Crypto week ahead – How U.S labor updates can affect Bitcoin, Ethereum

- BTC retested $66k following better-than-expected August inflation data

- U.S labor market update could set the next market direction

Bitcoin [BTC] edged higher and retested $66k on Friday following a softer reading from the U.S Fed’s favorite inflation data – The Core PCE Index (Personal Consumption Expenditure). This index tracks U.S inflation without the noise from food and energy price fluctuations.

The August Core PCE index reading came in better than expected, with a YoY (year-on-year) hike of 2.6%. This was contrary to market expectations of 2.7%.

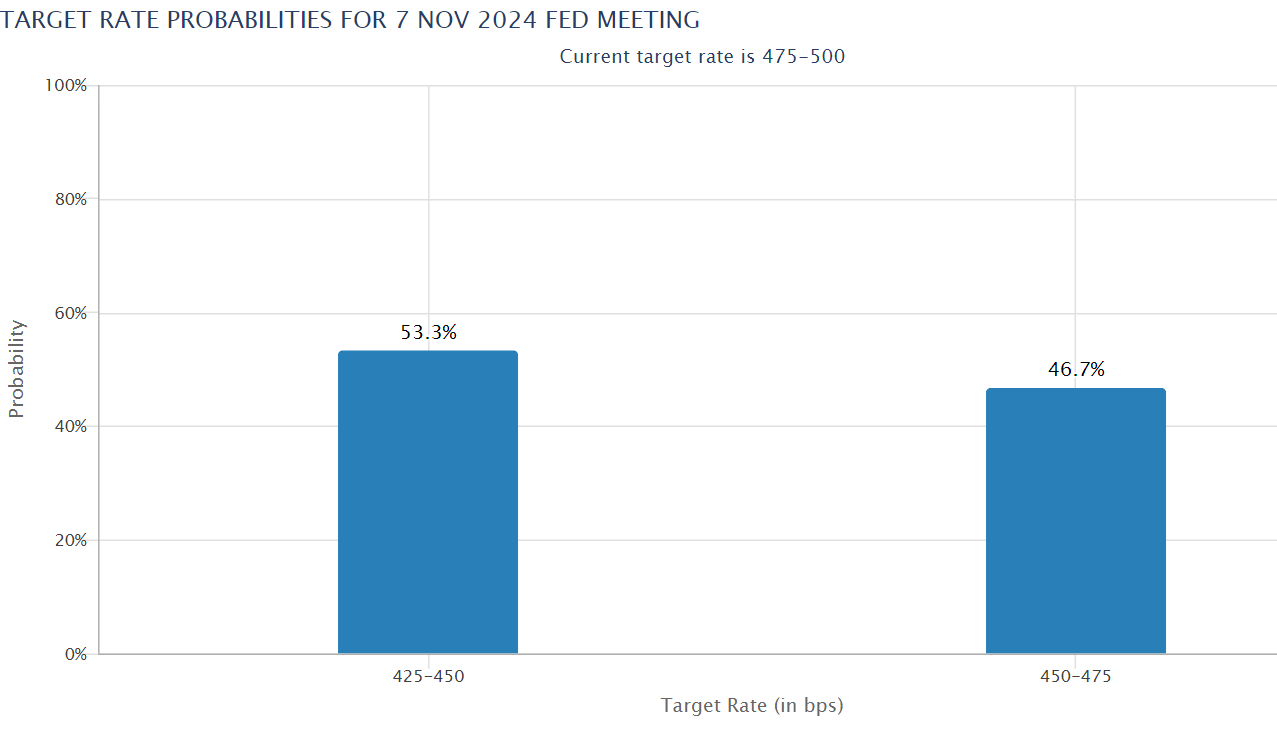

The low inflation data boosted the markets as speculators priced higher odds of another 50 bps (basis points) Fed rate cut in November.

Next market catalyst

The low inflation data meant that the Fed would now focus on the U.S labor market’s status, especially the unemployment rate, when adjusting its pace of interest rate cuts accordingly.

Ergo, upcoming U.S labor sector updates will impact the next market direction, noted trading firm QCP Capital.

Part of the firm’s weekend brief on 28 September read,

“As we head into next week, the key focus will be on upcoming labour market indicators, including JOLTs, ADP, and U.S unemployment rate.”

The key updates to watch out for are the JOLTs (Job Openings and Labor Turnover Survey) and employment situation scheduled for 1 and 4 October. Projecting the updates’ potential market impact, QCP Capital added,

“Strong performance in these metrics could bolster the case for a 50bps cut in November, further propelling risk assets.”

If that is the case, BTC could edge even higher towards $70k after the recent bullish market structure shift. Especially after it reclaims the 200-day MA (Moving Average).

The lift-off could also benefit Ethereum [ETH]. In fact, ETH has been outperforming BTC since the Fed’s pivot.

So, an extra macro tailwind could extend ETH’s remarkable recovery on the charts. In fact, according to market analyst Benjamin Cowen, ETH could hike to the psychological level of $3000 too.

That being said, the top digital assets saw renewed demand from U.S investors. This week, U.S BTC ETFs saw $1.11 billion inflows, the largest weekly inflows since 19 July.

A similar, but limited investor appetite was also observed in ETH ETFs. The products attracted $84.6 million inflows, the largest weekly demand since 9 August. If the trend continues, the $3k per ETH and $70k per BTC price targets could be feasible.