Bitcoin

Crypto week ahead for Bitcoin, Ethereum: How market sentiment can challenge shorts

There have been some signs of recovery, but will they be enough?

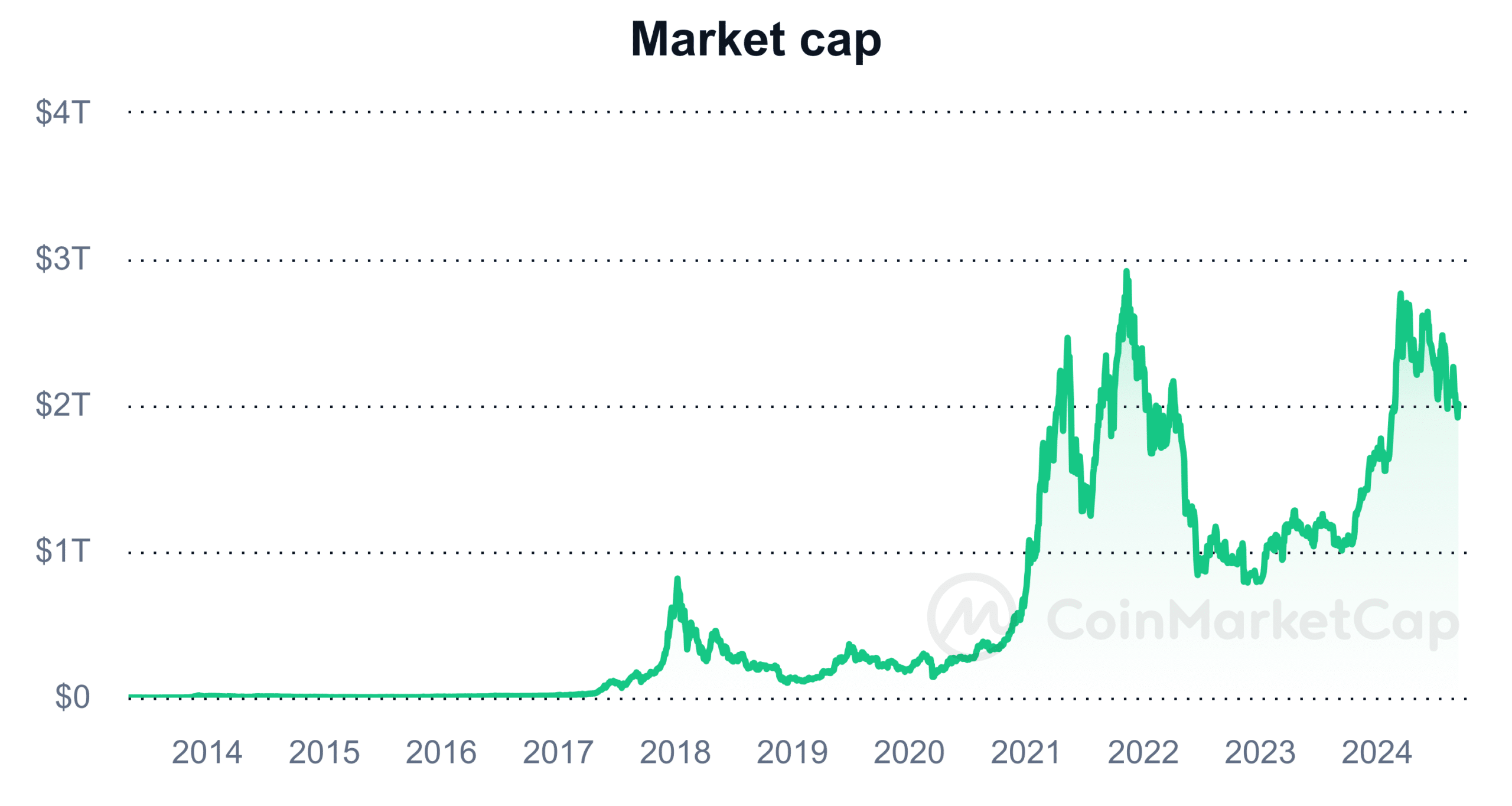

- Crypto market has reclaimed the $2 trillion mark

- BTC and ETH still hold over 60% of the market

The crypto market declined significantly over the past week, with the total market capitalization dropping below the $2 trillion mark. This decline was accompanied by a surge in long liquidation volumes as prices fell across major cryptocurrencies.

However, the market is now showing signs of a reversal. And, the outlook for the crypto week ahead appears positive, compared to the previous week.

Crypto week ahead: Market capitalization

An analysis of the crypto market capitalization on CoinMarketCap revealed that the market has had bouts of depreciation in recent weeks. The most significant drop occurred last week, bringing the total market capitalization down to around $1.9 trillion.

The price drops in major assets like Bitcoin and Ethereum primarily drove this decline.

However, it has rebounded over the past three days, hitting the $2 trillion threshold again. Along with this recovery, major cryptocurrencies have shown positive uptrends, suggesting the market could see further gains in the week ahead.

If this trend holds, it could begin a more positive phase for the crypto market.

Crypto week ahead: Market liquidations

An analysis of the total liquidations chart on Coinglass revealed that the market saw a surge in liquidations over the past week, with long liquidation volumes dominating. This confirmed the observed market capitalization decline. The data also underlined that long liquidations totalled over $520 million, while short liquidations amounted to around $223 million.

However, as the market began to recover, the volume of long liquidations fell and short liquidations saw an uptick. This shift suggests the market may be regaining upward momentum and short positions may be increasingly at risk.

If this trend continues, the week ahead will be challenging for short positions. Especially as rising asset prices may lead to more short liquidations. With the market showing signs of recovery, traders holding short positions may face increasing pressure as bullish sentiment returns.

Bitcoin and Ethereum leads market dominance

An analysis of the last seven days showed that Bitcoin (BTC) has lost over 3% of its value while Ethereum

(ETH) noted a steeper decline of over 6%. Despite these declines, however, both assets continue to dominate the cryptocurrency market.Bitcoin’s market capitalization, at press time, was around $1.13 trillion, representing 56.5% of the total crypto market. Ethereum’s market capitalization stood at $282.9 billion, with a dominance of 14.6%.

These two assets remain the most influential in the cryptocurrency space, and their price movements will significantly impact the overall market trajectory of the crypto week ahead.