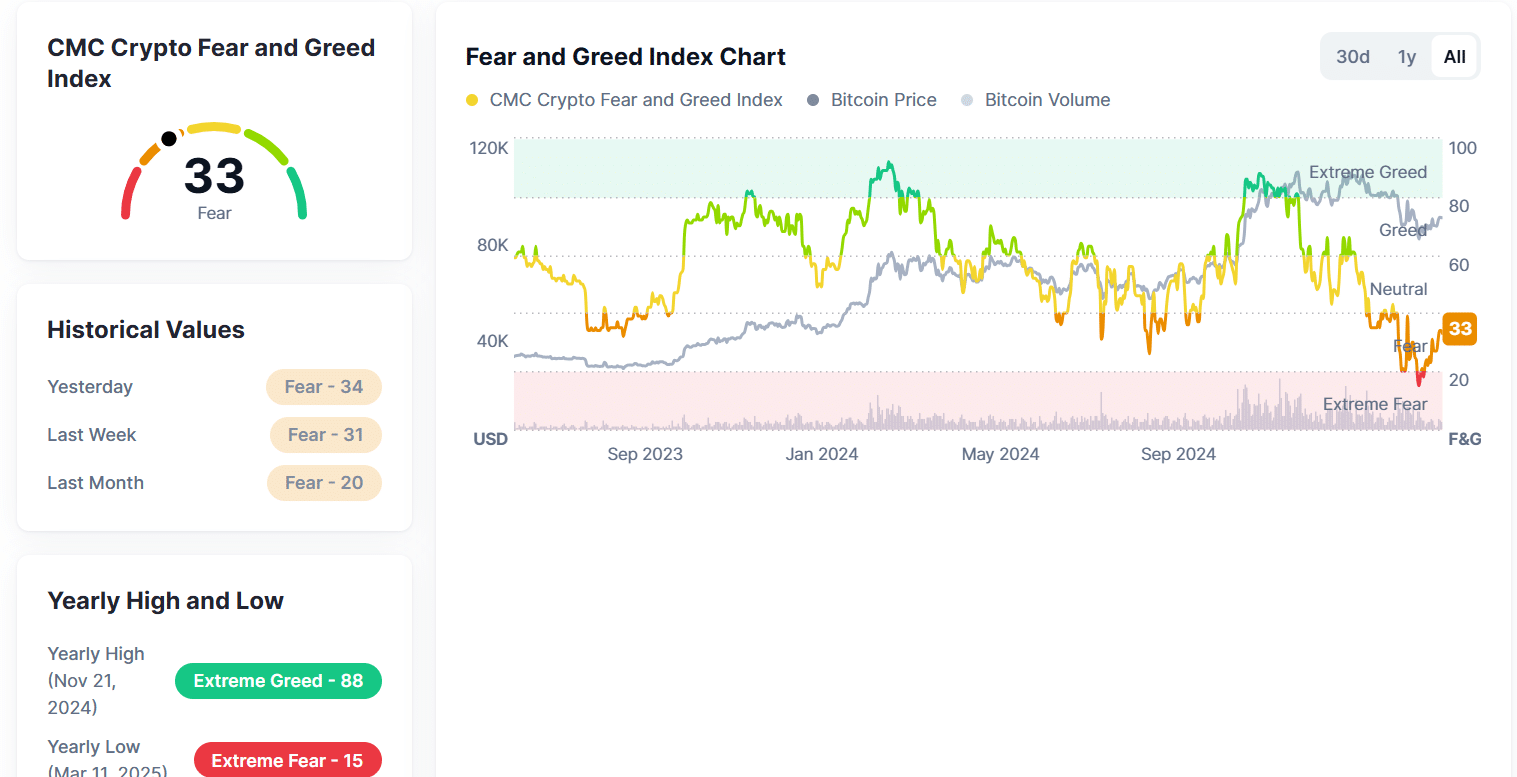

Data from the CoinMarketCap Crypto Fear and Greed Index shows the crypto market sentiment index at 33, firmly in the “Fear” zone.

This reflects a moderate improvement from last week’s value of 23, but it remains far from neutral, let alone greedy territory.

The index hit a cycle low of 15 on the 11th of March, highlighting the intensity of panic just two weeks ago.

The broader mood remains fragile despite the bounce in prices and sentiment since that trough.

The disconnect between price performance and on-chain inflows suggests that the recent recovery may be driven by rotation within existing capital rather than new money entering the market.

Low inflows could cap upside potential

If capital inflows remain this tepid, the potential for an aggressive upside could remain limited.

A meaningful rally requires stronger stablecoin inflows, rising derivatives Open Interest, and a shift in investor sentiment toward greed or neutrality.

The crypto market appears to be caught between holding its ground and lacking the fuel to charge higher.

Unless macroeconomic catalysts or institutional flows change the dynamic, the sideways action may continue through the short term.

Traders should watch for signs of renewed risk appetite, such as increased exchange volumes, stablecoin minting, and improvements in investor confidence metrics.