Crypto mining ‘strengthens America’s energy grids’ – A 30% tax means…

- Per Senator Lummis, a 30% tax on Bitcoin mining could push the industry outside the country.

- She cited the Laffer Curve to warn of reduced tax revenues from increased mining taxes.

On the 23rd of July, Senator Cynthia Lummis published a report challenging the Biden administration’s suggested 30% excise tax on the energy used by Bitcoin [BTC] miners.

Highlighting its potential negative impact, Lummis’s report titled “Powering Down Progress: Why A Bitcoin Mining Tax Hurts America,” noted,

“This move endangers America’s hard-won leadership position and the future of Bitcoin mining in America.”

Senator Lummis argued that the proposed 30% excise tax on BTC mining energy could disrupt America’s rapidly growing Bitcoin mining sector.

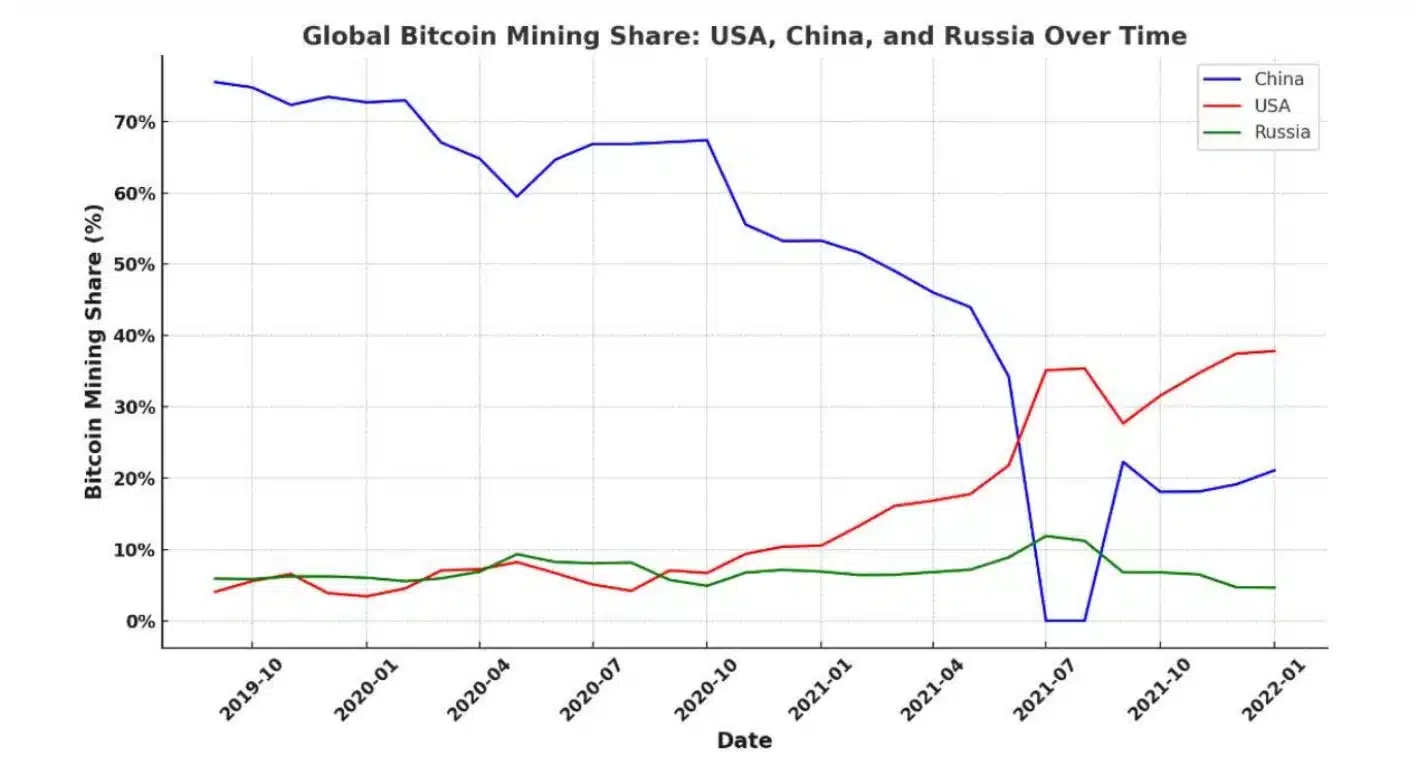

For context, following China’s 2021 ban on BTC mining, the U.S. capitalized on the opportunity. The States attracted significant investments and talent, leveraging its strong energy market and legal framework.

As a result, many major Bitcoin mining operations are now based in the U.S.

Crypto mining not a threat: Lummis

Lummis warned that this new tax could drive the industry overseas, suggesting that the Treasury’s rationale for the tax reflects outdated perspectives on energy consumption and technological progress.

“The U.S. is now estimated to account for more than 35% of the global BTC “hashrate,” a measure of the computing power dedicated to mining.”

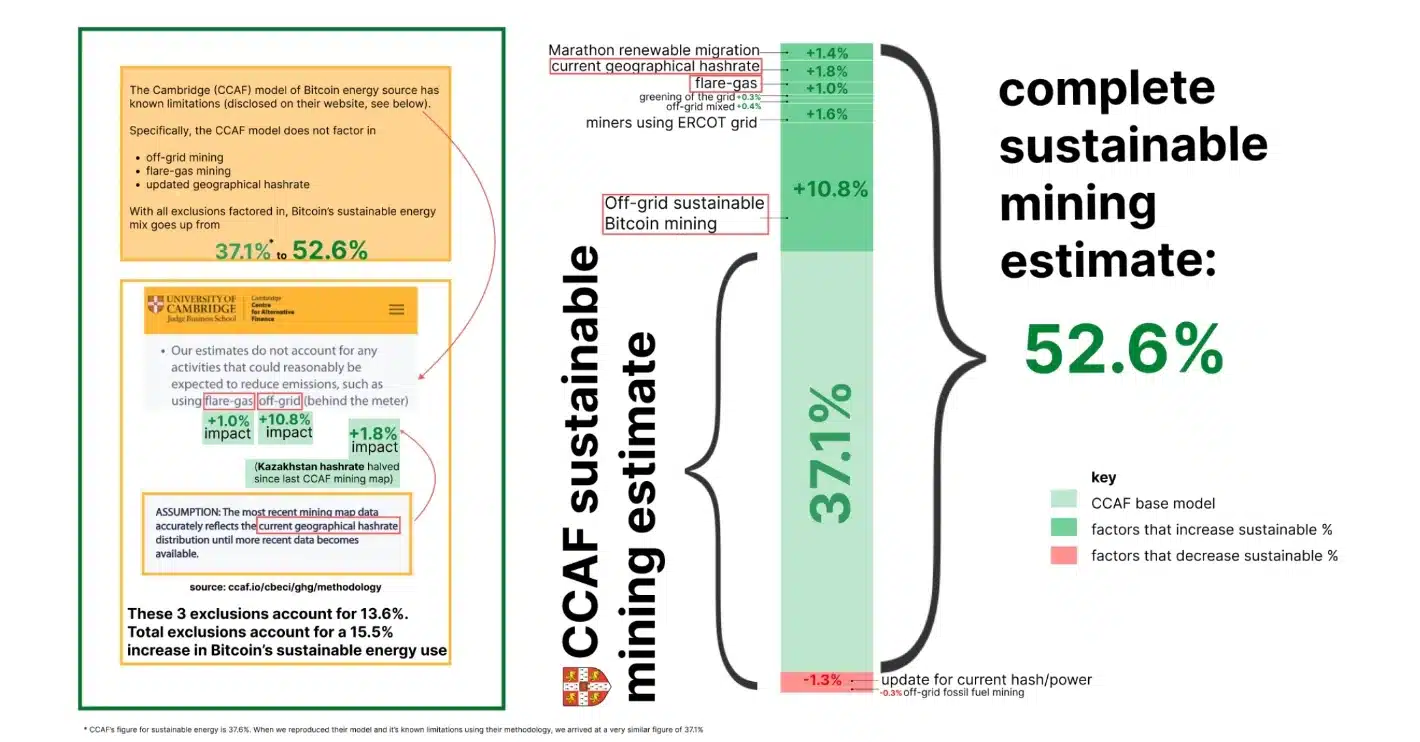

That being said, Lummis referenced the Bitcoin Energy and Emissions Sustainability Tracker to argue that BTC mining is more environmentally friendly than often perceived.

According to the tracker, as much as 52.6% of Bitcoin mining could be conducted with minimal or zero emissions.

She further added,

“The administration’s proposal claims that Bitcoin mining creates “risks” with local utilities on their grid operations. However, it provides no support for these claims. To the contrary, empirical evidence shows Bitcoin mining strengthens America’s energy grids.”

The Laffer Curve analysis

In her report’s conclusion, Lummis highlighted the principles of the Laffer Curve, which illustrated how higher tax rates could lead to lower overall tax revenues by discouraging economic activity.

Reiterating the same, Lummins, aptly summarized the situation with her comment when she said,

“If America fails to create a supportive and stable environment for Bitcoin mining, we risk squandering the advantages we currently enjoy and may find ourselves playing catch-up in a race we once had every opportunity to lead.”