Crypto market’s weekly winners and losers – WIF, WLD, UNI, TRX

- Dogwifhat, Worldcoin, and Arweave were the biggest winners of the past week.

- Uniswap, Tron, and Aave had the biggest losses in the past week.

According to recent data, Dogwifhat emerged as the cryptocurrency with the best price trend over the past week. On the other hand, despite efforts, Uniswap experienced significant challenges and ended up as the biggest loser in the same period.

Biggest winners

Dogwifhat (WIF)

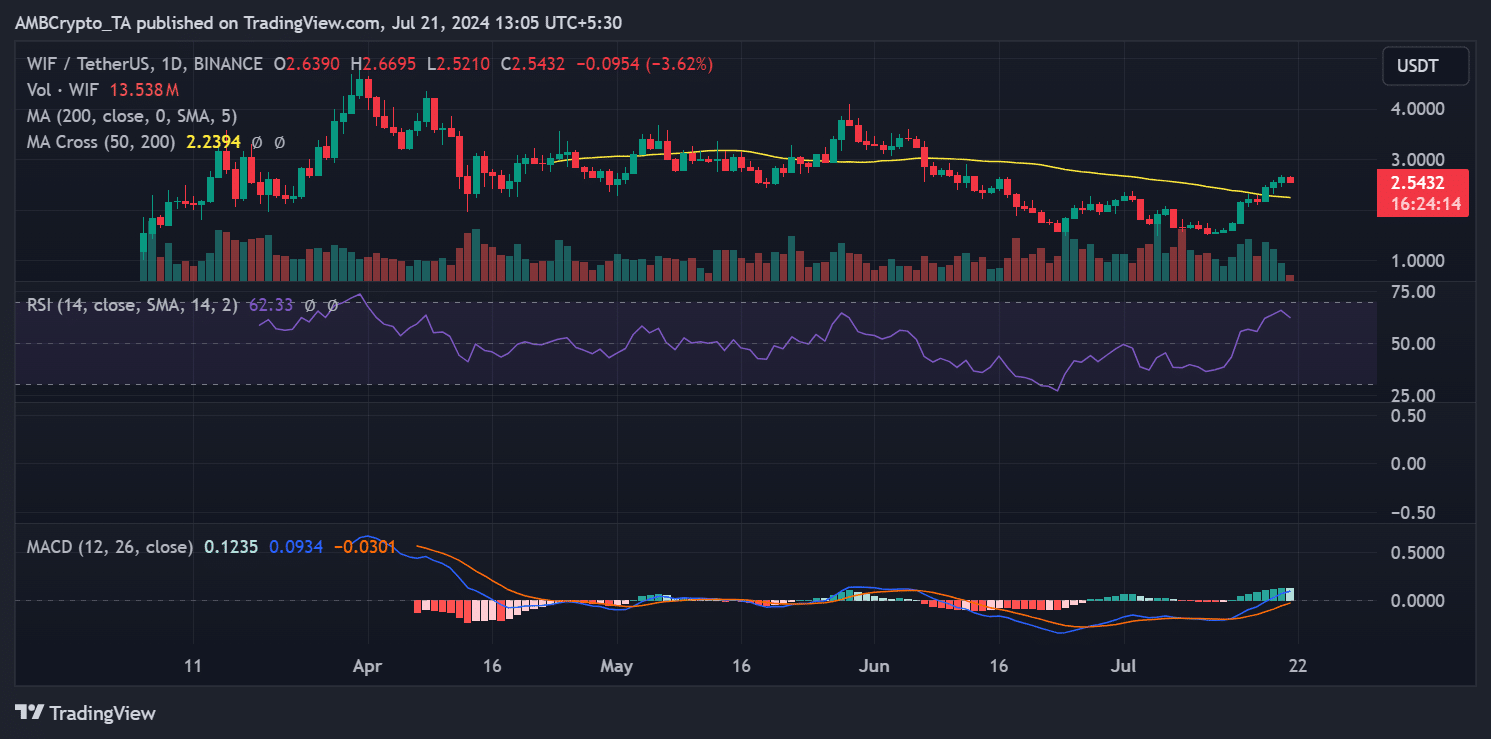

Over the past week, Dogwifhat (WIF) experienced a notably positive trend, as detailed in an analysis from AMBCrypto.

WIF began the week with a significant 8% increase, moving its price from approximately $1.6 to just over $1.7. Momentum continued the next day with an even more substantial rise of 24.62%, pushing the price from the $1.7 range to around $2.1.

Despite this strong upward trend, WIF saw a minor setback on 17th July, with a 1.5% decline.

Nevertheless, it quickly recovered, surging by over 12% shortly after that, which elevated its price to approximately $2.4. By the end of the week, it was trading at around $2.6, marking a closing weekly increase of over 3%.

According to data from CoinMarketCap, Dogwifhat registered the largest gain for the week, topping the chart with an impressive 51.72% increase.

However, as of the most recent observations, it was experiencing a slight downturn, trading with over a 3% decline at around $2.5.

The market cap of WIF stood at about $2.5 billion, while trading volume was noted at $334 million, experiencing a decrease of over 28% in the last 24 hours.

Worldcoin (WLD)

Worldcoin recently reemerged as one of the top gainers, securing the second-highest gain with an impressive 40.60% increase, as reported by CoinMarketCap.

Over the past week, WLD began trading at around $1.8 and experienced consistent growth. Its price even surpassed the $3 mark during the week before eventually settling down. By the week’s end, it was trading at nearly $2.6.

As the new week commences, Worldcoin has slightly retraced to approximately $2.5, marking a modest step back from its closing position the previous week.

Its market capitalization was around $709 million, but it had experienced a significant reduction, declining by over 8% in the last 24 hours.

Additionally, trading volume has also seen a substantial decrease, falling by over 30% to nearly $235 million.

Arweave (AR)

Arweave (AR) exhibited strong performance over the past week, starting at approximately $24 and quickly rising to over $30 by midweek. This positive momentum continued, and by the week’s end, AR was trading at around $33.5.

According to data from CoinMarketCap, this surge resulted in AR being ranked as the third-biggest gainer for the week, with an impressive increase of 39.22%.

As of the latest update, Arweave’s trading price has edged up further to approximately $34.3. Its market capitalization stands over $2.2 billion, showing a modest growth of less than 1%.

However, despite the increase in market cap and price, its trading volume has seen a significant reduction, declining by over 30% in the last 24 hours, totaling over $67 million.

Biggest losers

Uniswap (UNI)

Uniswap experienced a week of mixed performance on the daily timeframe chart. Initially, the week started positively, with its price increasing from approximately $8.1 to almost $8.6 during the first two days.

However, this upward trend was short-lived as Uniswap faced three consecutive days of declines, bringing its price down to around $7.8.

By the week’s end, Uniswap’s price managed to recover slightly to around $8, but this was not sufficient to offset earlier losses.

According to data from CoinMarketCap, this resulted in Uniswap being tagged as the biggest loser for the week with a 4.60% decline.

As of the latest data, Uniswap is trading at around $7.9, experiencing an additional decline of over 1%. Also, the Relative Strength Index (RSI) showed UNI below the neutral 50 line, suggesting that it is currently in a bearish trend.

Furthermore, its market capitalization has decreased by almost 1%, now standing at around $4.7 billion.

Trading volume has also seen a significant reduction, declining by over 20% in the last 24 hours to approximately $111 million.

Tron (TRX)

Tron (TRX) ended the week as the second-biggest loser, according to CoinMarketCap data, with a decrease of 2.97% over the past week.

The price analysis shows that TRX opened the week at approximately $0.138, but significant declines began around 15th July. Despite attempts at recovery towards the week’s end, TRX closed at around $0.134.

As of this writing, Tron’s market capitalization was about $11.6 billion, reflecting a modest decline of less than 1%.

Additionally, trading volume for TRX has seen a significant reduction, declining by over 23% in the last 24 hours to approximately $212 million.

Aave (AAVE)

Aave (AAVE) experienced a significant reversal in fortunes, shifting from one of the biggest winners in the week before last to one of the biggest losers last week. It registered a decline of 2.20%, ranking it as the third-biggest loser for the period.

Its price trend began positively at around $100 and even climbed to a peak of $104 during the week. However, it then faced a downturn, closing the week at approximately $98.

As of this writing, Aave’s price has continued to slide, now trading at around $97. This further decline has also been reflected in its market capitalization, which has decreased by over 1% and now stands at about $1.45 billion.

Additionally, its trading volume has dropped significantly, decreasing by over 18% in the last 24 hours to approximately $65.9 million.

Conclusion

Here’s the weekly recap of the biggest gainers and losers. It’s crucial to bear in mind the volatile nature of the market, where prices can shift rapidly.

Thus, doing your own research (DYOR) before making any investment decisions is best.