Crypto stock Marathon Digital Holdings (MARA) up 39%: Why and what next?

- MARA climbed following the announcement of JD Vance, a known Bitcoin advocate, as Donald Trump’s running mate.

- The outcome of the election could influence the future outlook as analysis showed that the token could hit $30.

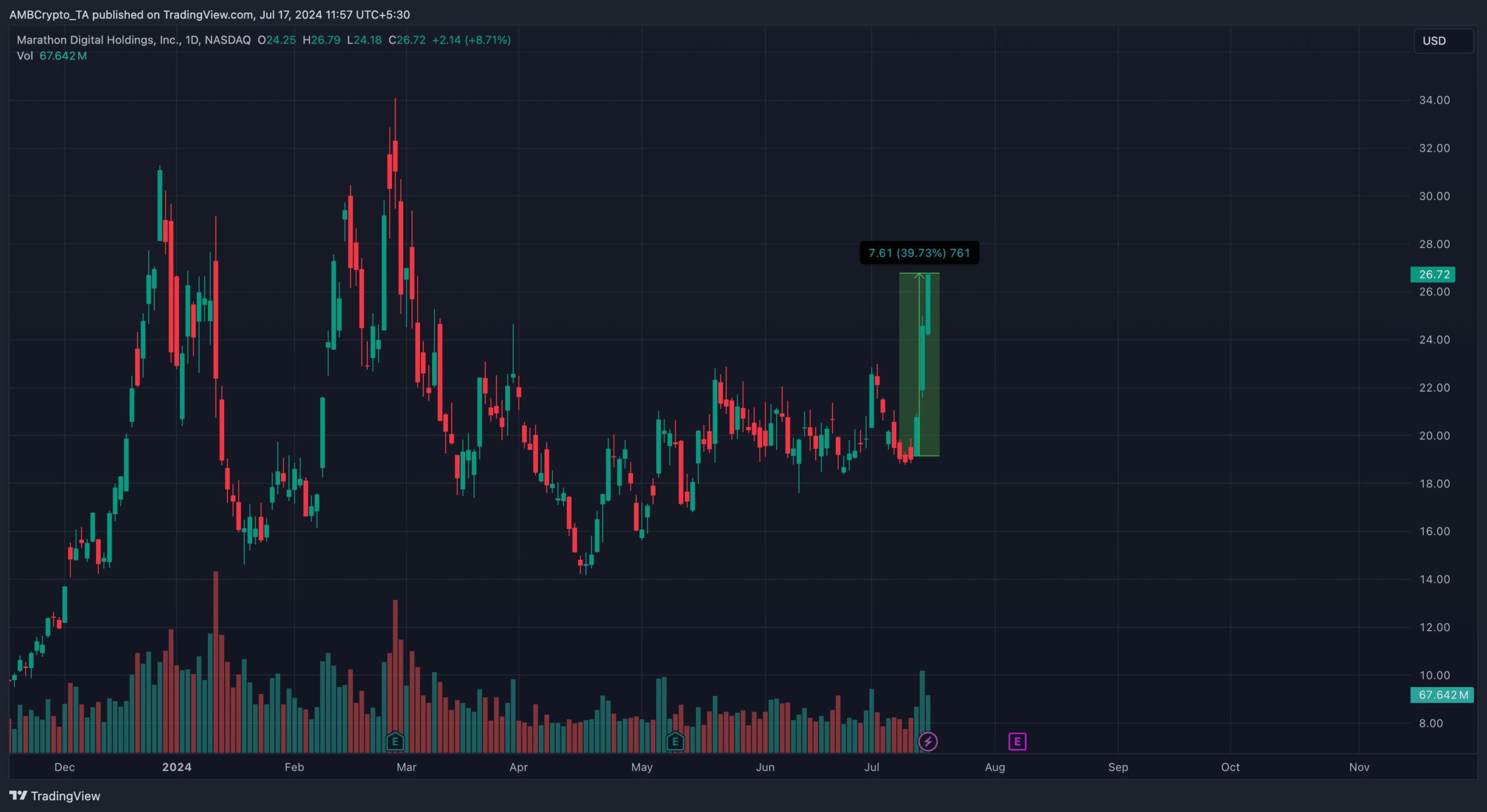

Between the 12th and 16th of July, Crypto stock Marathon Digital Holdings’ [MARA] price has increased by a whopping 39.73%. At press time, the MARA stock price was $26.72

Before its recent surge, the asset traded around a 30-day low of $18.80. However, the spike in price did not happen without cause and AMBCrypto was able to identify this.

Trump and Vance join hands in MARA’s favor

According to our findings, MARA stock price increased because of Donald Trump’s decision to name a pro-crypto personality as his Vice Presidential (VP) candidate.

On the 16th of July, the former U.S. president and candidate in the November elections chose JD Vance as his running mate. James David Vance is a U.S. Senator representing Ohio.

However, Vance is also known to be a strong advocate of Bitcoin and crypto at large. There are also reports that he own between $100,000 and $250,000 in Bitcoin [BTC].

Following the announcement, MARA stock joined other stocks and Trump-themed memecoins in rallying.

Furthermore, the incredible rise in the stock price might not end there. This is because the crypto sector is proving to be a major factor in the outcome of the elections.

Proof of this can be traced to Trump’s change in stance about the industry. Current president Joe Biden has also toned down on his administration’s strict approach toward the assets.

MARA stock price to $30 is possible

For Marathon Digital Holdings, this could be great news as MARA stock price could continue to surge as elections get closer. Should this be the case, it might not be out of place to predict that the crypto stock might retest its Year-To-Date (YTD) high of $31.80.

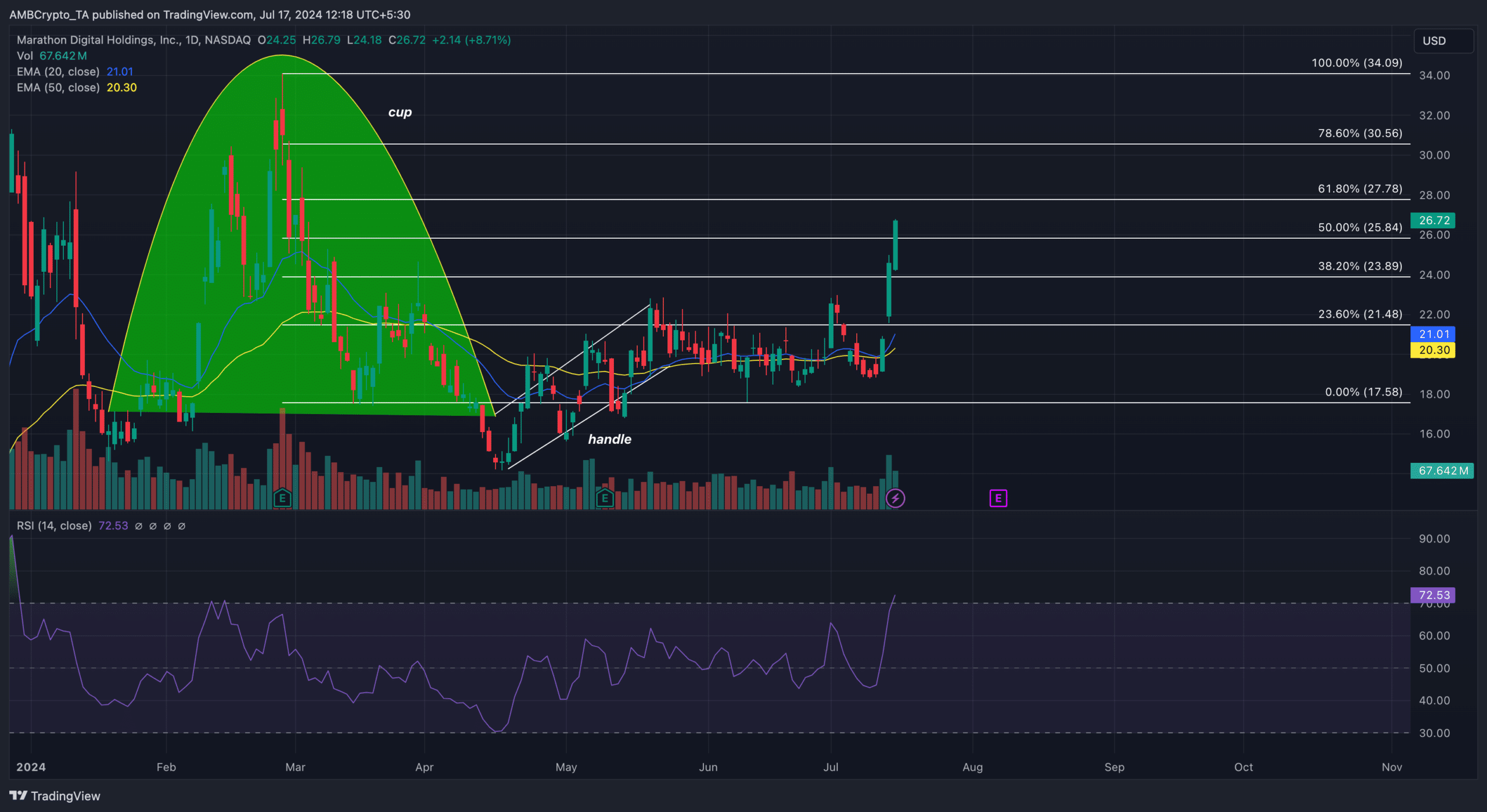

But it is however, important to look at the potential from a technical perspective. According to the daily chart, MARA had formed an inverse cup and handle pattern between January and May.

This technical pattern is a bearish continuation, indicating that the stock price might continue heading toward a downtrend. This potential outcome appeared between the last days of May and the first two weeks of June as MARA’s price hit $18.70.

However, the development mentioned above was instrumental to the reversal. Further, AMBCrypto examined the Relative Strength Index (RSI).

The RSI used the speed and size changes to measure momentum. If the rating increases, it means the momentum is bullish. However if the reading falls, it indicates a bearish momentum.

Also, RSI readings below 30.00 means a crypto stock is oversold. When it is above 70.00, it means it is overbought. In MARA stock’s case, the reading was 72.53, indicating that it was oversold.

But the price of the crypto stock was above both the 20 (blue) and 50 EMAs (yellow). Assuming the price was below the indicators, the trend would be termed bearish.

Is your portfolio green? Check the Bitcoin Profit Calculator

Therefore, this position implies that the trend is bullish. Hence, MARA’s price might ignore the oversold condition and move to a higher value.

By the look of things, MARA stock price could hit $30.56 in the coming days. In the mid term, the value could go higher especially if Donald Trump wins the U.S. elections