Bitcoin

Crypto week ahead: What to expect after recent BTC, ETH rebound

Here’s why BTC’s next direction could be set by this Tuesday.

- Coinbase projected a positive market shift, cautions about US CPI impact.

- QCP Capital supported the bullish outlook for BTC.

According to Coinbase analysts, the crypto market could extend its recovery in the near term after a massive liquidation scenario following Bitcoin’s [BTC] dip to $49k on 5th August.

Per the analysts’ weekly commentary, the plunge flushed out long positions, allowing a ‘cleaner positioning’ that could boost the market.

‘Cleaner positioning could be a positive technical indicator for crypto, in our view…This may indicate that the market could be done pricing-in pessimism.’

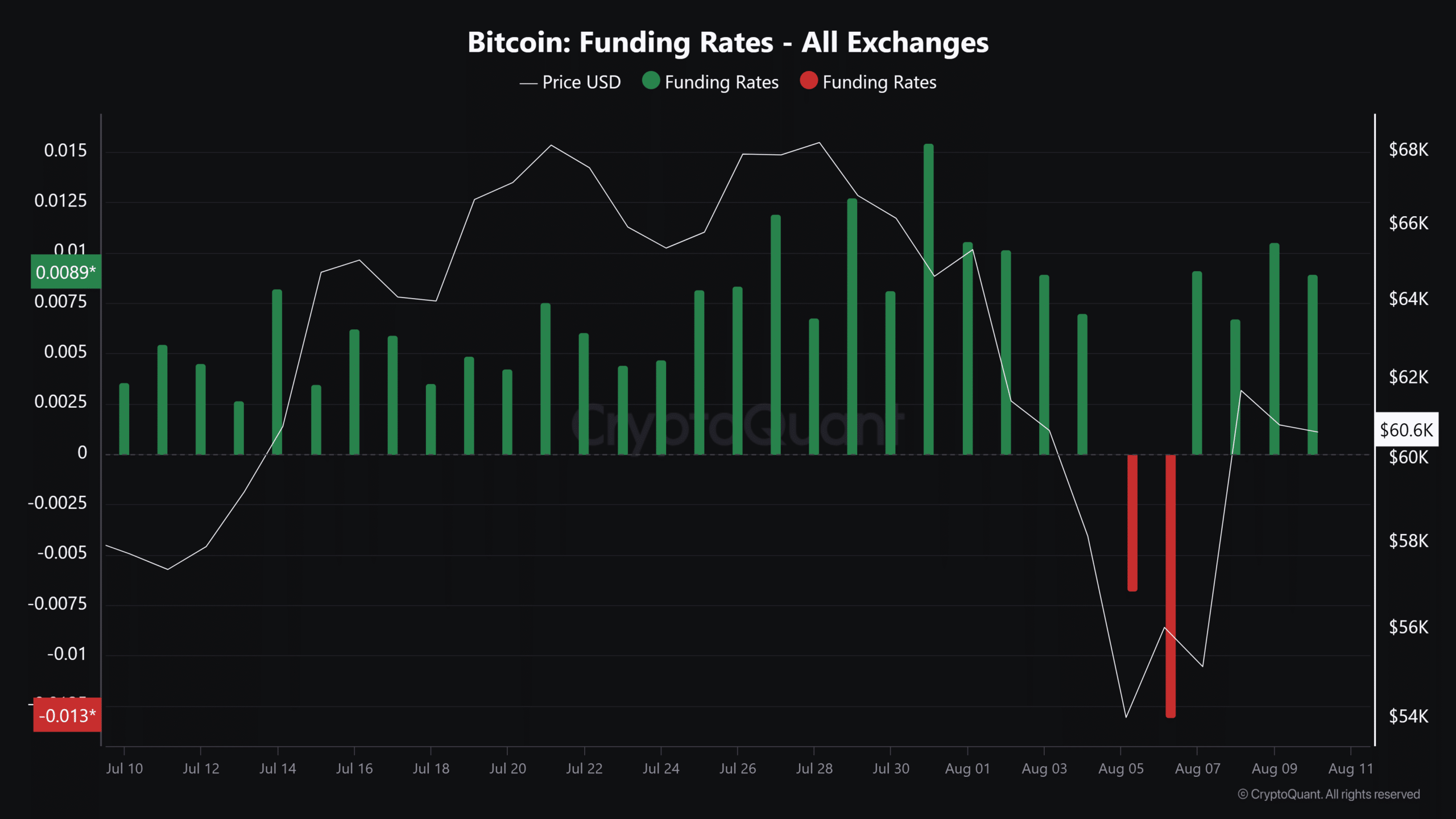

As of press time, traders’ sentiments in the futures market have changed to positive, as indicated by the positive funding rates. This also coincided with BTC’s rebound from $49K to the previous range-lows of $60K.

The same bullish outlook was reiterated by QCP Capital analysts in their weekend

brief.‘Bullishness in BTC is significant and structural. Throughout the week (and in spite of the crazy volatility), there was consistent demand for BTC calls expiring in 2025 with strikes closer to 100k.’

US CPI data to set the next BTC direction?

While Coinbase analysts acknowledged that the near-term price action for BTC, Ethereum [ETH], and Solana [SOL] could continue.

But macro factors would determine investors’ next move. They cited the US CPI (Consumer Price Index) data scheduled to be released on 14th August as a key factor to watch.

‘We would expect some of this selling pressure to ease…We think macro dominance could continue. For example, next week’s inflation print on August 14 will likely take on additional scrutiny given this week’s events’

However, Coinbase added that traders and investors could begin positioning accordingly using PPI (Producer Price Index) data to gauge CPI’s possible outcomes. PPI data track inflation from the producers’ perspective.

On the other hand, CPI measures inflation by tracking consumers’ spending on key goods and services. The Fed uses both data sets to make interest rate decisions. The PPI data will be issued on August 13th.

‘But also we expect many market players to look at PPI the day before to provide an early indication for CPI directionality, potentially affecting market performance as well.’

In short, another round of market volatility should be expected from 13th August, setting the next BTC and market direction for the week.

Over the weekend, BTC traded above $60k while ETH exchanged hands above $2500. On the other hand, SOL traded above $150.