Crypto outflows continue for the fourth week as Bitcoin clings to $40,000 level

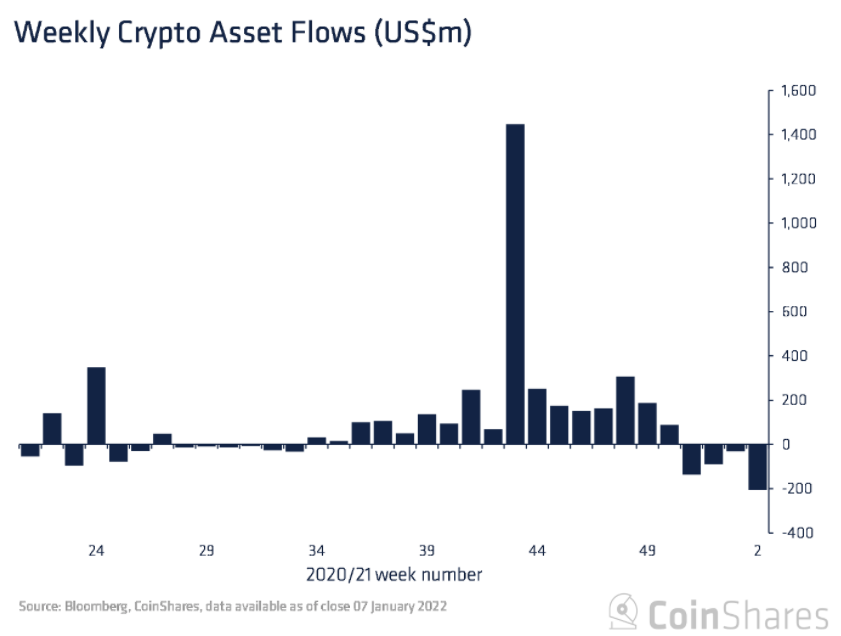

On days when the crypto market is bleeding, the latest report from CoinShares showed that investment products in the sector witnessed weekly record outflows of $207 million.

Prolonged winter

This is the fourth consecutive week of negative flows since December, which now totals to US$465 million, per the report. Additionally, the sluggish outlook also overshadowed the companies that invest in crypto and related assets. The report stated,

“Blockchain equities investment products did not escape the negative sentiment with outflows totaling US$10m over the week.”

Market weakness

Bitcoin has registered a massive 40% decline since its ATH of over $69,000 in November last year. Now as the coin desperately clings to the key support level of $40,000, after making a brief dip, it is noteworthy a fall of such magnitude was last seen in late September 2021. Kraken’s Dan Held recommends looking at the bigger picture instead of the short-term weakness in a recent tweet.

When in doubt, zoom out. #Bitcoin pic.twitter.com/Jbqn4BwYtn

— Dan Held (@danheld) January 9, 2022

With regards to outflow, CoinShares noted that Bitcoin outflows totaled to US$107 million as of last week. It further added the reason stating,

“[BTC Outflows] was a direct response to the FOMC minutes which revealed the US Federal Reserve’s concerns for rising inflation, and the fear amongst investors of an interest rate hike.”

Whales selling?

The now tapering-led downward spiral has become the ‘longest continuous decline since 2018.’ However, the question arises that if whales are exiting the bloodshed. Today, Whale Alerts noted that an anonymous wallet made a transfer of close to $40 million in BTC to crypto exchange Coinbase amid the mayhem.

? ? ? 946 #BTC (39,292,429 USD) transferred from unknown wallet to #Coinbasehttps://t.co/Bfv9pKaLO6

— Whale Alert (@whale_alert) January 11, 2022

Will the trend continue?

Julius de Kempenaer, the senior technical analyst at StockCharts.com, told Forbes that these declines indicate Bitcoin’s bearish trend, adding

“The drop below 45,500 support confirmed the downtrend in BTC that is underway after completing a double top formation on the break below 60k.”

However, this might not be Bitcoin’s biggest test of the time. Valkyrie CEO Leah Wald feels that Bitcoin’s biggest test will come amid a global sell-off, that will see a major correction in equities and other traditional assets in the year ahead or next year. She said in an interview,

“The real make or break will be on the horizon and I hope that we don’t see a bear market or a crypto winter anytime soon, but one day it will come, and that’s just the cycle of the markets. “

At the time of writing, there is extreme fear in the market on the Bitcoin Fear and Greed Index.